The average for investable assets of the regions is £48,847 vs a London average of £106,096

38% of women do not feel that they will be richer than their parents or grandparents vs 41% of men who do

‘I am more entrepreneurial than my parents’ say 16.5 million Brits

The Enterprise Investment Scheme Association launched last week its nationally representative research gauging the wealth, work aspirations, entrepreneurial sentiment, and investor profile of the British population.

The study found that the national average for investable assets is £60k; but a third of Millennials state they will not be richer than their parents. A fact that is representative of the pessimistic vision that new generations regard about their professional careers.

Mark Brownridge, Director General of the Enterprise Investment Scheme Association, said that, “British people in the workforce today are looking at the world of work differently to both their parents and grandparents. They are more disillusioned with the corporate ladder and see opportunities to work for themselves as a more attractive prospect.”

In the thoroughly made research, these were the major key statistics that could be found:

- Over a third (36%) of Brits – 19 million – said that they will be richer than their parents and grandparents

- 15.3 million feel the government is more supportive than ever before to start and drive your own business forward

- 18 million feel they have more opportunity now to be a business leader than ever before

- But over a third of 18-34s (36%) DO NOT feel that they will be richer than their previous generations.

- Nearly a third (32%) – 16.5 million Brits feel they are more entrepreneurial than their parents.

The Gender Split Index:

- Women have £43,000 in investable assets whilst men have near on double at £75,000.

- 38% of women do not feel that they will be richer than their parents or grandparents versus 41% of men who do.

- A third of women do not feel they are more entrepreneurial than their parents. Versus 36% of men that do.

The Nation’s Investable Finance Index

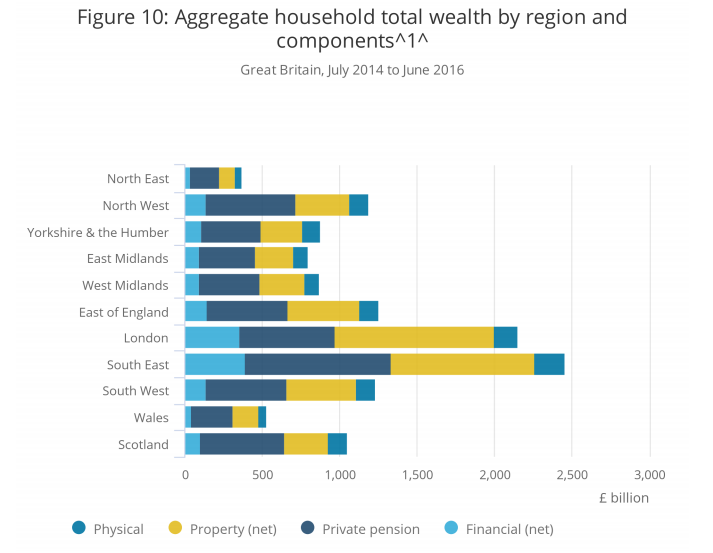

A snapshot of the value of each region’s investable asset average can be found below:

- The average investable asset value of the regions is £48,847

- London: £106,096

- North East: £33,622

- Wales: £52,354

- Scotland: £51,368

- Northern Ireland £88,447

London Vs the Regions

Nearly half (46%) of Londoners feel they are more entrepreneurial than their parents and grandparents vs 30% in the North East and 24% in the North West.

45% of Londoners feel they have more investible assets that their parents and grandparents vs 27% in the East of England and 35% in the North.

“We, as an investment community, need to take a leading role in supporting female investors, entrepreneurs, and business people to come forward to support the entrepreneurial economy. EISA takes an active role in supporting small and medium-sized companies, hundreds of which are founded by women,” added Mr Brownridge,

“Investment schemes into SMEs that supports entrepreneurs, such as the SEIS and EIS, should be encouraged to support our future business leaders across the country.”

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals