With the war between Russia and Ukraine dominating headlines inflation numbers not seen since the early 80s and what could be the first Fed rate hike this month. I want to break down how different Fed speakers are looking at how much to hike by.

At a very basic level we can say that inflation with the current situation in Russia and Ukraine is not coming down anytime soon. 25% of global Wheat production coming from the area and a large amount of NG that flows to the Euro zone. This will weigh on The Fed decision to keep prices in check by raising rates.

To get a clear picture we have to split the FOMC into two voting groups, members and non-voting members.

Voting Members

- Chair Jerome Powell – Not Announced

- Lael Brainard – Not Announced

- Michelle Bowman – 50 BPS

- Christopher Waller – 50 BPS

- John Williams – 25 BPS

- Loretta Mester – 25 BPS

- James Bullard – 50 BPS

- Esther George – 25 BPS

Non-Voting Members

- Charles Evans – 50 BPS

- Patrick Harker – 25 BPS

- Neel Kashkari – 25 BPS

- Thomas Barkin – 50 BPS

- Raphael Bostic – 50 BPS

- Mary Daly – 25 BPS

All of the above have been signaled within speeches given in February but they should not be taken as gospel with the developments in geo-politics towards the end of the month.

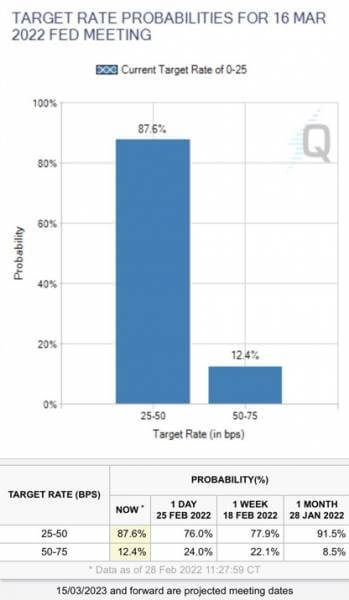

Market pricing

We started off in February with rate hikes being priced in at a phenomenal rate and at a certain point it looked like there was a high probability of a 50 BPS increase that has now been moved down to a 25BPS increase as an almost certainty.

(CME Group, FedWatch Tool)

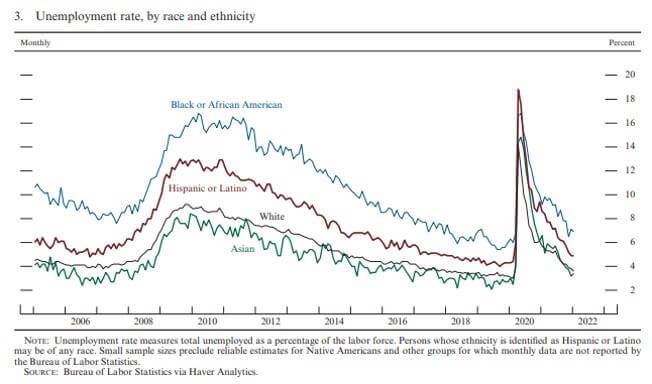

The important part to understand with the Fed is their two main objectives also known as the dual mandate. Maximum employment and price stability (inflation). By any historical measure the US economy is running hot.

In some part of the economy, we are nearly back to historical levels of unemployment going back to pre-pandemic.

Inflation numbers are well above the Fed mandate of 2% as shown below. Also, to take note that before any major crisis the parts shaded in grey inflation has spiked.

FX

USD

The greenback has had large swings over the last month with a flight to safety as people de-risk the DXY having a two and a half figure range from 95.2 – 97.8. This has mainly come from geopolitical tensions if we see some de-escalation expect the dollar to be sold off into high betas.

EUR

The EUR: has been beaten up this month understandably so given its proximity to the conflict. When looking at the ECB going full hawk, I wouldn’t hold my breath even though inflation is rampant in the Eurozone. There is already backpedaling going on “ECB READY TO TAKE WHATEVER ACTION NEEDED FOR STABILITY” BBG, Christine Lagarde.

GBP

Cable remains in its longer-term trend to the downside, my expectation is the BoE doesn’t hike in the coming meeting. This will prevent them getting ahead of the Fed, leaving a wait and see approach with developing tensions. This should put some pressure on the currency and its respective crosses.

JPY

We have now rejected 116 USDJPY twice the risk reward is to the downside especially if we see a bottom forming in US bonds as growth expectations diminish further out in the cycle.

CHF

As expected, the CHF has been bid with the flight to safety trade resulting in an increase demand. Most interesting is the Swiss government implementing sanctions against Russia which takes them from being neutral. Longer term that could have implications on how it is seen on the world stage.

AUD

The Aussie has put in an impressive 2.7% month partly because of equity’s for the most part bouncing from their respective lows but also the broader commodity trade. There are some topside resistance levels that if broken it could go on a tear.

CAD

Again, it’s been range bound torn between oil and domestic politics longer term with the amount of risk premium built into energy there is a room for a lot of downsides for the Loonie if rate hikes cool energy prices.

The post <h5>Macro Research</h5> <h3>Will The Fed Hike in March?</h3> appeared first on JP Fund Services.