As a CPA, you have always been required to stay up-to-date on tax laws and regulations, and those who have been in the field for many years have acquired new technical skills as computers and online technology have revolutionized the profession. The advent of Bitcoin and other cryptocurrencies has introduced yet another opportunity to expand your knowledge, and potentially grow your client base.

Firms that take the time to learn about this newest financial instrument will find their mastery rewarded, as cryptocurrency investors and businesses that accept it for transactions will need accountants who are able to guide them through the many issues that arise from their use.

The Basics of Cryptocurrencies

Cryptocurrencies are a digital currency that is completely virtual. Though they are not held by a bank and are transacted on a peer-to-peer basis without a middleman or centralized control, transactions using them are considered safer than those that use cash because they are encrypted for security. They operate using a technology known as blockchain that is run through a wide-ranging nature of computers that Investopedia refers to as a “decentralized system.”

Of all the cryptocurrencies, the one known as Bitcoin has been around the longest and is the best known. According to Statista, since Bitcoin’s advent over 6,000 other cryptocurrencies have been issued, and the ease of use and lack of shifting exchange rates that they provide for international transactions has added to their popularity, making them an increasingly major player in the global digital economy. In fact, a A World Economic Forum report entitled “Deep Shift – Technology Tipping Points and Societal Impact” predicted that by 2027, 10% of the world’s gross domestic product (GDP) will be stored on blockchain technology.

This emerging asset class’s growing popularity means that smart CPAs will attain a mastery of the language surrounding its use, as well as of what their clients will need from a tax service perspective, as they are also an attractive investment option.

Here are a few of the terms and concepts that CPAs will need to learn:

- Blockchain – This is the technology through which Bitcoin and other cryptocurrency transactions are recorded. It is a record-keeping technology that stores pieces of digital information.

- Cryptocurrencies – Encrypted digital currencies. The oldest and best known is Bitcoin, which was developed in 2009 and which Investopedia reports leads all others in terms of popularity, number of users, and market capitalization. Other popular cryptocurrencies include:

- Litecoin, an open-source global payment system. It was developed two years after Bitcoin and has a faster transaction confirmation rate.

- Dash offers virtually untraceable transactions and is viewed as more discreet than Bitcoin. It also goes by the name Darkcoin.

- Ethereum has distinguished itself by facilitating smart contracts that include terms and conditions between buyers and sellers incorporated into its code.

- Ripple facilitates the settlement of international payments in real time, making its network one of the more popular global offerings.

- Tokens are another type of virtual blockchain currency that can be traded or transferred, and which stands on its own as either a utility or an asset

- Wallet – The tool that owners of cryptocurrencies track and hold their assets in

- Mining – Mining as a way to earn cryptocurrency without having to purchase it, usually by using special software to solve math problems.

What CPAs need to know about cryptocurrency

Clients who invest in cryptocurrencies have access to so many different ways of using them or investing in them, but they may not realize that this new digital currency is considered property by the Internal Revenue Service. This makes recording profits and losses for this novel asset class a complicated undertaking that will require significant accounting expertise. Though cryptocurrencies are complex, being able to offer accounting services specific to cryptocurrency trading will provide a new way of attracting clients that will likely be worth the investment of time and effort.

If you are interested in expanding your accounting services into cryptocurrency, the best way to start is with the four steps listed here:

- Familiarize yourself with the basics. You don’t need to be an expert, but learning the concept behind cryptocurrencies, how income differs from investments and what separates Bitcoin from other cryptocurrencies will be a good start.

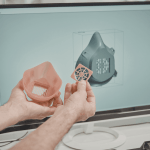

- Invest in tax software that is specifically designed for cryptocurrency. This specialized technology will make translating and cryptocurrency transactions into standard accounting software much simpler.

- Learn the distinctions between transactions that result in capital gains or losses and payments, because the two are treated very differently and the rules are changing quickly. If you can’t find the information you need, check with federal and state tax agencies.

- Market your cryptocurrency abilities. Once you’ve invested in educating yourself and in the technology to support cryptocurrency accounting, make sure that you include these abilities in your firm’s marketing so that you can attract a new class of clients. Digital marketing, blogging, social media, and SEO for tax preparers can all help you market your knowledge.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.