London continues to be the most ‘investable’ city in Europe for venture capitalists – and Brexit shows no sign of slowing this down – claims new report from global recruiter Robert Walters and market intelligence firm Vacancy Soft.

In fact, in 2018 London attracted almost double the amount of venture capital funding (39%) for the fintech sector when compared with any other European city – Berlin (21%), Paris (18%), Stockholm (5%), Barcelona (4%), Amsterdam (4%), Zurich (3%), Copenhagen (2%) and Dublin (2%).

Chris Hickey, CEO at Robert Walters said: “This boost to the fintech market resulted in a 61% increase in in job creation in London and an 18% increase in jobs outside of London in 2018 – making it the fastest growing sector in the UK.”

The expert mentioned that whilst Brexit has no doubt been a concern and slowed down hiring levels somewhat within financial services, the fact that the UK has one of the best IT and banking talent pools in the world continues to be a big draw for investors.

Recruitment into fintech, as a result, is soaring. Where the total amounts of jobs being created in the sector are still small compared to banking, the rate of growth is significant. For context, the sector created 61% more vacancies in 2018 compared to 2017, making it the fastest growing sector in the London economy. The growth is also felt at a regional level, where job creation increased by 18% last

year.

The growth of the fintech sector has been so explosive that London now has the second largest concentration of fintech start-ups. Of the 29 fintech unicorns worldwide (companies worth more than $1 billion), nine are in San Francisco, while seven are housed in the UK.

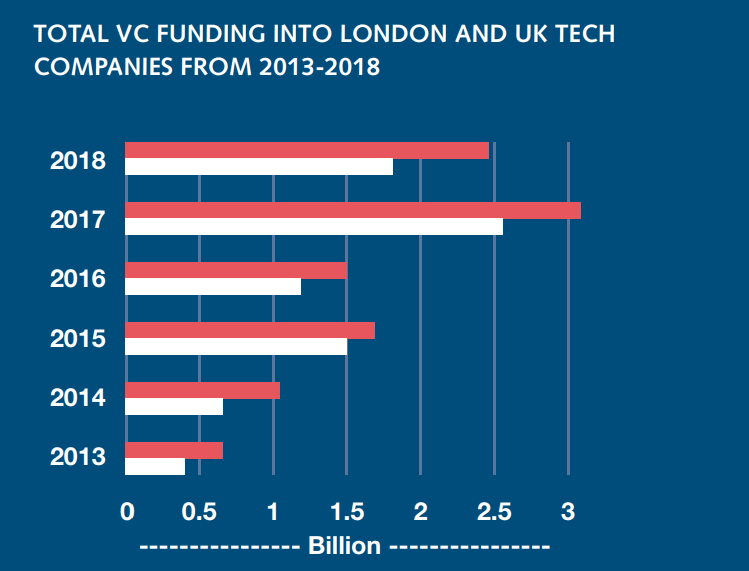

This wave of disruption would not have been possible without the influence of Venture Capital (VC) firms’ investment. The fintech unicorns have had to raise significant capital in order to get to a place where they can compete. It is now clear that they are

here to stay and London remains at the forefront of the fintech, as it was pointed out by the report.

In fact, the UK’s fintech ‘unicorns’ had a combined revenue growth of 130% in the last 12 months – in monetary terms this was an increase from £77.1m to £177.6m revenue.

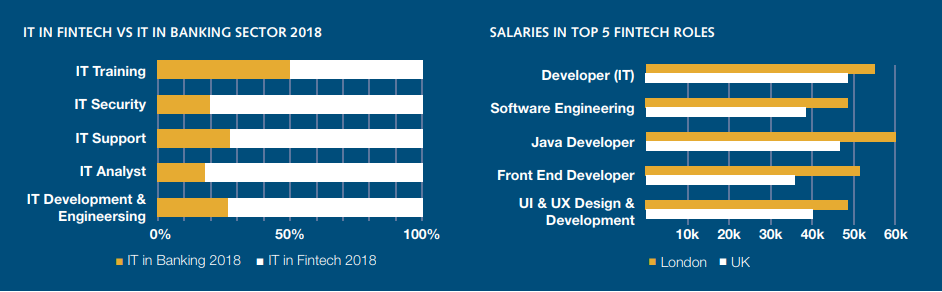

The report also analysed these unicorns and found out their international expansion in these Brexit times. “What is most interesting about the various fintech unicorns is their international expansion, with the majority now aggressively expanding either to North America or Europe or both. When looking at the composition of hiring within the

fintech unicorns, unsurprisingly IT dominates.”

Chris Hickey adds: “This is a positive story for the UK economy, and job creation across the board within the fintech sector has grown significantly.

“In fact, between 2017-18 job creation within fintech increased by 100% in HR, accounting, and business support roles, by 74% for IT positions, 48% in banking-specific roles, 40% in legal, and 16% in both insurance and sales.”

Read More:

mounjaro cost without insurance

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.