Hedge funds offer their investors some of the most lucrative returns available. Aggressively managed and administered, they have become one of the most popular investment options for individuals who can afford to invest in them. BarclayHedge is one of the many institutions that specialize in the research, performance monitoring and consultation of hedge funds.

Established in 1985 as the Barclays Group, BarclayHedge has grown over 29 years into one of the most recognized and respected hedge fund research and management institutions. Here is a closer look at the institution and just how well it has operated and grown in almost 3 decades:

From Research to Comprehensive Services

In the first 5 years since its inception, the institution was concerned primarily with researching hedge funds and monitoring their performance. Within another 10 years, it began to publish numerous papers that detailed new indices, performance matrices and analysis tools. From a small team of experts to a huge and diverse team of researchers, data administrators, consultants and programmers, BarclayHedge has grown significantly over almost 3 decades.

Innovations

Not only has BarclayHedge grown in size over the years, it has made a number of contributions to the field of hedge funds. Here is a quick look at some of the institutions most prominent innovations and contributions over the years:

- Creation of Proprietary Indices Over the years, BarclayHedge has worked on a number of hedge fund indices, eventually creating 18 proprietary indices for hedge funds.

- Creation of Proprietary Indices Once the institution began focusing on managed futures, it was not long before the company created a number of indices for managed futures as well. To date, BarclayHedge has created 10 proprietary indices for managed futures.

- One Of The Largest Hedge Fund Databases Monitoring over 7,100 hedge funds and simultaneously analyzing their performances, BarclayHedge created the BarclayHedge Database, one of the biggest hedge fund databases in the world.

- BarclayHedge Managed Funds Report With an increasing number of firms and managers requiring increasing amounts of information on the funds they managed, Barclay Hedge came up with the answer with the BarclayHedge Managed Funds Report. This report is published every quarter and has become one of the most sought-after publications on managed funds in the world.

Today, BarclayHedge stands at the precipice of hedge fund research, analysis, development, programming and consultation. Offering a range of services to countless hedge fund managers and administrators, while simultaneously tracking and analyzing thousands of hedge funds, BarclayHedge is an institution you can rely on for information on hedge funds, as well as managed futures.

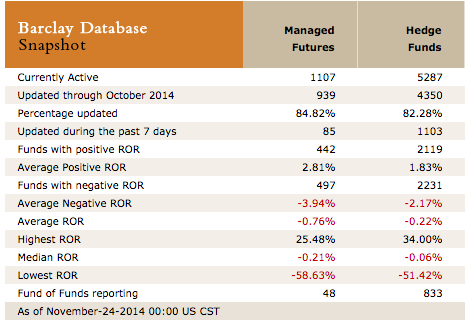

The Barclay Alternative Investment Database provides database on 5288 hedge funds including 1051 UK funds. The DataFinder tool provides latest information on each HedgeFund.

25 years of research of alternative industry as well as long-standing relationships with the fund managers provides the most accurate and reliable hedge fund information available. Below is the database snapshot as well as the vide with the database insights.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.