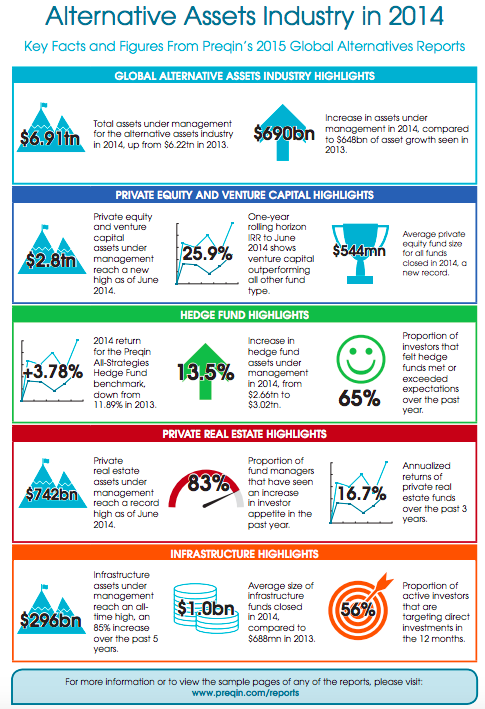

The Real Estate Private Equity Industry has shown an impressive performance with 16.7 % annualised annual return over the last three years. The Industry outlook for 2015 is positive, driven predominantly by improving valuations of unrealized assets.

Source: Alternative Assets Industry in 2014, Key facts and figures

Like other Private Equity, the Real Estate Private Equity firms pull cash from investors. They invest in a diverse mix of properties such as commercial, industrial, office complex, hotels, hospitals, and residential houses. The firms look for quality assets at competitive rates. They acquire the properties and improve them through better management and additional investments. They value addition results in appreciation in properties and then they sell their stakes at a premium and exit, generating good returns for their investors.

The assets under management by the Real Estate PE reached $742bn in 2014, up from $657bn in the previous year. The industry is likely to maintain the growth trend in 2015. Let’s take a look at the some key areas of the Industry.

Fundraising

In 2014 Private Real Estate Fundraising maintained growth momentum, crossing $92 bn raised in the previous year. But only 182 funds could reach final close in 2014, one fourth decline from the previous year. Small firms are facing difficulty in fund raising, as investors prefer larger players. The average size of fundraising jumped 25% to $528mn for funds closed in 2014 compared to $417mn in 2013. Though North America-focused fundraising declined, but Europe and Asia witnessed increased activities. Funds focusing on Europe raised $36bn in 2014, more than double to that in 2013. For example, Blackstone, the largest real estate private equity firm with $81 billion of assets under management, raised the largest Asia-focused fund and also globally largest fund in Europe in 2014. However the fundraising market has become more competitive. The fundraising remains a long process for managers. On average it takes 18 months to reach a final close.

With high returns earned by the Real Estate PE, the LPs (Limited Partners) are willing to invest more capital in coming years. Pension Funds and other institutional funds are earmarking higher proportion of funds for long term investment with the Real Estate Private Equity.

Investment Opportunities

With rising prices, it has become difficult to find attractive investment opportunities at reasonable prices. Higher asset valuations are affecting new investment activity. According to a recent survey by Preqin, the competition for investment opportunities by the Real Estate Private Equity has increased. Pricing for prime assets is a concern for many in the industry, and there is more competition for core real estate assets as well as value added and opportunistic assets. It is more difficult to find attractive investment opportunities in the current environment. Increased fundraising and decreased investment opportunities have led to $217bn dry powder. The managers take longer to invest their funds, as there are fewer good opportunities. The firms are under constant pressure to deploy capital.

Regulatory

Like other segments of the alternative investment industry, the Real Estate PE has remained lightly regulated in the past. The regulatory bodies are now focusing on them and regulatory reforms are taking place through new regulations such as Dodd-Frank Act, Alternative Investment Fund Managers (AIFM) Directive, European Markets Infrastructure Regulation (EMR), Basel III and Solvency II. Though these regulations would increase compliance requirements for the managers, the investors will feel more secure and so more funds would flow to the Real Estate PE. The regulations would ultimately help in the growth of the industry.

Fees and Operational issues

Fees charged by the Real Estate firms are under pressure from the investors. Like other alternative asset classes, the Real Estate is also facing criticism on its fee structure. The industry and the investors need to discuss and redesign a reasonable fee structure. This will bring improvements in the alignment of interests between the GP and the LP.

Institutional Investors want higher scrutiny and control over their real estate exposure. They are more interested in alternative ways to gain real estate exposure other than commitments to multi-investor funds. Structures such as separate accounts, joint ventures and co-investments are becoming more acceptable to investors. Fund managers would be offering more separate accounts to investors and more co-investment opportunities in coming years.

To conclude, Real Estate is set for largest capital inflows. “Investor satisfaction with their real estate investments is increasing. As a result of increasing satisfaction, many investors look likely to commit more capital to the asset class in 2015,” finds Preqin in an investors’ survey.

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.