In the previous post within the series on “The Pragmatic Hedge Fund Manager” we presented the Upside part of creation of Hedge Fund. As we know advantages are always accompanied by the disadvantages. In order to minimize their risk it is necessary to be aware, alert to their impact. Therefore, it is vital to evaluate all pros and cons. Below is the part that focuses only on the Downside.

The Downside

Who wouldn’t want to maximize returns on an investment and earn more than a billion dollars off just one year of diversified investment? In real hedge funds world, the risk associated with a hedge fund is much more glaring. The fact that hedge fund managers make speculative investments may mean that investors are exposed to greater risk than ever.

Although hedge funds promise bond-like returns in times of low market activity, the fact is that money is not liquid for at least a year. Additionally, hedge funds may often not be seen as completely transparent in their provision of information about returns. This dispiriting trend is not expected to improve over the next one to two years, leaving smaller investors weighing out transparency lags against more stable fixed income alternatives.

Hedge funds are mostly tailored for the sophisticated investor, and require a large initial minimum investment. According to the EY Global Hedge Fund and Investor Survey, the year 2012 saw 90% of net inflows to hedge funds in funds of more than US$10bn under management. It is also recorded that most brokers will not work with funds under $5 million in assets under management (AUM).

Hedge Fund Meltdowns

Risk tolerance is a major issue that investors seem to be hung over. We have seen in the recent past that hedge fund blowups are more common for the very same reason that they are sought after: amplified diversification. Hedge fund managers have been repeatedly lambasted for failing to allocate funds appropriately when incorporating high-return strategies. The resultant higher levels of volatility in the investment mix exposes investors to a wide range of losses, especially when using derivative instruments.

Blindly investing more money in a high-performing stock or combination strategy may mean that as a fund manager you are lacking the ability to judge how this performance was obtained and whether it will persist in future. Therefore, a wrong choice of investments may be the cause behind a huge meltdown.

While hedge funds are seen as obstinately profitable parts of investment portfolios, the truth is that some of them have been the cause of the biggest meltdowns that the investment world has seen. Strategies such as short only funds and managed futures are lurking in the background while hedge fund managers look to launch their high-return fund offerings.

Global Macro strategies tend to open you up to the broad based global markets, but these highly leveraged macro funds have made for some of the largest hedge-fund blow-ups that we have seen. You need to be wary of the risks associated with the pricing of underlying assets before making your call. The Long-Term Capital Management (LTCM) fund of 1994 collapsed in 1998 when Russia defaulted on its debt, incurring losses of over $4billion. The US government intervened, bailed out LTCM as a large financial crisis was looming on the horizon.

Costs associated with Hedge Funds

While the level of diversity offered by hedge funds is an upside, for institutional investors, the issue of fee costs is one that they want to stamp out before being more optimistic about growth in the following years. Higher costs of regulatory reporting, technology and infrastructure maintenance means that medium sized firms (US$5bn to 10bn) will see their expectations of increasing margins dashed in the coming years.

One of the initial challenges faced by a hedge fund manager is one of hiring the right people for the front and middle offices so make sure you do your share of “head hunting”. At the same time, you have to strive to keep your management expense as low as 2.5% or even lower to demonstrate operational efficiency and a commitment to lower cost of ownership.

In addition to hiring management executives, managing a hedge fund is something you cannot opt for as a side business. It entails long working hours and at least 20-30% of your time on administrative matters. In the worst-case scenario, you also have to engineer your own exit strategy.

Compared to mutual funds and exchange traded funds, hedge funds entail high minimum investments and fee structures. Therefore, you need to generate a mix of investments for the average investor.

Other Challenges

Leverage employed by a hedge fund provides investors with the convenient possibility of entering cashless derivative transactions to earn returns on stocks investors don’t have to use up all their cash for. However, high leverage leads to magnified losses when the market moves in an unfavorable direction. As a high performing hedge fund manager, you need to be able to take the right directional positions on underlying assets to avoid higher losses in a highly levered fund.

A hedge fund requires participants to invest their money for at least one year. Lower liquidity in a hedge fund thus implies that investors are searching for the right option to lock their money in. Investors will be looking out for mispricing and performance improvement risk when choosing the hedge fund to place their bets on.

It is pertinent that a fund manager looks as meticulously at the concentration of the overall portfolio as he does to a single investment. Stocks with similar performance drivers pose a threat to the portfolio; therefore, a balanced asset mix will include a hedge fund that correlates minimally with the rest of the positions.

The level of net and gross exposure of the portfolio is significantly impacted by the particular hedge fund strategy used by the manager. Investors will be interested in the long and short positions in your fund and the leverage they are using. A 10% position in a fund which is 10-times levered, for instance, the addition of the hedge fund to portfolio will increase the gross exposure of the portfolio to 190%, assuming all other positions maintain 100% exposure.

When measuring risk, the standard deviation is the most commonly used evaluator for funds, as it measures the volatility of returns. However, in the case of a hedge fund, the measure fails to capture the risk element due to the absence of normally distributed returns. Investors are then forced to use measures such as value-at-risk, which shows the probability of losses on a particular investment.

Operational Efficiency and Regulation

The hedge fund industry now sees managers grumbling about a great deal of regulation. A challenging business is now made harder as the government imposes more regulations on the alternative investment. According to the global hedge fund and investor survey, most managers believe that mitigating systematic risk and supporting the due diligence process are concerns secondary to regulatory directives.

Managers have recorded increased regulatory demands as one of the major challenges facing them, along with the need to integrate more efficient data management strategies. As a shrewd hedge fund manager, you may have to outsource professional money managers and hire legal counsel to deal with compliance and legal issues to boost operational efficiency.

Data management, technological advancement and proportionate investments in infrastructure are factors that will make or break you. Availability and accuracy of data has been identified as a better risk management tools therefore investment in technology will be a demanding area. With cost optimization, a frightening challenge for you as a manager, you will have to be pulling some strings to avoid getting run down by established hedge fund managers.

According to P& I data, 57% of the rise in assets recorded for hedge fund managers in 2013 can be attributed to performance. This puts a lot of the burden on the middle office that is burdened with the task of boosting operational efficiency (in terms of trading, compliance, marketing and administration), and keeping up with some of the top hedge fund companies.

Hedge fund strategies need precise evaluations based on potential returns and risks associated with economic factors such as market dynamics, sector-specific anomalies and regulatory impacts. You will find yourself adapting your strategies to meet the risk/return objectives of your funds in order to fully deliver a trustworthy image.

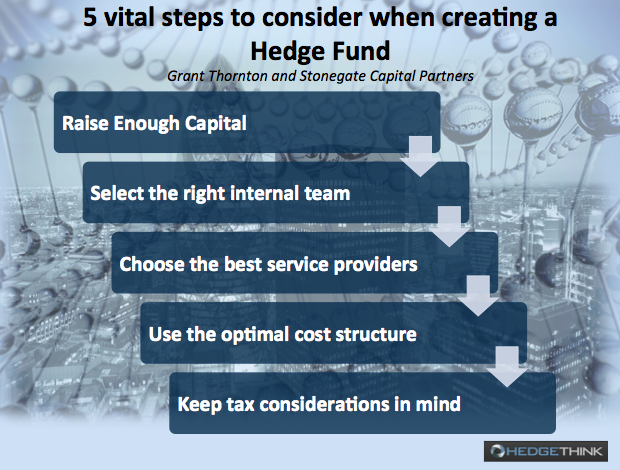

There are many steps to consider while creating a hedge fund. As suggested by Grant Thornton and Stonegate Capital Partners, there are five steps critical for a hedge fund creation:

- To Raise enough capital

- Select the right internal team

- Choose the most appropriate service providers

- Use the optimal cost structure

- Keep tax considerations in mind

Related Posts:

Hedge Fund Industry Today – Part 1

The History of Hedge Fund Industry – Part 2: How to attract Investors

Why Create A Fund Or A Hedge Fund?

Dinis Guarda is an author, academic, influencer, serial entrepreneur and leader in 4IR, AI, Fintech, digital transformation and Blockchain. With over two decades of experience in international business, C level positions and digital transformation, Dinis has worked with new tech, cryptocurrencies, drive ICOs, regulation, compliance, legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

Dinis has created various companies such as Ztudium tech platform a digital and blockchain startup that created the software Blockimpact (sold to Glance Technologies Inc) and founder and publisher of intelligenthq.com, hedgethink.com, fashionabc.org and tradersdna.com. Dinis is also the co-founder of techabc and citiesabc, a digital transformation platform to empower, guide and index cities through 4IR based technologies like blockchain, AI, IoT, etc.

He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays and governments all over the world.

He has been a guest lecturer at Copenhagen Business School, Group INSEEC/Monaco University, where he coordinates executive Masters and MBAs.

As an author, Dinis Guarda published the book 4IR: AI, Blockchain, FinTech, IoT, Reinventing a Nation in 2019. His upcoming book, titled 4IR Magna Carta Cities ABC: A tech AI blockchain 4IR Smart Cities Data Research Charter of Liberties for our humanity is due to be published in 2020.

He is ranked as one of the most influential people in Blockchain in the world by Right Relevance as well as being listed in Cointelegraph’s Top People In Blockchain and Rise Global’s The Artificial Intelligence Power 100. He was also listed as one of the 100 B2B Thought Leaders and Influencers to Follow in 2020 by Thinkers360.