– $1bn+ global discretionary funds produced notable excess returns over sub-$1bn funds during the past two years.

– Systematic macro has outperformed discretionary approaches on average over the same period.

In recent years, there has been a resurgence in the success of macro hedge funds, with notable funds demonstrating impressive performance. According to data from With Intelligence, macro emerged as the second most lucrative hedge fund strategy last year, surpassed only by CTAs (Commodity Trading Advisors). Billion-dollar global macro funds achieved substantial gains, averaging double-digit returns.

Haidar Capital, for instance, achieved an extraordinary annual return of 193%, marking its best performance to date. Similarly, Rokos Capital experienced a remarkable turnaround, bouncing back from a challenging year in 2021 (-26%) to achieve a record-breaking gain of 51%.

Amidst the backdrop of a challenging financial landscape, macro hedge funds demonstrated exceptional performance, surpassing the overall hedge fund universe and traditional investment avenues. While the hedge fund industry experienced a 5% loss and stocks and bonds endured their worst year since 2008, macro funds showcased resilience. In contrast, the typical 60/40 portfolio suffered a significant decline of over 15%.

The recent macro trading environment has witnessed notable shifts in the global economy, leading to substantial fluctuations in bonds, currencies, and commodities. These developments have opened up renewed opportunities for macro strategies. Notably, With Intelligence data highlights the importance of scale in macro trading, as billion-dollar global discretionary funds like Brevan Howard and Haidar showcased their ability to generate significant excess returns compared to smaller funds during the past two years.

In 2022, billion-dollar funds achieved an average gain of 14.9%, marking their first double-digit gains since 2013. Conversely, smaller macro funds, on average, experienced losses during the previous year.

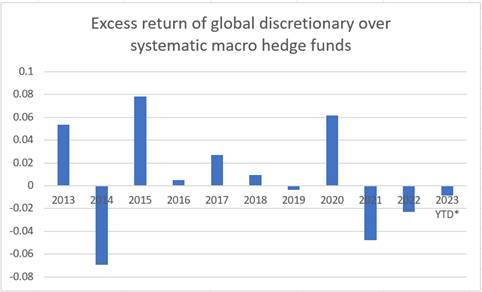

Over the past couple of years, there has been a noteworthy trend of systematic approaches outperforming discretionary approaches in the macro space, resulting in impressive excess returns.

In 2020, discretionary global macro strategies surpassed systematic macro strategies by the largest margin since 2015, with billion-dollar funds averaging a solid 14% gain. However, the tables have turned in the subsequent calendar years, as systematic macro strategies have outperformed.

Systematic macro approaches have demonstrated their strength and yielded better results in the past two years, showcasing their ability to navigate the evolving market conditions effectively.

The current year has brought about a change in the fortunes of larger macro funds, as they faced the brunt of the banking crisis in March and the sudden reversal of US government bonds.

Furthermore, the ongoing uncertainty surrounding the US debt ceiling negotiations has contributed to reduced risk appetite and a more cautious trading approach, leading to muted returns for some funds.

Year-to-date, through May, billion-dollar macro funds experienced an average decline of nearly 3%, with certain firms experiencing even greater losses. On the other hand, smaller funds have remained relatively stable, with their performance being mostly flat this year.

Although the Q1 banking crisis posed challenges for many larger macro funds, resulting in significant losses, their longer-term return statistics over three and five years continue to demonstrate their compelling performance.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals