Uncategorized

A Blueprint For An Interoperable Digital Carbon Market By Hirander Misra, CEO ZERO13

Hirander Misra -0

Carbon credits exchanges are merely adopting ‘old-school’ models based on a traditional ‘walled garden’ approach. The COP28 award-winning solution by ZERO 13 offers an interconnected digital carbon market infrastructure that is leveraged by multi-blockchain technology. The article is by the Chairman & CEO of GMEX Group and ZERO13, Hirander Misra, that highlights the collaborative ‘network of networks’ approach to...

Innovation

BNP Paribas THEAM Quant And Exane Research Launch Thematic Product Partnership With New Energy Opportunities Fund

HedgeThink -

The THEAM Quant New Energy Opportunities fund is the first thematic fund that exposes to an index to leverage market-leading research capabilities of BNP Paribas Exane, combined with the equity selection expertise of BNP Paribas Quantitative Investment Strategies (QIS).

The disciplined framework of the fund seeks to identify companies with high Environmental, Social & Governance (ESG) standards and...

alternative investment

Blockchain Coinvestors’ Bi-Annual Institutional Digital Finance Adoption Report On World’s Top 50 Financial Institutions

HedgeThink -

Report Reveals the World’s Top 50 Financial Institutions are Rapidly Embracing Digital Finance.

Despite conservative public stances, global financial leaders have already built digital product offerings to enable digital monies, commodities, and assets.

Among the top 50 financial institutions globally, more than 50% already support use of digital wallets, custody and/or trading, and more than 40% support digital...

cryptocurrency

India to Hit 270 Million Crypto Users this Year, more than US and Europe Combined

HedgeThink -

According to the data presented by AltIndex.com, India is expected to have almost 270 million crypto users this year, more than the United States and Europe combined.

Over the past years, India has seen a significant rise in crypto investors despite the government's historically negative attitude toward the sector. The country's crypto market will continue growing in 2024 and reach...

Industry

Amid Global Downturn, Germany’s Resilient VC Surges, GlobalData Advises Innovation Strategy To Unlock Unicorn Growth

HedgeThink -

The Venture Capital (VC) Investments in Germany show resilience amidst global market uncertainties amongst major economies like China, the US, the UK, and India. GlobalData reveals that there is a need for an innovation strategy to cultivate unicorn startups.

Germany experienced a notable shift in venture capital (VC) investment trends in January 2024 despite a decline in the number of...

Market View

GlobalData Report: UK Witnesses 41.3% YoY Decrease In VC Funding, Reaches $615.4 Million In January 2024

HedgeThink -

Despite recent setbacks, the UK remains a prominent player in the global VC market, though facing increased competition from other European counterparts, according to GlobalData, a leading data and analytics company.

The UK's venture capital (VC) landscape experienced a significant year-on-year (YoY) decline of 41.3% to $615.4 million in January 2024. This decline, attributed to macroeconomic challenges and geopolitical tensions,...

Alternative Asset Management

Money Laundering Challenges On The Rise: Insights From A Comprehensive Study On Alternative Fund Managers

HedgeThink -

A recent study by Ocorian highlights a concerning trend among alternative fund managers, with 73% reporting an increase in Anti-Money Laundering (AML) risks over the past two years. More than 70% of these managers faced AML fines or sanctions during this period. Looking forward, about 87% of respondents plan to enhance their organisation's focus on AML management in the...

Financial Industry

The Future Identity Finance Conference Explores Explore Top 4 Themes In Digital ID And Finance

Pallavi Singal -

The Future Identity Finance conference 2024, London, aims to explore key themes reshaping the intersection of digital identity and finance, with a keen focus on reducing fraud, ensuring compliance, and fostering customer trust.

Scheduled for March 19th at Venues St. Paul’s, London, the Future Identity Finance is poised to bring together over 500 innovators to delve into the transformative potential...

Hedge Funds 101

SEC Implements Sweeping Changes To Regulate High-Speed Traders And Hedge Funds In $26tn Treasury Market

HedgeThink -

A recent regulatory development in the United States mandates certain high-speed traders and hedge funds to undergo registration as dealers.

The Securities and Exchange Commission (SEC) introduces rules compelling firms designated as dealers to enhance transparency regarding their positions and trading activities.

These firms are now obligated to maintain sufficient capital reserves to support their respective deals.

In a...

managing risk

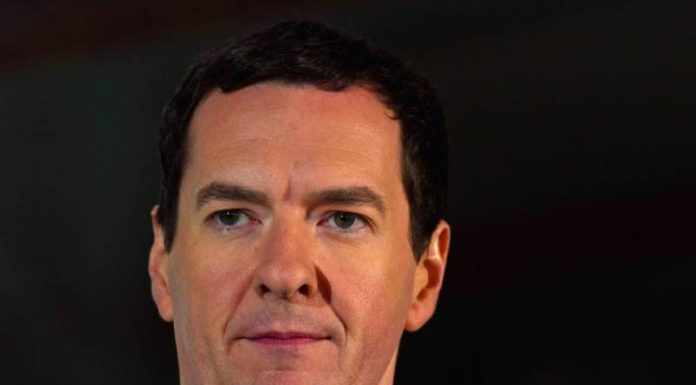

Former UK Chancellor George Osborne Joins Coinbase Global Advisory Council

HedgeThink -

Coinbase, a leading cryptocurrency platform, announces the addition of George Osborne, former Chancellor of the Exchequer of the United Kingdom, to the Coinbase Global Advisory Council. Osborne, known for his extensive experience in government, journalism, and international finance, joins the council at a pivotal moment for Coinbase's global expansion strategy.

Coinbase has recently achieved significant milestones in its international growth,...

Ambienta Sustainable Credit Opportunities has held a first close, already reaching half its initial target.

Commitments secured from a broad range of thought leading investors across Europe and the US, including foundations, pension funds and family offices.

The strategy, with an exclusive focus on backing environmental champions, will leverage the team's deep experience in corporate credit with Ambienta's...

A recent survey from The Small Business and Entrepreneurship Council (SBEC) reveals that a growing number of small businesses are harnessing AI tools to significantly enhance efficiency, resulting in annual savings totaling hundreds of billions of dollars.

Amid reports that 99% of CEOs are making or planning significant investments in generative AI, the business investment experts at Oxford Capital have...

asset management

Revolutionising Africa’s Financial Landscape For Climate-Centric Growth: Insights From COP28

HedgeThink -

Does Africa need a climate-centric financial architecture? Funmi Dele-Giwa, General Counsel & Head of GRC and Group Company Secretary at Onafriq presents his insights.

At the recently concluded COP28 climate summit in Dubai, African financial and political leaders spoke extensively about the role of finance in shaping Africa's future, particularly regarding climate and the environment. Of particular note was the...

City Index's latest study unveils the top 50 most confusing financial terms, shedding light on the challenges people face in navigating the complex world of finance. 'Equity' emerges as the most misunderstood term, dominating online searches with 277,000 monthly queries globally, while 'GDP' and 'Acquisition' follow closely.

As UK inflation hits 4% in December, delving into the intricacies of finance...

The fintech sector has been one of Africa’s biggest technology success stories. According to one report, the continent’s 678 fintech startups raised more than US$2.7 billion between 2021 and August 2023. Additionally, almost all of the continent’s unicorns (startups valued at more than US$1 billion) are in the fintech sector.

The majority of that success has, however, come from the...

Kathleen Brooks, one of the best recognised financial markets research specialists in the retail investment industry, has today joined XTB UK as its Research Director.

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.Having started her career at BP, she worked across a variety of departments, including...

Each year, Agecroft Partners predicts the top hedge fund industry trends through their contact with more than two thousand institutional investors and hundreds of hedge fund organisations.

Given the hedge fund industry's dynamic and constantly changing nature, it is crucial for firms to anticipate likely changes. Those that are able to adapt effectively to industry shifts will succeed, while...

HL’s experts pick investment trusts for investors to watch in 2024.

Volatility is likely to continue through 2024, on a long-term view this could be a great opportunity to pick up reasonably-priced stocks.

Our trusts to watch for 2024 have a cautious tone.

2024 is not going to be a year of rapid or sustained economic growth. Market consensus...

