There is a new trend in the alternative investment market that affects directly to Hedge Funds and Alternative Risk Premia. The latest bfinance white paper: Hedge Funds Plus Risk Premia: Fantastic Fusion or Baffling Blend?’ concludes that there has been a notable increase in asset owners now combining Alternative Risk Premia and Hedge Fund strategies in one portfolio, or even in one mandate, while a growing number of asset managers are providing products that incorporate both. The marked trend is motivated by three factors; cost reduction, customisation and consistency. Many questions rise at this point: is this just another bluff or something investors should really take a deep look at? We are going to provide the answers below.

While noting the potential advantages, the paper emphasises the importance of coherent portfolio construction, highlights manager selection issues with a growing number of products and potential combinations, and also prompts investors to be mindful of recent fee changes.

Alternative risk premia and hedge funds make natural but somewhat uneasy bedfellows

Hitting the mainstream in the post-Global Financial Crisis decade, alternative risk premia strategies were seen by many commentators as an attack on hedge fund territory, beating at defences that had already been weakened by disappointing average performance in 2008. These new approaches promised access to risk premia that hedge funds had traditionally exploited, but at a fraction of the cost.

Yet these two sectors increasingly work together in a complementary rather than competitive fashion. ARP and hedge funds are now often found side by side in portfolios, whether that combination takes place at the level of the asset owner of at the level of the asset manager, with a substantial and growing number of firms offering ARP and hedge funds together in multi-manager mandates.

Yet these combinations create new questions and challenges. Some HF/ARP blends are far less well-structured than others. While the cost reduction benefit is relatively straightforward (and still represents one of the primary motives for incorporating an ARP slice), portfolio construction is not.

Chris Stevens Director, Diversifying Strategies, commented: “Investors can benefit from more choice and better customisation as a result of the rising number of asset managers offering ARP strategies and, in many cases, ARP alongside hedge funds in one mandate. Yet implementation is tricky: we see some excellent work going on in this space, but we also see some incoherent portfolio construction with inappropriate overlaps and problems with alignment or governance.”

Cost considerations are key driver

Cost tends to be a significant driver in the decision to use ARP alongside hedge funds. Moving 30% of a hedge fund portfolio over to ARP strategies would currently result in total savings, very conservatively speaking, of around 50bps on overall management fees and another 30bps on performance fees. These savings should be achieved whether the investor is using an external ARP manager or a multi-manager (e.g. FoHF) with a blended mandate; in the case of the latter, managers only charge a single layer of fees for the ARP component.

Yet investors focusing on cost should also be aware of the substantial fee compression that FoHF and ARP sectors have undergone in recent years and factor those new pricing expectations into decision-making.

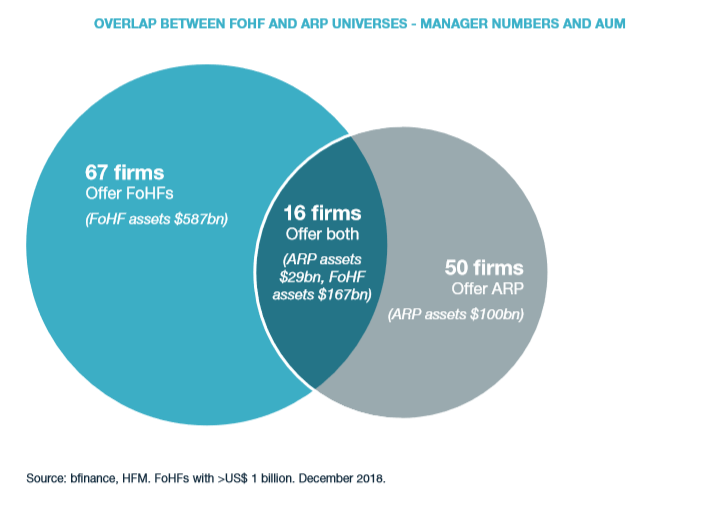

Very few sectors have come under as much cost pressure as fund of hedge funds, where average fees have experience sustained compression over many years. As a result, this strain has driven major consolidation in the FoHF world with managers requiring ever greater AuM to make the business work. There are now 67 FoHFs with an AuM over $1 billion, versus 76 just one year ago. While the AuM of the sector has increased, this growth has been concentrated among the larger firms: the 21 managers with over $10 billion in AuM now account for $450 billion, or more than two thirds of total FoHF AuM, according to HFM. In such a climate there are obvious attractions drawing FoHF firms to ARP.

Rising importance of factor investing across different asset classes, but ARP-HF blends require different portfolio construction philosophy

It is tempting to look for parallels in long-only equities, where investors have moved towards portfolios incorporating both passive or smart beta strategies and active management. In such combinations, investors increasingly seek active managers that offer differentiation versus the premia that are being captured elsewhere at lower cost. The priorities for active equity management are thus defined by what smart beta can capture, rather than vice versa (the essence of a core/satellite model).

The comparison is, in some ways, a helpful starting point in terms of establishing a coherent HF+ARP approach. Yet there are fundamental obstacles to approaching ARP-HF blends with a true core-satellite mindset. The investor must consider the challenge of determining how much of a hedge fund manager’s performance can be attributed to the chosen/ preferred factors, mirroring the application of style analysis to active equity manager track records. It is also crucial to remember the high dispersion in the performance of ARP strategies which nominally target the same risk premia, due to the way in which they are constructed and executed.

We observe asset owners and relevant FoHFs more likely to favour a “multi-core” approach. Instead of treating ARP as the starting point and picking hedge funds based on how differentiated they are from ARP, the investor seeks to establish a portfolio in which the various ingredients are compared against each other for a coherent whole.

Toby Goodworth, Head of Risk and Diversifying Strategies, said: “The rising popularity and greater sophistication of ‘hedge fund plus ARP’ combinations continues what is a very significant long-term trend towards factor investing, with investors examining portfolios through a factor lens to identify what “true alpha” looks like and what can or should be captured in a more cost-effective manner.”

“Investors can benefit from more choice and better customisation as a result of the rising number of asset managers offering ARP strategies and, in many cases, ARP alongside hedge funds in one mandate. Yet implementation is tricky: we see some excellent work going on in this space, but we also see some incoherent portfolio construction with inappropriate overlaps and problems with alignment or governance,” Mr Goodworth continued.

Blended portfolios do not always deliver the desired coherence

bfinance analysis shows that there are broadly two different approaches to portfolio construction. Some prefer a “best ideas” method where a team considers the opportunities across different strategies and solves them for minimum overlap of premia, while others prefer to divide the premia focus upfront.

In practice, effective portfolio construction is not always achieved. Even where the investor uses one mandate with one multi-manager for all areas, there can be problematic overlaps, such as the use of multiple CTAs alongside trend ARP strategies. The number of managers offering such mandates has expanded to more than 15, but a single provider is no guarantee of a thoughtful approach.

Multiple access points need to be carefully assessed

Investors seeking to use both ARP and hedge funds can access the ARP slice in three distinct ways: a multi-manager offering ARP alongside their FoHF strategy, an external ARP fund manager, or a portfolio of bank premia (either in-house or externally supported).

Each of these implementation approaches bring advantages and disadvantages in areas such as cost transparency, capital efficiency, portfolio construction, flexibility, diversification, conflicts of interest and the capabilities or skills required internally.

The expanding universe of providers in both ARP and blended multi-manager products leads to a dramatically increased number of potential combinations alongside hedge funds – good for customisation, but somewhat challenging to assess in full.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals