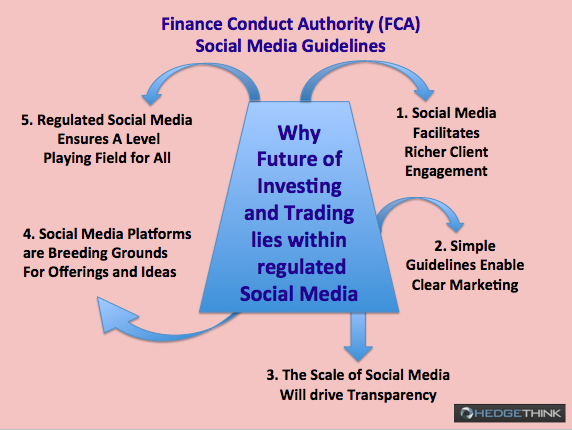

Social media is fast becoming a dominating force online, helping both individuals and businesses gain the attention they need and/or want. For businesses who want to promote trading, transparency and help promote their offerings, social media is a key field they need to understand. Moreover, it’s a field that can help shape the future of investing and trading.

To ensure that the benefits of social media are available to all and do not harm common interest, both of businesses and their clients, the Financial Conduct Authority (FCA) has provided numerous guidelines on how businesses should act. Here is a closer look at the FCA and why they believe the future of investing and trading lies within regulated social media:

1 – Social Media Facilitates Richer Client Engagement

Traditional communication channels, such as email, provide a channel for businesses to communicate with clients but it can be difficult to engage them. Social media platforms are an engine for engagement, allowing businesses to communicate and interact with their clients better than before. As a result of the benefits of such interaction, the FCA highly recommends businesses increase their use of social media as a means to engage their clients and to keep them engaged for some time to come.

Whether it is through messages, tweets, re-tweets, picture replies on Instagram or videos on YouTube, social media platforms facilitate richer client engagement. In fact, Josiane Feigon said,

“By the year 2020, 85% of buyer and seller interaction will happen online through social media and video.” This shows just how vital social media is as a channel for client engagement.

2 – Simple Guidelines Enable Clear Marketing

One of the biggest problems with traditional marketing is that the messages were often unclear and left to the infamous asterisks symbol to explain. More than just the symbol, countless marketing firms began obscuring messages to deliver what they wanted, even if the real product or service was different. This is especially true on social media networks. To bring an end to such unfair practices, the FCA has set out guidelines which help reduce and possibly eliminate message obscurity on the internet.

For example, businesses are increasingly using abbreviations symbols on channels where characters in posts are limited, such as Twitter. However, the FCA requires them to make clear statements with such symbols and abbreviations to ensure their clients receive the right message. Scott Cook states that,

“A brand is no longer what we tell the consumer it is — it is what the consumers tell each other it is.”

As such, you need to send the right message so your clients will spread it as well.

3 – The Scale of Social Media Will Drive Transparency

One of the biggest issues with social media marketing is transparency. When businesses are trying to promote their products and/or services, trying to get their clients to trade and invest, they need to be absolutely transparent with their social media posts. The inability to be transparent will deter investors and cause social media marketing efforts to deteriorate.

However, by being both clear in their messages and providing the right information in their social media posts, businesses can use social media to shape their investing and trading business. For example, if a trader warns clients their money is in danger, and the solution is in the link below, they both provide a warning and clearly state the link will help them safeguard their money.

In another example, if a business is promoting its services on any social media site, they are required to place a warning there as well. For example, if a real estate agent is advertising a mutual fund on Facebook, they are required to list the risks either within the post or in the image posted with it. By introducing such guidelines, the FCA helps enable clear and fair online social media marketing that helps drive transparency and levels the playing field.

4 – Social Media Platforms Are Breeding Grounds for Offerings and Ideas

Emails are a great platform for communication, as are one-on-one meetings with clients. However, when you want to improve offerings, discover new ways to improve transparency and share marketing ideas, social media works as a prime platform. Reidd Hoffman said,

“Help the people in your network. And let them help you.”

In essence, when you spread your idea on social media, other businesses will engage you and your posts become larger as ideas grow on it. Multiple investors discuss new strategies and work on your original post. This helps shape the future of investing and trading for the better and helps improve your own sales.

5 – Regulated Social Media Ensures A Level Playing Field for All

The FCA has provided businesses a large degree of freedom, allowing them to make posts as they will. However, to ensure a level playing field for everyone, certain guidelines are provided. This helps bring every business to one platform and ensure their marketing plays a major role in their success. For example, promotions on Twitter should have certain elements in it to comply with the FCA guidelines. In another example, a system for storing records of social media interactions must be created. In another example, as already stated, all businesses are required to post warnings alongside or on promotional posts.

These guidelines help ensure that every business is providing clear and undiluted messages to its clients in order to promote investing and trading. It helps ensure that businesses improve their social media ROI due to their marketing efforts, rather than foul play and undermined tactics.

The FCA is working towards ensuring financial activities, including communication, investing and trading on social media, are both regulated and fair. By encouraging the fair use of social media platforms, the FCA is encouraging innovation in the field, helping businesses dig deeper to shape the future of investing and trading. If your business has not yet made its presence known on social media platforms, perhaps it is time for you to do so.

Chris Turner is a versatile content writer with a passion for technology, finance, Investing and trading. He writes extensively on the subjects of Trading, Investing, Bitcoin, Forex trading, investing and general finance. He is writing and providing advice, education and encouragement to budding investors and traders, on Hedge Fund and alternative investments and other emerging financial trends. He is a contributor writer for HedgeThink.com and TradersDNA.com.