News

Spectrum Markets Becomes Associate Member Of The Italian Association Of Certificates And Investment Products (ACEPI)

HedgeThink -

By joining ACEPI, Spectrum furthers its commitment to collaborate closely with securitised derivatives associations in Europe.

Since 2006, ACEPI has brought together the main operators in the sector, currently representing over 90% of the primary market for certificates in Italy.

As a member of ACEPI, Spectrum Markets will bring its contribution on legal, marketing and products related activities.

Spectrum...

While rising inflation rates, the Silicon Valley Bank crash, CBDCs, were some of the highlights in the financial landscape of 2023, Ram Gopal, Director of the Gillmore Centre for Financial Technology at Warwick Business School and Professor of Information Systems Management, shares some of his insightful predictions for the year 2024.

As we stand at the threshold of the New...

Cryptocurrencies, CBDCs, AI integration, cybersecurity…..As we look ahead to 2024, several key trends are poised to shape the landscape of the booming industry, affirms the CEO of deVere Group, one of the world’s largest independent financial advisory, asset management, and fintech organisations.

The fintech sector stands on the brink of remarkable growth and innovation, marked by various transformative trends. The...

Business

Liquidnet To Integrate BondIT’s AI-driven Credit Research Into Its Electronic Trading Platform

HedgeThink -

Liquidnet and bondIT announce their collaboration to advance traders’ ability to anticipate critical market changes.

Liquidnet, a leading technology-driven agency execution specialist, and bondIT, a leading provider of next-generation investment technology, announced today their partnership to integrate bondIT’s Scorable Credit Analytics into Liquidnet’s Fixed Income electronic trading platform. The collaboration aims to empower traders to anticipate market trends, mitigate credit...

Fund managers play a pivotal role in shaping investment strategies and steering portfolios through the unpredictable currents of markets. Their experiences, insights, and the wisdom garnered from navigating the ever-changing landscape offer invaluable lessons for investors.

These quotes from eminent fund managers offer a glimpse into the mindset of those who navigate the complexities of financial markets. As investors chart...

Business

The Top 10 UK’s Youngest Billionaires: City Index Analyses The Changing Dynamics Of Billionaires’ Ages

HedgeThink -

City Index, a global spread betting, FX and CFD Trading provider, reveals the top 10 youngest UK billionaires in 2023. The study reveals 12 out of the 13 of UK’s top 10 youngest billionaires are male, with just Denise Coates making it as the only female on the top 10 list.

In a recent study by City Index, analysts predict a continuous decline in the net worth...

Education

Empowering Financial Literacy: The Role Of Technology In The Banking And Financial Landscape In 2024

HedgeThink -

New OECD report highlights 63% of adults who held any type of financial product do not score the minimum target financial literacy score. Zahra Hassan, co-founder of Eligible, discusses how lenders can embrace technology to reconnect with customers and leave financial illiteracy in 2023.

A recent OECD report on global financial literacy levels revealed significant concerns, particularly in the context...

Market View

2024 Predictions From Christopher Crawford, Portfolio Manager At Eric Sturdza Investments

HedgeThink -

As we head towards the end of 2023, here are the predictions for 2024 from Christopher Crawford, Portfolio Manager of Eric Sturdza Investments’ Strategic Long Short Fund.

The impact of rising interest rates will become more apparent in 2024, as leveraged companies face increasing stress. The market will realise that these risks are not fully reflected, leading to potential concerns...

The economic outlook for 2024 is mixed and markets are likely to be volatile.

Investors should consider diversifying their investments and adding defensive selections.

Our Responsible Funds to watch offer exposure to a mix of asset classes and geographies.

Funds positioned to whether sustainability issues, and even benefit from them, are likely to do well over the long...

alternative investment

The Top Celebrity Investors of 2023: Babyface, YouTubers, and More

HedgeThink -

FOREX.com identifies the top celebrity investor of the year 2023. While Babyface shows the highest return on net worth at 134.40%, YouTubers emerge as the most successful group, achieving the best return on investments at 13.6%. Despite having the highest average net worth at $905 million, athletes only manage a modest 9.84% return on investments, while social media influencer...

The Fund invests in one of the world’s fastest-growing economies

Eric Sturdza Investments, an independent asset management firm providing active strategies to institutional and professional clients, is delighted to announce the launch of its Strategic Vietnam Prosperity Fund, providing exposure to an Asian equity market that is poised to record significant economic expansion.

Vietnam benefits from the trend in China,...

From diversity in finance to the impact of electrification and the role of artificial intelligence, these themes by CIO View Special offer valuable insights for investors seeking a competitive edge.

The new CIO View Special presents ten topics that we believe will be relevant for investors and offer food for thought for 2024 and beyond. Recognising the need for strategic...

asset management

The Impact Of Stablecoins In Boosting The Pace Of Digital Currency Adoption

HedgeThink -

In this episode, Hilton Supra and Peter Kristensen are joined by Morten Christorp Nielsen, CFO & Co-founder of ARYZE abd Jack Nikogosian, CEO & Co-founder of ARYZE, to discuss the important role of stablecoins in the digital assets economy while going through some market opportunities in the space.

Hosted by seasoned financial markets experts Adam Hill, Hilton Supra and Peter...

Business

2024 Investment Lookahead: UK VS US, Bond Yields Compelling And Gold On A Roll

HedgeThink -

Domestic economy is under pressure – but the market is cheap.

Bonds are no longer boring.

The US is expensive, and emerging markets overlooked.

Geopolitics impact commodities.

2024 is not going to be a year of rapid or sustained economic growth. Market consensus in recent weeks seems to have shrugged off recession fears and is pricing in a Goldilocks...

Business

Partnerships For Progress: Collaboration Between Banks And Fintechs Is The Future Of Banking In Africa

HedgeThink -

The introduction of digital technologies is completely changing the financial services landscape on the African continent. Not only are these new and cutting edge technologies helping to renew the traditional banking sector, but they have also led to a boom in financial technologies such as the rapidly growing mobile money market and digital payments landscape, with the continent now...

Saxo’s award-winning platform now includes funds - allowing retail investors to trade & invest across much of the entire investment universe.

Saxo has added a curated list of more than 6,000 global funds from the world’s top fund managers.

Includes 500 equity, 2,000 fixed income, 730 multi-asset and 160 alternative funds, including many thematic and sustainable funds.

Offering...

The UK government is considering selling shares it holds in NatWest to retail investors for the first time.

How a share sale might work for NatWest.

NatWest has had a difficult 2023, but headwinds are set to subside.

Lloyds had a solid third quarter, while asset management and pension expansion. provides opportunities.

Barclays valuation below its peers but Investment Bank faces challenges.

...

The reforms are expected to generate a new wave of share ownership among retail customers amid widespread investor apathy. Claire Trachet, Founder/CEO of the UK’s leading business advisory, Trachet, comments on the need for further government support in the private investment scene.

Reports from the Treasury reveal that the Chancellor of the Exchequer, Jeremy Hunt, will unveil the most dramatic...

Finance

Equity Release vs Inheritance Tax – How Do Both Routes Differ When Passing Wealth Onto The Next Generation?

HedgeThink -

Chancellor Jeremy Hunt expected in his Autumn Statement to announce a cut inheritance tax (IHT) effecting 4% of all UK families. Rudy Khaitan, Managing Partner of the UK’s leading later-life lending specialist, Senior Capital, explains why equity release can represent an attractive option for those looking to pass on tax-free wealth to their family.

Chancellor Jeremy Hunt is expected to announce a...

Innovation

Cleantech For Iberia: Pioneering A €1 Billion Investment Wave For Sustainable Innovation

HedgeThink -

As Europe races to scale cleantech manufacturing capacity, Cleantech for Iberia launches coalition to supercharge Iberian cleantech with investors representing funds of over €1 billion.

This morning, at Web Summit, Cleantech for Iberia presented its coalition of cleantech leaders. Amongst its 18 members, it counts the region’s main investors, innovative scaleup companies and universities across Spain and Portugal, with a combined...

alternative investment

FCA Finds Further Work Required To Fully Embed ‘Guiding Principles’ For ESG And Sustainable Investment Funds

HedgeThink -

A review by the Financial Conduct Authority (FCA) has found that while most Authorised Fund Managers (AFMs) have made efforts to comply with the FCA’s expectations on the design, delivery, and disclosure of their ESG and sustainable funds, further improvement is needed.

