Last week despite the overshadow of the continuing war in Israel the market mood was lifted as Central Banks pushed the pause button and inflation continued to fall.

All 3 big announcements the Fed, BoJ and BoE left rates unchanged, and the forward guidance seems that this is the peak of the cycle. Inflation is falling but the global economic outlook is still pessimistic.

The Dollar had a huge reversal as NFP missed as well as US Treasury yields falling. The DXY fell 1.4% to end the week just above the 105 level.

The Euro had a good week but mostly of US Dollar weakness. CPI number came in lower-than-expected YoY and with inflation falling it could signal the end of rate rises for the ECB.

The Pound had a good week but with the BoE holding rates and further challenges economically ahead it is difficult to read too much into the week’s gains.

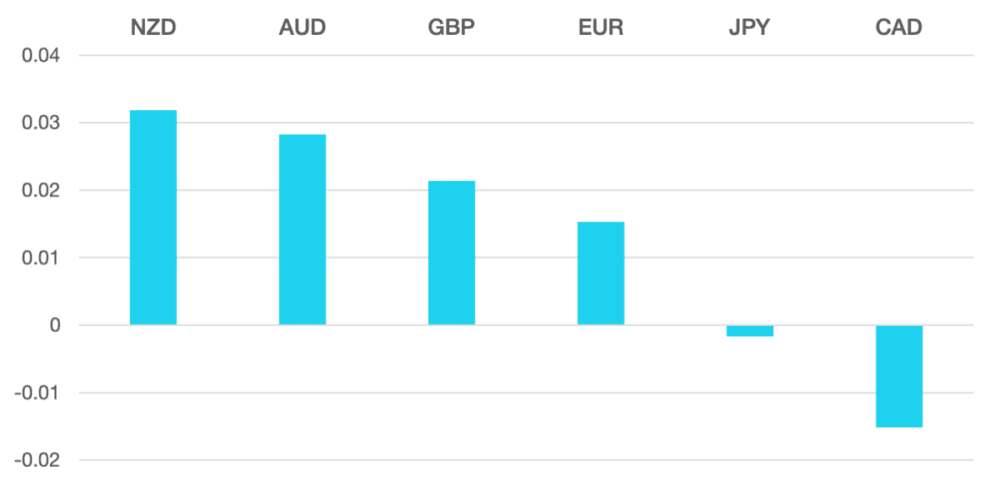

Commodity currencies had a great week as the risk on sentiment and falling dollar and yields pushed risk currencies to the highs of recent weeks. Both AUD and NZD posted 3% gains with the Yen posting a small gain.

Oil continued its recent theme of lower and last week was no exception as WTI fell around 5%.

The week ahead is hard to read as the recent significant gains in risk currencies could be set to continue. The markets will be looking towards the data to gain a read on how things may pan out over the coming weeks.

We have further interest rate decisions from the RBA and a host of PMI data releases.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Week of Central Banks first appeared on trademakers.

The post Week of Central Banks first appeared on JP Fund Services.

The post Week of Central Banks appeared first on JP Fund Services.