In part three of this series we turn our attention to the Millennials. As explained in part one, the Millennial Generation was born from 1981 to 1997 and in 2015 they are aged between 18 and 34.

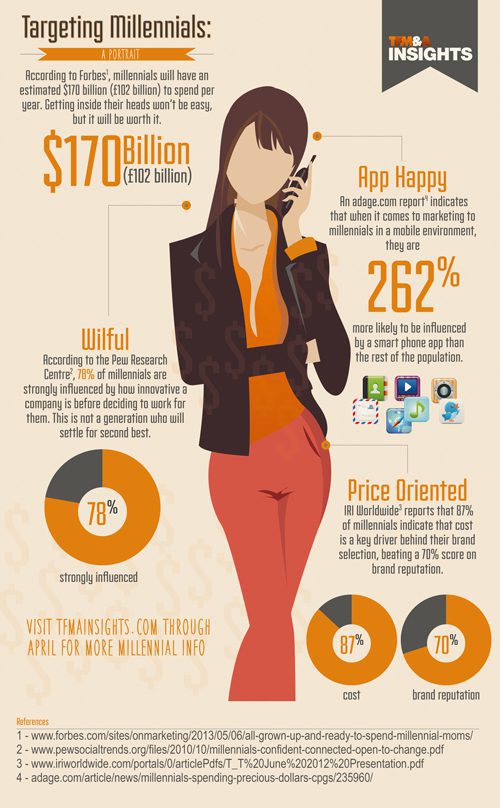

Source: Define Millennial: Who they are and why to target

Financial concern

Over the upcoming years it is anticipated that millennials will grow their wealth as they start to join the workforce in greater numbers, create their own households, and begin growing savings. One big problem for this group however, is that their average wealth overall is likely to be significantly lower than that of Boomers or Generation Xers. Older Millennials may balance this out somewhat as they start to move into jobs that pay more. Overall, Deloitte suggests that:

“Millennials’ financial assets are projected to grow from $1.4 trillion in 2015 to $11.3 trillion in 2030, a compound annual growth rate of nearly 15%.

Unfortunately, it is also anticipated that their debt levels will rise rather rapidly too. Over the next twenty years it is forecast that millennials will find their debt levels rise at a compound annual growth rate of 6.5%. Student debt is expected to be especially problematic for millennials, causing them trouble with budgeting. The level of debt they face could be particularly problematic as they approach retirement.

Advantages of ‘Millenials’

Looking at how financial services firms should handle this, Deloitte is of the view that innovation is needed to help millennials in a manner that is profitable. Deloitte believes that while the wealth of this generation is nothing like that of generations that went before it, the impact they will have on the financial services sector will still be very great. However, as at the current time, it was identified that only 14% of millennials have more than $100,000 in investible assets. They are finding that they are not being approached by premier wealth managers as they are getting started from a lower base.

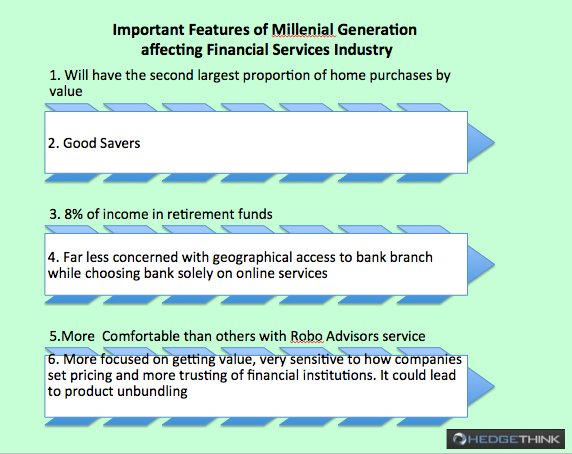

On the other hand, the millennial generation is believed to have the second largest proportion of home purchases when measured by value. Not only that but they are good savers. Evidence shows that they put eight per cent of their income in retirement funds. Even more important however, it is believed that millennials may require structural transformation in the financial services sector. For example, millennials are far less concerned with having geographical access to a bank branch and they may make their choice of bank solely based on its online services. This changes the way that financial services companies find customers and also the ways that they can grow competitiveness from a retail base, according to Deloitte. Of note, millennials are more comfortable than other generations with robo advisors offering them financial advice. This indicates that it might be hard for financial services companies to get the same kinds of fees that they got from prior generations. Not only that but millennials have different values than generations that came before them. They are more focused on getting value, very sensitive to how companies set pricing and more trusting overall of financial institutions. Deloitte suspects that this could lead to product unbundling which has not been targeted as an approach until now, by many.

Adam Hanft (2014) of the Huffington Post agrees that millennials are different. They have been quick to seize the opportunities that financial services robo advisors like Wealthfront, Betterment and LoanVest offer them. That has led these organisations to place efforts into targeting the reported 47 trillion in liquid assets that it is expected that millennials will have by the end of the decade. Hanft does not however concur that millennials have greater trust, citing a Pew study, called “Millennials in Adulthood”. In this study it was found that only 19% of millennials are of the belief that most people can be trusted, compared with 31% of Generation X and 40% of Baby Boomers. The lack of agreement may be due to the fact that the millennial generation is particularly diverse, and represents a great many different opinions and approaches. Either way, in the longer term financial services organisations will have to find a way to meet their needs if they are going to keep thriving. This may be easier said than done, as robo advisors sneak in to take potential customers away early.

Related Posts:

Top Trends in US Wealth: part 1 – Baby Boomers

Top Trends in US Wealth: part 2 – Generation X

Paula Newton is a business writer, editor and management consultant with extensive experience writing and consulting for both start-ups and long established companies. She has ten years management and leadership experience gained at BSkyB in London and Viva Travel Guides in Quito, Ecuador, giving her a depth of insight into innovation in international business. With an MBA from the University of Hull and many years of experience running her own business consultancy, Paula’s background allows her to connect with a diverse range of clients, including cutting edge technology and web-based start-ups but also multinationals in need of assistance. Paula has played a defining role in shaping organizational strategy for a wide range of different organizations, including for-profit, NGOs and charities. Paula has also served on the Board of Directors for the South American Explorers Club in Quito, Ecuador.