The FCA is publishing this review ahead of its final rules and guidance on Sustainability Disclosure Requirements (SDR)...

Financial Industry

10 Banking And Tech Innovations Shaping The Financial Landscape In 2024

HedgeThink -

From artificial intelligence to blockchain, these innovations are set to redefine the financial landscape in 2024.

The financial industry is undergoing a profound transformation driven by the integration of cutting-edge technology.

Here are ten banking and tech innovations that will play a pivotal role in shaping the future of finance:

Artificial Intelligence (AI): AI is at the forefront of technological advancements,...

Industry

Photonic Inc. Raises $100 Million To Advance Its Work In Quantum Computing

Pallavi Singal -

Photonic Inc. raises $100 million, backed by investors like the British Columbia Investment Management Corporation (BCI), Microsoft Corporation, the UK government’s National Security Strategic Investment Fund (NSSIF), Inovia Capital, and Amadeus Capital Partners in a recent investment round. The company’s total fund is currently around $140 million.

With significant advancements made in the areas of qubit quality and error correction,...

Founded by Nick Perrett of digital bank Tandem, Ricky Knox of Tandem and Azimo, and Phil Bungey of Nutmeg, new wealth-tech platform Prosper plans to revolutionise how we save and invest.

Like other fintechs have done for currency exchange and banking, Prosper is building a customer champion business, because it is on a mission to maximise its members’ long-term wealth...

market views

Gilts Top The Table For Most Popular In September While Responsible Funds Wane

HedgeThink -

The Investment Association (IA) data for September 2023 offers a glimpse into the evolving financial landscape in the UK, marked by notable changes in investor behavior and fund preferences.

The Investment Association (IA) data for September 2023 provides valuable insights into the dynamics of the UK investment landscape, indicating how investors responded to evolving market conditions and preferences for different...

alternative investment

Boosting SMEs And Green Projects: EIB, ICO, And Banco Sabadell Commit €936 Million In Financing

HedgeThink -

The European Investment Bank (EIB) Group, in collaboration with the European Investment Fund (EIF) and the Instituto de Crédito Oficial (ICO), has invested €380 million in an asset-backed securities (ABS) transaction to provide critical financial support to small and medium-sized enterprises (SMEs) in Spain. This initiative aims to promote green projects and address investment constraints faced by Spanish SMEs.

The...

While the UK has made significant progress in reducing greenhouse gas emissions, only 28% of British companies have robust transition strategies. Position Green highlights the endeavours of the UK's Transition Plan Taskforce.

The United Kingdom distinguishes itself with its legally binding commitment to achieve net-zero status, a milestone underscored by its groundbreaking decision in 2021 to become the world's first...

asset management

Innovative Monitoring Capabilities For Crypto Assets: Gillmore Centre For Financial Technology Launches Crypto Dashboard

HedgeThink -

The Gillmore Centre for Financial Technology at Warwick Business School launches the Crypto Dashboard at the DeFi and Digital Currencies Conference, Warwick Business School, London. Designed by leading academics, this open platform is equipped with features to provide users with valuable insights, market overviews, and AI-powered investment analysis.

The Crypto Dashboard made its official debut at the Centre's DeFi and...

Business

KPMG In India And Vianai Systems Alliance: AI-Driven Conversational Finance For CFOs With Vianai’s Hila™ Enterprise

HedgeThink -

The alliance introduces a reliable AI, enabling finance users to pose real-time questions to enterprise systems in plain language. It empowers finance users to interact directly with AI, promptly receiving accurate responses in the form of dashboards, charts, or text, all without the need for middlemen or niche visualization tools.

KPMG in India and Vianai Systems, a leading Human-Centered AI...

Using artificial intelligence (AI) in our everyday lives, and in business, is firmly in the mainstream and it’s now commonly accepted that any organisation that doesn’t ultimately integrate AI into its services and offering is going to fall behind.

Research from Manx Financial Group asked brokers about advancements in AI, and how it will affect small and medium-sized enterprises (SMEs)...

Alternative Asset Management

Millennial And Gen Z Consumers Turn From Banks To Brands For Financial Products

HedgeThink -

An independent survey of 3,007 European consumers has found:

52% of 25-34-year-olds said using financial products via their favourite brands was more convenient than using a conventional bank.

51% said brands offer products more tailored to their needs than traditional institutions.

50% will only stay loyal to brands offering financial benefits and incentives like Buy Now, Pay Later (BNPL)...

Business

Wealth Management On Growth Path But More Tech Investment Is Needed, According To New Report

HedgeThink -

New global study among wealth managers and financial advisers reveals client growth is expected to continue over the next three years, due to impact of technology and growing population of mass affluent.

Nearly all (98%) wealth managers and financial advisors say clients are increasing their ESG focus but 95% say there must be more investment in technology to...

The total amount of data created, captured, copied, and consumed globally is forecast to increase rapidly, reaching 64.2 zettabytes in 2020. Over the next five years up to 2025, global data creation is projected to grow to more than 180 zettabytes. How are advanced tech tools like Finance AI going to leverage quantitative models of financial management?

“Data is the...

digital wealth management

XTCC™ Pioneers The World’s First Exchange-Traded Voluntary Carbon Credit Investment Product On Bermuda Stock Exchange, Deutsche Börse, And SECDEX Exchange

HedgeThink -

Powered by GMEX ZERO13.

Investors for the first time can invest in the asset class for the net zero world.

High-quality credits are derived from verified and audited projects.

Unique retirement (offset) or investment features

Capital markets credibility for this critical asset class.

Covers renewable energy-sourced credits and blue carbon credits

XTCC™, the pioneer in exchange-traded carbon credits, unveils the...

Business

Wealth Management On Growth Path But More Tech Investment Is Needed, According To New Report

HedgeThink -

New global study among wealth managers and financial advisers reveals client growth is expected to continue over the next three years, due to impact of technology and growing population of mass affluent

Nearly all (98%) wealth managers and financial advisors say clients are increasing their ESG focus but 95% say there must be more investment in technology to...

alternative investment

Investment Forecast: HL Investors Buy Cash, Tech Energy And Short-Dated Bonds

HedgeThink -

HL fund flows for the third quarter reveal a mixed bag

Passive funds dominate, with cash and tech the most popular picks

Alternative sectors including energy, mining and infrastructure are the investment trust top buys

If the top buys for the past three months were a rather niche puzzle – where you had to determine the state of the...

Interviews

ESG Integration: Sovereign Wealth Funds Navigating Towards Positive Societal And Environmental Impact

Pallavi Singal -

From investing in renewable energy, affordable housing, and clean technology projects to investments in cooperatives and employee-owned businesses……. Sovereign Wealth Funds are increasingly aligning their investments with UN SDGs goals for 2030, actively seeking opportunities that contribute to positive societal and environmental outcomes.

The UN SDGs for 2030 have become a guiding compass for Sovereign Wealth Funds committed to ESG...

Business

GMEX ZERO13 Partners With HalaZone Technologies And CarbonCX To Provide Turnkey Digital Carbon Credit Services

HedgeThink -

ZERO13, GMEX Group’s digital climate fintech ecosystem is collaborating with Dubai-based HalaZoneTechnologies, the carbon credit project finance specialist, and Calgary-based CarbonCX, a digital platform for integration, calculation, aggregation, management and monetization of Carbon Reduction Credits™. This partnership will enable clients with CO₂e¹ reduction projects to originate carbon credits and gain access to project financing or benefit from carbon offsets.

This climate fintech...

Finance

Unlocking Investment Opportunities: Europe’s Most Profitable Companies By Profit Per Employee

HedgeThink -

Hapag-Lloyd makes over £1 million per employee.

Shell is in second with £365,041 per employee.

Other energy giants, BP and ENI come in third and fourth.

A recent study conducted in partnership with the global fintech group Plus500 has shed light on a unique perspective that can help identify investment prospects—the profitability of companies per employee. By analyzing the...

As the aviation industry across APAC region requires 17,000 new aircraft over the next two decades, industry experts highlight aircraft leasing as a source of economic growth

As global aviation passenger numbers rebound, emerging markets are consistently capturing more market share through increased investment, drawing the attention of American finance firms. According to a report by the International Air Transport Association (IATA), global passenger demand is expected to reach 85.5% of 2019 levels...

Education

It’s Time To Safeguard The Financial Sector: Navigate Employee Turnover To Defend Against Escalating Cyberattacks

HedgeThink -

It’s no secret that cybersecurity has a significant skills shortage. According to ISC2 research, the worldwide shortage is as high as 3.4 million cybersecurity workers. As a result, security professionals’ skills are in very high demand, making finding and retaining talent challenging. Swimlane’s own research shows that 82% of organizations report it takes three months or longer to fill...

The first edition of The Europe 250 from Gain.pro finds that American and British investors dominate European private equity landscape.

Gain.pro, the market intelligence and software innovator delivering a wholly new level of insight into private companies, has announced that private equity firm, CVC, has emerged as the leading European investor in Gain.pro’s inaugural The Europe 250 ranking report and...

alternative investment

The Net Zero Banking Alliance Leads The Global Charge Towards A Net Zero Carbon Future

HedgeThink -

In the drive towards a net-zero carbon future, the global banking industry is making remarkable strides. UNEP's Net Zero Banking Alliance in its progress report, unveils that over 50% of its member banks, including major institutions like Bank of America, HSBC, and Standard Chartered, have committed to credible science-based net-zero targets for 2050. What are the strategies and initiatives...

alternative investment

The Road To Sustainability: How Green Investments Are Making An Impact

HedgeThink -

Green investments align with the Sustainable Development Goals (SDGs) and other ESG initiatives. With major businesses, like HSBC, Amazon, Apple, Tesla, and many others, adopting green investment practices, the trend reflects not only our responsibility towards the environment but also their financial prudence. Read on to explore the profound impact of green investments on our journey toward a sustainable...

While some crypto proponents argue that regulation undermines the core tenets of decentralization, there is a growing consensus that striking a balance between innovation and safety is imperative for DeFi's continued growth. Concordium, a blockchain platform that pioneers comprehensive regulatory compliance through Concordex, its decentralized exchange (DEX), explores the multifaceted challenges in the space of DeFi.

The meteoric rise of...

Alternative Asset Management

Investing In ESG And Nature-Based Solutions: An Inaugural Annual Report By FIC

HedgeThink -

In a world grappling with climate change and biodiversity loss, the need for innovative solutions to combat these pressing issues has never been more apparent. Enter the Forest Investor Club (FIC), a groundbreaking initiative spearheaded by the World Business Council for Sustainable Development (WBCSD) that is on a mission to boost investment in nature-based solutions (NbS).

FIC, established in 2021...

Later-life lending specialist highlights Residential Mortgage-backed Securities (RMBS) and European equity release as leading asset class for institutional investors.

"These assets not only offer attractive risk adjusted yields but crucially, much coveted 17+ year duration cash flows that align with our clients' liabilities and (often narrow) regulatory requirements," explains Rudy Khaitan, Managing Partner of the UK’s leading later-life lending specialist,...

Set against the stunning backdrop of Gibraltar and hosted aboard the luxurious 5-star Sunborn Yacht Hotel in Ocean Village, Crypto Gibraltar promises to be an extraordinary experience unlike any other.

In the ever-evolving world of cryptocurrency, networking and collaboration are the cornerstones of innovation and growth. It's within this dynamic landscape that Crypto Gibraltar emerges as a unique and exclusive...

Financial Industry

Transforming Financial Services: The Synergy of ChatGPT and GenAI for Enhanced Productivity and Profitability

Hernaldo Turrillo -

In the fast-evolving world of financial services, the race to stay ahead of the curve has never been more intense. Fueled by innovative technologies, financial institutions are embracing a future where personalization and efficiency are the cornerstones of success. In this article, we delve into how the synergy between ChatGPT and GenAI is reshaping the landscape of financial services.

Among...

The United Kingdom, with its robust economy and thriving business landscape, is home to a growing number of billionaires. While wealth may be concentrated among a select few, many of these billionaires started with humble beginnings, relying on ambition, determination, and entrepreneurial spirit to build their fortunes. In a recent analysis, SuperCasinoSites explored the birthplaces of the UK's self-made...

blockchain

Transforming Traditional Finance: LSEG’s Blockchain-Based Digital Markets Business

HedgeThink -

In a groundbreaking move, the London Stock Exchange Group (LSEG) is set to pioneer blockchain technology's extensive use in traditional financial assets. With experts like Mona El Isa, founder of Avantgarde: one of the world’s-first institutional-grade DeFi companies, recognizing the potential for blockchain to drive efficiency and transparency, it's evident that traditional finance is ready to harness the transformative...

investing

Equity release products an untapped opportunity for UK pension funds, expert reveals

HedgeThink -

This comes after warnings that increasing PE allocations could result in lower returns for retirement incomes.

Equity release market has grown 100% in the past five years - with record activity in 2022 as a result of living squeeze.

Rudy Khaitan, Managing Partner of the UK’s leading later-life lending specialist, Senior Capital, explains why equity release products could...

The voluntary carbon credits market has shrunk for the first time in seven years, falling 6 per cent in the first half of 2023, and demand on track to fall further, according to two of the top data providers including BloombergNEF.

Confidence ebbed as large corporates such as Nestle, Gucci reduced their purchases due to studies finding that several forest...

investing

Unleash investment in tech adoption and innovation for small firms to kick-start economic growth, Government told

HedgeThink -

New research shows 7 in 10 small firms have modernised processes and developed new or improved products in the last three years

These enhancements typically mean a nearly 15% increase in revenue

Close to a third identify cost as a barrier to bringing in new ideas and changes

The Federation of Small Businesses (FSB) is urging the Government to...

Market View

Financial Industry Urged to Prioritize Clients as Saxo Bank CEO Calls for Change in Rate Hike Practices

Hernaldo Turrillo -

Kim Fournais, CEO and Founder of Saxo Bank has shed light on a practice within the financial industry that often goes unnoticed: the retention of benefits from central bank rate hikes by some banks and brokers, depriving clients of potential gains. Fournais calls for a shift in this practice, urging the industry to prioritize clients and embrace a more transparent...

Industry

Carbon Pricing Strategies: Navigating Emission Controls for Corporate Responses

Hernaldo Turrillo -

Maria Cecilia Bustamante and Francesca Zucchi have released an economic research shedding light on the strategic dance that businesses must choreograph to master optimal carbon management strategies. Their research has unveiled a strategic framework that dissects the intricate nuances prompted by carbon pricing mechanisms, offering a glimpse into how corporations strategically respond to this environmental challenge. The research was...

The first half of 2023 saw the beginning of a banking crisis that will have repercussions for years to come, which will lead to a period of consolidation within the banking industry as well as a rethink of the role of banks in the US economy.

During this period of significant stress, it is important to note that there are...

In a strategic move set to unfold in September 2023, the British chip design giant Arm, backed by Softbank, is gearing up for an Initial Public Offering (IPO) with a remarkable target valuation of $64 billion on the Nasdaq. This ambitious endeavor, however, hinges on Softbank's ability to convincingly position Arm as a significant player in the artificial intelligence...

Market View

CMA Approves Broadcom’s $69 Billion VMware Deal, Clearing The Way For One Of The Biggest Tech Deals Ever

HedgeThink -

This follows the approval of UnitedHealth Group’s £1.24 billion acquisition of EMIS

Following various high-profile deals being blocked, the Competition and Market’s Authority (CMA) has cleared Broadcom’s $69bn (£54bn) acquisition of VMware, one of the largest tech transactions ever completed. The news comes after the authority also announced its preliminary approval of UnitedHealth Group’s £1.24 bn ($1.58 bn) acquisition of EMIS, a healthcare technology...

Financial Industry

Financial Literacy: Understanding the Most Confusing Financial Terms

Hernaldo Turrillo -

Possessing financial literacy is a vital skill in today’s economic driven society. However, numerous individuals still grapple with the intricacies of financial jargon, which can be both bewildering and daunting. To alleviate this issue, City Index conducted an analysis using Ahrefs, a search analytics tool, to identify the top 50 most perplexing financial terms based on their monthly search...

Alternative Asset Management

Sweeping Disruption Looms as PwC Predicts One in Six Asset Managers to Vanish by 2027

HedgeThink -

Pandemic provokes shift as Asset Managers seize opportunity in aviation due to traditional lending downturn.

Due to a combination of market volatility, high-interest rates, and pressure on fees, the asset management industry is predicted to undergo a significant consolidation by 2027, with around 16% of existing companies either exiting the business or being acquired by larger entities, according to a...

Market View

The Intersection of Asset Digitalization and Regulation: A Deep Dive with Jonny Fry on the Dinis Guarda YouTube Podcast

Hernaldo Turrillo -

Dinis Guarda and Jonny Fry, a distinguished figure in the crypto space as the CEO of TeamBlockchain and the recipient of the CryptoAM 2022 Influencer of the Year Award, delve into the intricate landscape of asset digitalization. In a recent interview, they explore the latest developments in blockchain technology and the ever-evolving global regulatory framework. This dynamic dialogue takes...

Financial Industry

AI Concerns in European Financial Services: A Sectorial Analysis

Hernaldo Turrillo -

A significant 63% of prominent leaders within the European Financial Services sector have revealed prevailing concerns regarding the adequacy of preparations to address the potential unintended consequences stemming from the integration of artificial intelligence (AI).

These apprehensions have come to light through the latest EY CEO Outlook Pulse Survey, shedding light on a pertinent issue that demands...

Financial Industry

Investor Confidence Surges As Economists Expect An Inflation Decline

Hernaldo Turrillo -

Investor confidence is on the rise as inflation expectations decline, according to the HL Investor Confidence Index, which has recently reached a level of 78.

This increase in confidence is particularly notable in various markets, including the Asia Pacific, European, Global Emerging, and UK markets. However, in the US market, confidence has experienced a slight decrease. Interestingly, this hasn't deterred...

investing

First European Alternative Investment Fund Leveraging Ethereum Staking Launches, Targeting $150 Million USD

HedgeThink -

Launched and managed by GL21 CAPITAL, the Ethereum Staking A/S fund uses Northstake’s unique, regulated staking platform to offer easy and compliant access to Ethereum staking with limited counterparty risk.

Northstake A/S, the digital asset staking provider regulated by the Danish Financial Authority, has announced its role as service provider to asset management investment firm GL21 CAPITAL’s brand new Ethereum Staking A/S fund....

investing

Retail Investment In The Digital Assets Market Grows, With 75% Of Traders Starting To Yield Returns

HedgeThink -

More than three out of four non-professionals make money this year and plan to increase how much they trade.

One in three have started trading in the past two years, GNY study finds.

GNY Range Report uses advanced AI Crypto Intelligence to forecast the volatility of the 12 top cryptocurrencies.

More than three out of four crypto traders have...

The United States leads the way in terms of the number of crypto billionaires and total net worth amount.

Prominent crypto billionaires such as Chris Larsen, Cameron and Tyler Winklevoss, Michael Novogratz, Brian Armstrong, and Barry Silbert are based in the US.

Other countries such as China, South Korea, and Canada have also produced notable crypto billionaires.

Cryptocurrency has...

Industry expert discusses the potential consequences of CMA decisions on dealmaking activity in the UK.

Claire Trachet, tech industry expert and CEO of business advisory, Trachet, assesses the balance between stimulating competition and making the UK an attractive dealmaking destination.

Executives seeking to engage in multinational deals must prepare themselves for the additional challenges from regulators due to the...

investing

The financial sector ranks among the top five best sectors for investment, new study reveals

HedgeThink -

The IT sector is the best sector to invest in with an average return of investment of 18.1%

The consumer discretionary sector comes in second with 15.3%

The worst sector to invest in is communication services with 8.4% average return

IT is the best sector to invest in based on average returns, a new study reveals.

The study, conducted by InvestinGoal.com,...

In this episode Hilton interviews Bertram Seitz and Katja Damij from the Best Crypto Index Fund, an EU-regulated cryptocurrency fund for everyday investors. Joined by Peter Kristensen, CEO of JPFS, episode 12 lays out how you can invest in a professionally managed crypto fund, regulated in the EU.

Hosted by seasoned financial markets experts Adam Hill, Hilton Supra and Peter...

FinTech investment has slumped 57 per cent in the first half of 2023 amid economic uncertainty, but the UK has maintained its position as a leading European financial centre, according to data from KPMG.

During the first six months of this year, total UK fintech investment declined to $5.9 billion (£4.6 billion), a sharp drop from the $13.8 billion recorded during the...

Distressed investing is often characterized as a cyclical strategy dependent on macroeconomic factors that focuses primarily on the undervalued distressed debt of struggling companies that may require a restructuring through bankruptcy or another form of reorganization. Benefits presented by investing in this asset class can include equity-like returns with lower volatility and risk, illiquidity premiums, differentiated return drivers and...

Inspiration comes in strange places and as I sat watching Barbie, the charismatic Weird Barbie struck a chord with me. She reflects an antidote to groupthink, lethargy and the popular dumbing down at the institutional and individual levels.

For those who don’t know who Weird Barbie is, she is the Barbie whose hair is cut short and often has felt-tip...

The new episode of Market Views explores how Edward Males, CEO at ALPHAtrade leads the strategy team behind Lecka Quant FX, the flagship FX investment program recently launched on trademakers.com as a fractionalised investment.

https://www.youtube.com/watch?v=6XV_lVBJtzw

Hosted by seasoned financial markets experts Adam Hill, Hilton Supra and Peter Kristensen, Market Views aims to cover the latest news on trading, trading strategies and...

- The IT sector is the best sector to invest in with an average return of investment of 18.1%.

- The consumer discretionary sector comes in second with 15.3%.

- The worst sector to invest in is communication services with an 8.4% average return.

IT is the best sector to invest in based on average returns, a new study reveals.

The study, conducted...

Product harnessing generative AI is first of its kind dedicated to providing real-time, transparent responses on the ESG data of portfolio companies.

Iceberg Data Lab (“IDL”), the independent green fintech providing science-based environmental data solutions for financial institutions, today announced the launch of the world’s first ESG AI assistant “Barbatus”. The new product harnesses generative AI technology to generate real-time, text-based...

Financial Industry

Investing In Bond And Debt Derivatives At Financial Insights By Hilton Supra

Hilton Supra -

Welcome to "Financial Insights," a series that guides investors through the intricate paths of the investment landscape. In the first part of this series, we dove into the complex world of bonds and debt investments. In this part, we complete the guide to bonds and debts, taking a closer look at bond options and additional examples of how investors...

Bitcoin

G20 Watchdog Asserts Global Regulations Leave Cryptocurrency Firms with Nowhere to Evade

HedgeThink -

According to the G20's Financial Stability Board, universally accepted regulations compel cryptocurrency firms to implement essential precautions to avoid incidents like the FTX exchange and other crypto-related losses.

On Monday, the FSB released its conclusive recommendations, as requested by the G20, regarding the oversight of companies engaged in trading crypto assets like bitcoin. Additionally, the watchdog revised its existing recommendations...

The new episode of Market Views explores the performance of fractionalised investments in 2023, including trademakers’ latest investment offering in green hydrogen.

https://www.youtube.com/watch?v=WYOAO5JkSCU

Hosted by seasoned financial markets experts Adam Hill, Hilton Supra and Peter Kristensen, Market Views aims to cover the latest news on trading, trading strategies and markets. In Episode 10 of MARKET VIEWS, join Peter Kristensen, CEO at...

Digital Asset Insights

Deglobalisation Represents New Niche Investment Strategy: Fund Manager Comment

HedgeThink -

Fund manager Niche Asset Management says it has identified a new niche for its trademark approach to investment management. The asset management firm specialises in identifying both short and long term niches within global equity markets, some of which can grow into new strategies within its Niche Jungle project platform.

The “Deglob Niche”

Massimo Baggiani, Co-founder of Niche Asset Management, explained:

“We...

A new survey of UK human resources (HR) managers and directors working in the finance sector shows they will need three years to be ready for the impact of AI on the workplace – yet all of them believe artificial intelligence (AI) will deliver benefits.

In total, nearly half (47%) said it would take a minimum of three years before...

- SERIX sentiment index on both cryptocurrencies risen consistently since start of 2023.

- Retail investors took advantage of the 24/5 access to the securitised derivatives via Spectrum on those two cryptocurriencies.

Spectrum Markets (“Spectrum”), the pan-European trading venue for securitised derivatives, has published its SERIX sentiment data for European retail investors for June, revealing retail investor sentiment towards cryptocurrencies Bitcoin and...

Alternative Asset Management

Bonds and Debt Investments At Financial Insights By Hilton Supra

Hilton Supra -

Welcome to "Financial Insights," where we uncover the mysteries of the investment world. In today's Insight, we're diving into the complex world of bonds and debt investments. Whether you're an experienced investor or just getting started, understanding these financial instruments is crucial. So, let's unravel the complexities and explore the various forms of bonds and debt investments.

In its simplest...

Education

Introducing SGT Africa at Market Views Podcast: Unveiling an International Trading Hub for the African Market

HedgeThink -

Meet Peter Kristensen and Fortune Orianwo, Country Director at SGT Africa, share some of the reasons behind the launch of SGT Africa and explain why traders in Africa choose to trade with a local team, supported by an international network of specialists.

https://www.youtube.com/watch?v=JYXbLbnLTPw

Peter Kristensen, CFO at SGT Markets:

‘SGT Africa was invented to service the needs of online traders from dedicated...

Cryptocurrency has become a global phenomenon with billions of dollars being invested in the market every day. Crypto casino experts Wegamble investigates which countries have emerged as leaders in this field, and who have produced the most crypto billionaires.

- The United States leads the way in terms of the number of crypto billionaires and total net worth amount.

- Prominent crypto...

Interviews

Investors Now Have Responsibility to Consider ESG as Global Temps Hit Record High

HedgeThink -

As global temperatures hit a record high, every investor now has a responsibility to consider environmental, social and governance (ESG) investments, says the CEO of one of the world’s largest independent financial advisory, asset management and fintech organisations.

The comments from Nigel Green of deVere Group come as it is revealed that Monday was the world’s hottest day on record,...

Business

McKinsey & Company Reveals Minerals and Metals Required for the Energy Transition Might Face Temporary Supply Shortages by 2030

HedgeThink -

Research suggests an investment of $3-4 trillion by 2030 is required to meet the speed of global decarbonization.

Latest analysis from McKinsey & Company (McKinsey) reveals minerals and metals required for current decarbonization trajectories may not meet demand and could require $4 trillion of investment by 2030. The net-zero materials transition: Implications for global supply chains report data shows the supply...

- Managing Partners Group marks High Protection Fund’s 14th anniversary with 2% boost for investors.

- Nearly half of professional investors expect dramatic increases in Life Settlements allocations driven by attractive valuations and consistent returns.

Wealth managers and institutional investors are targeting dramatic increases in allocations to the Life Settlements asset class due to increasingly attractive valuations and consistent returns, new...

Finance

PM and Chancellor Should Unlock £150Bn Economic Boost through Government Investment, Urge IPPR

HedgeThink -

Rishi Sunak and Jeremy Hunt have been urged to ramp up government investment spending to unlock a £149bn economic boost, according to a report by the Institute for Public Policy Research (IPPR).

The IPPR stated spending on expanding quality projects such as renewable energy infrastructure and improving transport networks could “pay for itself” by retaining tens of billions of pounds...

Foreign Exchange

BMAMS: An Inclusive Foreign Exchange Investment Program for All Portfolios In The Latest Market Views Podcast

HedgeThink -

Hosted by seasoned financial markets experts Adam Hill, Hilton Supra and Peter Kristensen, Market Views aims to cover the latest news on trading, trading strategies and markets. In Episode 8 of MARKET VIEWS, Peter Kristensen and Norm Hart, the strategist behind BMAMS lay out the fundamentals of investing in professionally managed foreign exchange programs.

https://youtu.be/SAHy0Nq0LDQ

Norm Hart leads the strategy team...

Industry watchdog The Financial Conduct Authority (FCA) has written to banks that lend to UK companies to warn them about “greenwashing” and “conflicts of interest” in the sustainable loans market.

The rising popularity of deals that link borrowing costs to sustainability targets has prompted fears that banks and high-emitting companies use these to enhance their reputation without setting meaningful climate targets in...

Business

Bite Investments Report: Digitalization a Priority for Private Markets Firms Following a Direct, Positive Impact on Profit

HedgeThink -

- Keeping ahead of competitors in terms of technological capabilities is now a top priority for private equity and other alternative asset management firms as 79% of organizations report a direct, positive impact on profit because of digitalization over the past two years.

- Investor relations and communications, cybersecurity, and due diligence are the top drivers for investment into digitization.

-...

Hosted by seasoned financial markets experts Adam Hill, Hilton Supra and Peter Kristensen, Market Views aims to cover the latest news on trading, trading strategies and markets. This week, we re-join Richard Winterbourne, CEO at Haush, Steve Saunders, Director at Arup and Peter Kristensen, CEO at JPFS as they explain how investors are really getting excited about investing in...

Jeremy Hunt, Chancellor of the Exchequer, has signed an agreement on financial services cooperation with Commissioner Mairead McGuinness, which will help to establish a constructive, mutually beneficial relationship between the UK and the EU in financial services.

This comes as the Chancellor is in Brussels for a series of meetings with European Commissioners, in the first visit from a UK...

Industry

Investors Increasingly Attracted to West Africa’s Gold and Critical Metals Sector

HedgeThink -

Increasing US Focus on Metal and Mineral Supply Chain Will Drive Growth

Investment opportunities in West Africa's gold and critical metals mining sector are poised to become increasingly appealing, according to recent research conducted by Tresor Gold. The New York City-based mining company focuses on exploration and development projects in West Africa, and conducted an international study involving global institutional...

The current world economy is between $80 - $100 trillion. Broad and inexpensive access to digital money and phone-based transactions has opened the door to financial services for 1.7 billion people worldwide, even including those without traditional bank accounts. On the second day of the SOFTin Space 2023 conference, industry experts gather for an engaging panel discussion, moderated by openbusinesscouncil and ztudium CEO...

- $1bn+ global discretionary funds produced notable excess returns over sub-$1bn funds during the past two years.

- Systematic macro has outperformed discretionary approaches on average over the same period.

In recent years, there has been a resurgence in the success of macro hedge funds, with notable funds demonstrating impressive performance. According to data from With Intelligence, macro emerged as the...

In Episode 6 of MARKET VIEWS, Peter Kristensen and Chris Butler, the strategist behind Cromwell FX lay out the fundamentals of investing in professionally managed foreign exchange programs. A new podcast hosted by Hilton Supra and powered by openbusinesscouncil.org and jpfs.com.

https://www.youtube.com/watch?v=ylYYJI-XrAM

Cromwell FX and Fractionalised Investments are the topics discussed on the Market Views Podcast. The podcast delves into the...

Business

Bank of England Should Tread Cautiously Amid Rising Inflation Concerns, Warns PGIM Wadhwani CIO, Sushil Wadhwani

HedgeThink -

Sushil Wadhwani, CIO, PGIM Wadhwani has emphasised the critical need for the Bank of England (BoE) to address the growing possibility of embedded inflation. Wadhwani's remarks come in the wake of three consecutive months of higher-than-anticipated Consumer Price Index (CPI) inflation and a surge in wage growth, raising concerns of a potential wage-price spiral reminiscent of the 1970s. While urging...

blockchain

Laser Digital Investor Survey Finds That 96% Of Those Questioned See Digital Assets As An Investment Opportunity

Hernaldo Turrillo -

In the latest Investor Survey by Laser Digital, an overwhelming majority of investors recognize the significance of digital assets within the investment landscape. According to the survey, a staggering 96% of respondents view digital assets as a valuable opportunity for diversification, on par with traditional asset classes like fixed income, cash, equities, and commodities.

Laser Digital, the digital asset subsidiary...

By Charles White Thomson, CEO at Saxo UK

Before we start, I should declare that where AI is concerned, I am a specist.

AI has the ability to do great good but also great harm. I heed the warnings of Elon Musk, ‘AI Godfather’ Geoffrey Hinton and the notable figures who declared the importance of ‘mitigating the risk of extinction from...

Bitcoin

Market Views #5 – Crypto Trading: What Is It, How It Works, and Why Traders Should Consider It

HedgeThink -

Cryptocurrencies, or digital currencies, are fast emerging as one of the most popular asset classes for seasoned traders as well as new arrivals to the scene.

https://www.youtube.com/watch?v=1zT2uWe-QHk

While some investors prefer to own cryptocurrencies such as Bitcoin (BTC), many are opting to deal in CFDs instead, and that’s what this video focuses on – how to buy and sell cryptos for...

Finance

Nature-based Solutions: EIB Report Finds Scope for Regulatory and Subsidy Reforms as well as a More Flexible Spectrum of Financial Instruments

HedgeThink -

- European Investment Bank (EIB) report on nature-based solutions (NBS) investigates financial barriers and opportunities for scaling green actions that protect or restore natural ecosystems while mitigating threats to society, such as floods, coastal erosion, and overheating cities.

- Market mechanisms required to scale the uptake of nature-based solutions in the European Union are not currently in place.

- Regulatory and...

blockchain

AFAK Events & FIMA PR LLC Presents the Third Iteration of “SOFTin Space” – The Premier Annual Banking and Fintech Event in Istanbul

HedgeThink -

AFAK Events & FIMA PR LLC, a prestigious event organizer based in Istanbul, Turkey. With a solid track record of hosting successful industry conferences, is thrilled to announce the highly anticipated third edition of "SOFTin Space." This renowned banking and fintech event will be held on the 20th and 21st of June 2023 at the prestigious Hilton Bosphorus in...

asset management

Binance’s Delisting of Privacy Coins Amidst EU’s Regulatory Measures Raises Concerns

HedgeThink -

Binance's recent decision to delist privacy coins has ignited a heated debate within the cryptocurrency community, shedding light on the implications of the European Union's regulatory measures. The EU's adoption of the Markets in Crypto-Assets (MiCA) Regulation, aimed at bringing clarity to the crypto space, has garnered praise from industry players. However, concerns have been raised regarding the impact on...

The ‘Magnificent Seven’ stocks that account for around 90% of gains on Walls Street’s S&P 500 this year are impressive, but not a silver bullet for investors, warns the CEO and founder of one of the world’s largest independent financial advisory, asset management and fintech organisations.

The warning from Nigel Green comes as high-profile market commentators among others flag the...

MC cools significantly but remains the global top earner.

The generated $1.06 billion in revenue for lenders in May 2023, according to DataLend, the market data service of fintech EquiLend. The figure represents a 15% increase from the $923 million generated in May 2022.

Global broker-to-broker activity, where broker-dealers lend and borrow securities from each other, totalled an additional $255 million...

Bitcoin

Yellow Card and Tether Join Forces to Drive Stablecoin Education and Adoption Among the African Youth

HedgeThink -

Yellow Card, a pan-African fintech and cryptocurrency exchange, and Tether, the world's largest stablecoin provider, are pleased to announce the successful completion of Phase 1 of their strategic collaboration across three key African markets. The two-month collaboration focused on raising awareness, providing education and driving the adoption of USD₮, Tether's stablecoin, among students and young professionals in Nigeria, Kenya...

Investors must take a cautious approach to the Artificial Intelligence (AI) boom to avoid getting ‘burned’, warns a serial tech entrepreneur and the CEO and founder of one of the world’s largest independent financial advisory, asset management and fintech organisations.

The warning from Nigel Green of deVere Group follows Nvidia last week shocking the stock market, posting better-than-expected results in...

In episode 3 of MARKET VIEWS, we’re exploring fractionalised investments.

What they are, how they work and why fractionalised investing is allowing ordinary everyday investors to invest their money in professionally managed investment programs, for the first time!

Normally, to invest in a professional investment program built and managed by seasoned professional investment managers, you needed to be a professional investor...

Market analysis by digital identity security specialists, ID Crypt Global, has shown that Europe is leading the way when it comes to the number of ESG investment funds, although Asia, Australia and New Zealand have shown the largest degree of growth.

ID Crypt Global analysed the latest data for Q1, 2023 on ESG investment funds, encompassing open-end funds and exchange-traded funds that...

The rising cost of living, economic uncertainty, and geopolitical issues have driven-up demand for financial advice by 21.2% over the last year, according to one of the world’s largest independent financial advisory, asset management and fintech organisations.

As the figures from deVere Group, which are based on enquiries from new and existing clients, are released, the company’s Regional Director Europe...

In a major initiative designed to improve global standards of regulation of crypto-assets, IOSCO has set out how clients should be protected and how crypto trading should meet the standards that apply in public markets. The Recommendations cover six key areas, consistent with the IOSCO Objectives and Principles for Securities Regulation and relevant supporting IOSCO standards, recommendations, and good...

Bitcoin

Shattered Trust: Ledger’s New Recovery Feature Stirs Up Crypto Security Concerns

HedgeThink -

By David Carvalho, Co-Founder & CEO of Naoris Protocol

Disruption in the Cryptocurrency Landscape

In the dynamic arena of cryptocurrency, Ledger's recent introduction of its new "Ledger Recovery" feature has stirred the proverbial pot. Aimed at mitigating the problem of users losing access to their cryptocurrency due to forgotten seed phrases or damaged hardware wallets, Ledger’s new $9 a month subscription...

IOSCO, the global standard setter for securities markets, has issued for consultation detailed recommendations to jurisdictions across the globe as to how to regulate crypto assets. It consists of 18 measures to cover conflicts of interest, market manipulation, cross-border regulatory cooperation, custody of crypto assets, operational risks, and treatment of retail customers.

In a major initiative designed to improve global...

• Humphrey Yang (54.3M followers, likes and subscribers) conquers social media as the most popular finance influencer.

• Tori Dunlap (26.9M followers, likes and subscribers) and Taylor Price (21.9M followers, likes and subscribers) take centre stage in the top three.

• The new research ranked 50 influencers based on their follower, like and subscriber count across Instagram, TikTok, Twitter, YouTube and...

Business

Investment Expert Explains How Startups Can Use Sustainability to Fuel Brand Growth

HedgeThink -

Despite mass layoffs and increased caution from recession-wary businesses causing many to scale back, sustainability has remained an optimistic strategy for businesses looking to drive growth. Fuelled largely by growing public sentiment around the importance of corporate responsibility, over 1-in-3 (36%) UK consumers admit to choosing brands with good sustainability credentials, according to Consultancy.uk. Further research from Nielsen IQ reveals that...

• Income-paying assets will once again offer a real rate of return as inflation falls.

• BoE hiked for the 12th consecutive time to fight stubborn inflation.

• But hope is on the horizon as economists predict an inflation drop by next year.

Despite annual CPI inflation still being in double digits at 10.1% for March, there is good news on the...

Financial Industry

To Learn About Investment Strategies: openbusinesscouncil and JPFS Launch New Market Views Podcast

HedgeThink -

Hilton Supra, Vice President of Ztudium Group and openbusinesscouncil.org, in collaboration with Adam Hill and Peter Kristensen, from JP Fund Services, launch Market Views podcast. In this new series, the three of them discuss the latest financial and trading news with veterans and industry experts. The first episode features founder and CEO Dinis Guarda. With new episodes released weekly,...

Bitcoin

Decentralised Exchange Protocol, Dolomite, Raises $2.5 Million: DGC, NGC Lead Ventures

HedgeThink -

British Virgin Islands, May 12th, 2023

Leavitt Innovations, the lead developer of next-generation DeFi money market and decentralised exchange protocol Dolomite, has announced the successful completion of a $2.5 million funding round. The investment was led by venture capital funds Draper Goren Holm (DGH) and NGC, with participation from over a dozen other firms including Coinbase Ventures, WWVentures, and 6th...

Amsterdam-based institutional-grade service provider moving towards MiCA regulation.

Hyphe, the digital asset liquidity provider for financial institutions, has received a certificate of compliance to ISO 27001 Information Security Management by internationally-renowned certification body, BSI Group. The certification reinforces Hyphe’s commitment to the highest security standards ahead of Europe’s new Markets in Crypto Assets (MiCA) regulation.

Hyphe’s ISO 27001 certification covers...

• Early bird SIPP investors picks positive on global equities in the new tax year.

• SIPPs are for the long term, so higher short-term volatility is less of an issue.

• Equities typically provide the greatest long-term returns.

• But where you are in life should impact your portfolio exposures.

By Hal Cook, Senior Investment Analyst, Hargreaves Lansdown.

Early bird SIPP trading in...

trademakers launches its first investment opportunity in renewable energy.

The Whitehill project in Scotland, is a 100% clean, green energy project to create renewable hydrogen for transport from wind and water.

Investing in this project will enable it to move through planning permission (which is supported by both local government and the Scottish government) and on to development.

The investment timeline is up to...

Digital Assets

Warren Buffett vs Big Tech: Does AI Have a Place in Your Investment Portfolio?

HedgeThink -

Artificial Intelligence (AI) stocks should now be part of most investors’ portfolios as Big Tech prepare for an AI boom, suggests the CEO and founder of one of the world’s largest independent financial advisory, asset management and fintech organisations.

The comments from deVere Group’s Nigel Green follow last week’s earnings reports from tech titans including Microsoft, Alphabet (parent company of...

The metaverse has emerged as a revolutionary virtual space that offers endless possibilities for gamers, investors, and creators alike. With the growing interest in the metaverse and its potential as a virtual economy, the need for reliable and secure crypto trading platforms has become more important than ever. MetaX Exchange, powered by Binance Cloud, is positioning itself as a...

Amid recent reports that Britain will have the worst-performing major economy this year, with the UK’s GDP expected to contract by 0.6%, it can be revealed that ‘GDP’ is the most confusing financial term in the UK.

That's according to new research by CityIndex. The experts utilised the search analytics tool, Ahrefs, to identify the average number of monthly searches...

Fintech revenues are projected to grow sixfold from $245 billion to $1.5 trillion by 2030, according to a report from Boston Consulting Group (BCG) and QED Investors.

The fintech sector, which currently holds a two per cent share of the $12.5 trillion in global financial services revenue, is estimated to grow up to seven per cent. Last year, 2022 proved a...

• BlackRock’s Larry Fink tops the ranking in Peregrine Communications’ inaugural CEO report analyzing the personal brands of CEOs at the world’s 150 largest asset management firms across five key metrics, including personal brand awareness, share of voice, media sentiment and social media presence.

• Report shows ~10% CEO turnover in the last 12 months with 14 asset management CEOs...

• Digital euro potentially available initially to euro area residents, merchants and governments

• Digital euro could be made available via existing banking apps and Eurosystem app

• Offline and person-to-person payments across euro area seen as highly valued

The European Central Bank (ECB) and the euro area national central banks launched the investigation phase of the digital euro project in October 2021. The investigation...

• New analysis shows there were 19 reported hacks in Q1 2023 – up from 16 in Q1 2022 and 10 in Q1 2021.

• $265 million has been lost so far this year, with $197 million stolen in the biggest single hack of 2023.

New analysis* from Naoris Protocol, a global cyber security firm, reveals there was a rise in...

Out of the $2.9B in total funding; Content Creator Startups attracted more than $800M investment in 2022.

In recent years, the creator economy has experienced a surge, allowing individuals such as bloggers, social media influencers, podcasters, TikTokers, and YouTubers to earn money from their content. Venture capitalists have been major supporters of this thriving industry, particularly after the COVID-19 pandemic,...

Bitcoin

European Union (EU) Reaches Agreement on MiCA Crypto-asset Regulation for Digital Finance

HedgeThink -

The EU brings crypto-assets, crypto-assets issuers and crypto-asset service providers under a regulatory framework for the first time.

The Council presidency and the European Parliament reached a provisional agreement on the markets in crypto-assets (MiCA) proposal which covers issuers of unbacked crypto-assets, and so-called “stablecoins”, as well as the trading venues and the wallets where crypto-assets are held. This regulatory framework will...

• Humphrey Yang (54.3M followers, likes and subscribers) conquers social media as the most popular finance influencer.

• Tori Dunlap (26.9M followers, likes and subscribers) and Taylor Price (21.9M followers, likes and subscribers) take centre stage in the top three.

• The new research ranked 50 influencers based on their follower, like and subscriber count across Instagram, TikTok, Twitter, YouTube and...

• 22 April is Earth Day – a day to reflect on the environmental successes so far, and the challenges ahead.

• It could be a great time to check if your portfolio is ready to weather the environmental challenges facing us in the decades ahead.

• We look at two companies and two funds with sustainability at their core.

By Dominic...

investment

AI Investment: University Seeking World-leading Innovators for New AI Accelerator Programme

HedgeThink -

A University of Edinburgh initiative which helps emerging Artificial Intelligence (AI) companies maximise their full commercial potential is now accepting applications for its 2023 programme. Open to both Scottish and international companies, the AI Accelerator is seeking innovative scale-ups to be part of its sixth cohort.

Since its launch in 2018, the programme has supported a wide range of innovative...

In 2019, Aramco went public on the Saudi stock exchange and raised $29.4 billion, making it the largest IPO in history at the time. Initial Public Offerings (IPOs) are a way for companies to raise capital by offering shares of their company to the public for the first time. Over the years, there have been many successful IPOs that...

Investor focus is set to shift from inflation to earnings season, which starts on Friday, as it will give us more insight about a forthcoming recession, says the CEO of one of the world’s largest independent financial advisory, asset management and fintech organisations.

The assessment from deVere Group’s Nigel Green comes ahead of earnings reports on Friday from major Wall...

Financial Industry

European Firms Increase Investment in Climate Action, According to EIB Climate Investment Report 2022-2023

HedgeThink -

According to the EIB Climate Investment Report, 53% of European companies are now investing in climate action, which marks a 10 percentage point increase from 2021. Notably, Central and Eastern Europe have witnessed a considerable surge in such investments, alongside small and medium-sized enterprises. Energy-intensive manufacturers display a higher inclination towards climate investments compared to non-energy intensive firms. Despite...

Business

US Continues to Establish AI Regulations: Will the UK Prioritise Investment over Stringent Regulation?

HedgeThink -

While Generative AI continues to experience rapid growth, dominating headlines and bringing with it a global wave of excitement, turbulence has struck as privacy and transparency concerns send the US and EU into establishing further regulations. This announcement follows Italy temporarily banning ChatGPT, while the US saw its government introduce a code of conduct placing responsibility on software makers...

The Paris Blockchain Week, Europe’s largest gathering of thought leaders, innovators, and experts from around the world, has concluded and demonstrated that the blockchain space is maturing. 8,500 attendees flocked to Paris, joining executives and change-makers from major companies such as Google, Coca-Cola, Amazon Web Services, Deutsche Bank, Bloomberg, LVMH, Coinbase, Circle, Microsoft, and Mercedes. The week had three...

UK consumers reported 10,000 incidents of cryptocurrency fraud between October 2021 and September 2022, amounting to a total loss of £226 million and representing a 32% increase from the previous year, according to data from Action Fraud.

In response to the rise of cryptocurrency fraud, Cybersecurity expert VPN Overview reveals the ways in which consumers can avoid five common...

DKK Partners, a leading fintech company specialising in emerging markets (EM) and foreign exchange (FX) liquidity, has announced a circa 60 per cent growth in revenue in 2022, surpassing £100 million, up from £63 million the previous year.

Fuelled by its global expansion, opening new offices in Ghana, Dubai, Cameroon and Ivory Coast, DKK has increased its client base by...

ChatGPT, Bing AI, Google Bard….. Chatbots currently represent the top use of AI in enterprises, and their adoption rates are expected to almost double over the next two to five years. While AI chatbots make their way as panellist at fintech conference by the Gillmore Centre for Financial Technology, what could be the other potential areas where chatbots can...

investment

The Current Banking Crisis: A Critical Analysis Of The Strategies To Manage Financial Risks

Hilton Supra -

The Current Banking Crisis: A Critical Analysis Of The Strategies To Manage Financial Risks - The recent crashes in the financial markets have shaken the global banking industry. This article will discuss the recent financial crashes and their effects on investors and the future of banking, with a particular focus on asset-liability management.

The purchase of UBS by Credit Suisse...

Stablecoins are digital currencies that maintain a stable value relative to specific assets. They are popular because they provide a stable store of value and fast transfer of funds, but also pose risks to financial stability and consumer protection, as demonstrated during the SVB crash.

Stablecoins have gained popularity due to their ability to offer users a stable store of...

Bitcoin