Robo advisors have been offering services that were in the past offered by wealth management firms. Some in the wealth management industry have been becoming concerned that robo advisors could draw away a lot of their business. According to CEB Financial Services (2015) this is probably unlikely at the current time, but it would be unwise to pay these services no regard at all.

What are robo advisors?

Well, this is the term that is used to describe software that has been built to deliver good investment advice to consumers. Such robo advisors are growing quickly, and mergers and acquisitions have already been happening in this relatively new field.

Indeed, big established companies in the wealth management sector have been working to come up with ways to compete. The way that they have gone about this so far has largely been to develop the technology or alternatively to acquire it. Large companies such as Vanguard and Schwab do bring in very large revenues (estimated at around $20 billion in assets at least. However, smaller, new entrants including companies such as WealthFront, Betterment, and Personal Capital have all been growing at a tremendous pace. It is reported that these three companies achieved growth in their assets under management by at least 45% just in the first seven months of 2015.

Growth of Robo Advisors

This growth of robo advisors has occurred both inside of and outside of the United States. The revenues that they command are currently thought to be rather low, compared to the massive revenues that comprise the overall wealth management industry. One important reason for this is that typically large, established wealth companies focus on selling to individuals that are able to invest a great deal. This makes good sense, as it is possible to achieve more for less. However, these new robo advisor services have mostly been focusing on a much more mainstream audience, trying to draw new investors into the market. As explained by CEB Financial Services:

“Robo advisor providers are still primarily targeting accounts in the mass market and mass affluent segments currently, with average client assets at the firm ranging from $35,000 (Betterment) to $300,000 (Personal Capital).”

Currently robo advisors are also not able to take away from the benefits of an investor being able to develop an advisory relationship with their wealth management firm, and this is an important drawback in this market. It is believed that where wealth management companies are also able to use digital services that enhance the interaction that the investor is having with them, this is considered to be significantly better than a robo advisor. Robo advisors are not really able to compete in this area at the current time. Despite their name, they are not even robots. Rather, they might better be described as “electronic portfolio managers.”

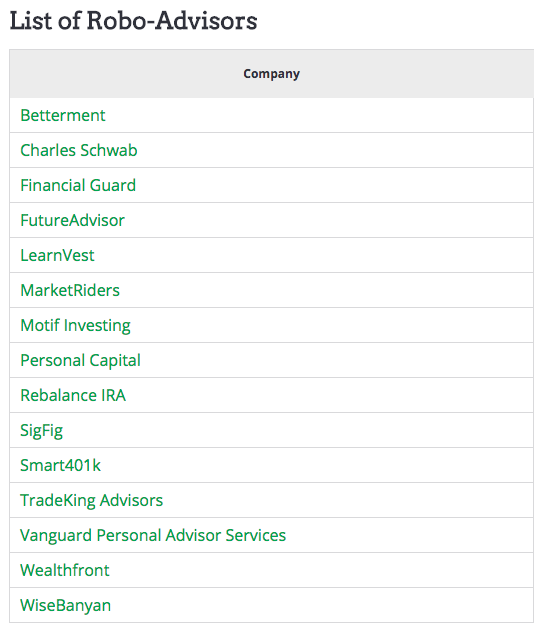

Source: Investorjunkie, Larry Ludwig

Wealth Management’ response

All of this does not mean that wealth management firms should not react: indeed, they should. Robo advisors are start up companies that cannot be ignored. They are important for the markets that they service because they offer a value proposition of cost. Customers in the sector that robo advisors target are concerned about price, so this is an important differentiating factor for them. Robo advisors compete by working to link up straightforward financial advice through channels that people want to receive it through – namely online and mobile channels. They also add other services that people want like portfolio management capabilities as well as tax loss harvesting and automated rebalancing. Rates are pleasing to the customers. For example, WealthFront charges nothing when customers invest their first $10,000. Meanwhile, Personal Capital charges 0.89% for its phone based financial planning in addition to online services.

It is argued that an appropriate response to this is for wealth management companies to focus on why they offer value for money to their target audiences. This will demonstrate to customers why they should use these services instead of turning to robo advisors. It does not have to become a price war. Overall this means providing a range of different advice types across a variety of different platforms (such as online and mobile) to be able to draw some of these bigger new entrants in.

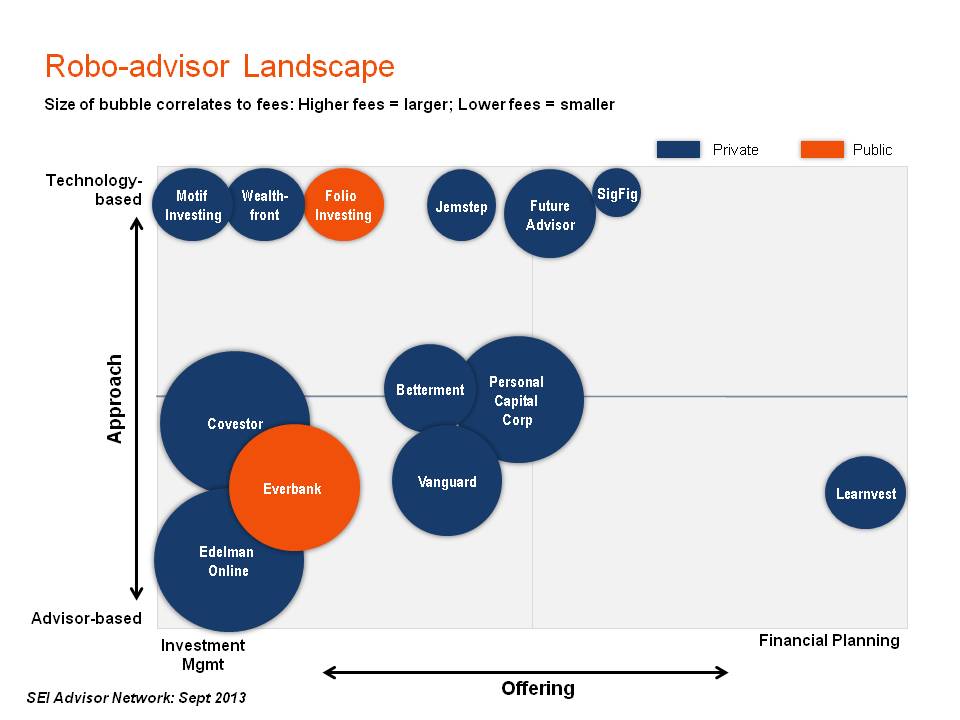

Source: The Robo Advisor Landscape

Related Posts:

The Emergence of Robo Advisors

Paula Newton is a business writer, editor and management consultant with extensive experience writing and consulting for both start-ups and long established companies. She has ten years management and leadership experience gained at BSkyB in London and Viva Travel Guides in Quito, Ecuador, giving her a depth of insight into innovation in international business. With an MBA from the University of Hull and many years of experience running her own business consultancy, Paula’s background allows her to connect with a diverse range of clients, including cutting edge technology and web-based start-ups but also multinationals in need of assistance. Paula has played a defining role in shaping organizational strategy for a wide range of different organizations, including for-profit, NGOs and charities. Paula has also served on the Board of Directors for the South American Explorers Club in Quito, Ecuador.