The ongoing digitalisation of services across all economic spheres brings challenges that most businesses struggle to overcome. Even in those enterprises that have already embraced new techniques, the treasury area always run behind everything else. Ironically, it does so not for lack of will within their accountants or low resources towards such end, but for a growing underestimating in their overall impact. At least, that’s what a new survey has found.

The number is surprisingly problematic when taking the matter into account as although 80% of treasurers believe they have the majority of skills required to meet the challenges of treasury’s technological transition, the responses shown on the survey suggest that they are underestimating the importance of crucial technologies, such as APIs and robotic process automation.

The survey, named ‘The Future is Now: How ready is treasury?’ and carried out by the Economist Intelligence Unit on behalf of Deutsche Bank, opens up widely a technological dilemma. In the survey, they stated that treasury, on one hand, cannot de-emphasise its core functions of cash and liquidity management, accounts payable/accounts receivable (AP/AR) oversight, funding, and financial risk management. But at the same time, it has progressed from being a transaction

and reporting centre to a more strategic risk holder and analytics centre of excellence.

“This strategic evolution means treasury has to mobilise new automation technologies such as artificial intelligence (AI) and robotics, open application programming interfaces (APIs), and cloud services if it is to free up resources and add more value,” they pointed out.

The survey report reveals what 300 senior treasurers really think about the technology changing their departments, where they see the most value emerging and how they plan to move forward. “While confidence is definitely a positive,” says Deutsche Bank’s Head of Cash Management, Michael Spiegel, “it needs to be founded on a holistic understanding of the changes at hand – which should be the basis for effective preparation.”

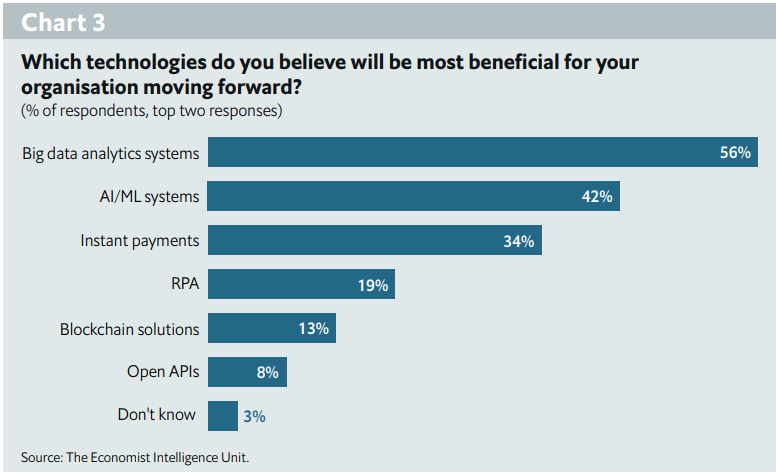

When asked to identify the two new technologies they believe will be the most beneficial to treasury, data analytics topped the poll with 56%, followed by artificial intelligence at 42% and instant payments with 34%. While these technologies will eventually have a tremendous impact on the treasury, the building-block technologies that will underpin them were curiously undervalued. Only 19% of respondents cited robotic process automation as most beneficial and just 8% voted for open APIs – this despite both technologies promising to drastically accelerate and simplify processes. If treasurers do hold these technologies in less esteem, as the results suggest, there may be a need for further clarity on the technologies transforming their departments.

Certainly, there is a need for action and awareness. As a result of these changes, treasury has the opportunity to demonstrate unprecedented strategic value to senior management teams. Assuming this role will mean taking a leading role in driving investments in treasury architecture, rethinking the skill sets required across treasury teams, and cultivating a thorough understanding of the technologies driving this change.

“Treasurers don’t need to be on the cutting edge of technology – but they do need to be proactive and aware of what is coming,” says Spiegel. “This report details some of the challenges and opportunities that treasurers are facing, how they view them, and – moving forward – how we can meet these challenges and opportunities effectively together,” he ended with.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals