Investors Remain Positive on Private Equity Outlook

“The institutional community remains confident in the ability of alternatives assets industry to help them meet their return objectives. The majority feel returns are meeting or exceeding expectations and, as a result, a much larger proportion of investors plan to increase their exposure to alternatives than plan to reduce it. There remains huge scope for the alternative assets industry to grow in future years, both as investors build up existing allocations, and as they also further diversify their portfolios to include a wider range of asset classes,” says Preqin– a leading source of information for the alternative assets industry.

These findings are based on the latest Investor Outlook survey for H2 2015 undertaken by Preqin. Around 450 institutions were surveyed and data for 12,500 investors were analyzed. The survey reveals a positive outlook for private equity over the coming 12 months. Institutional investors continue to prefer to allocate capital to alternative assets to achieve a broad range of other objectives besides diversification. While hedge funds reduces volatility and real assets provides inflation-hedging, the high absolute returns generated by private equity attract institutional and high net-worth investors in a big way.

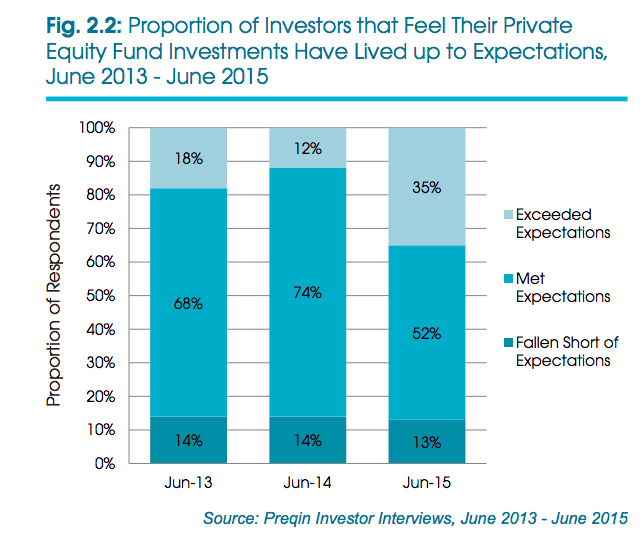

Investors’ satisfaction level high

Nine out every ten investors said their expectations of return on private equity investments were met. A third of them even exclaimed that it had exceeded their expectations. A very good compliment for private equity managers like Lincoln Frost. The private equity asset class outperform markets over the longer term. The investors are looking to invest more capital in private equity in coming months.

Last year the California Public Employees’ Retirement System (CalPERS) decided to cut back on the number of Private Equity Managers. It was feared that other pension institutions might also follow the path of CalPERS, the largest pension fund in the U.S. But the latest data show that the institutional investors at large is not following the lead of CalPERS.

Dry powder level continues at high at around $1tn

The value of dry powder, uncalled capital, remains high at $965bn at the June end. The private equity managers are under constant pressure to find reasonably priced opportunities to deploy capital in current highly inflated markets. The fund managers wait and take longer time to invest their funds.

Fundraising Slows down

The high level of unspent capital has adversely affected fund raising. Before committing fund further, investors prefer to wait for previously committed capital is called up and put to work. Fundraising and investor activity seems to have slowed slightly in H1 2015. Private Equity fundraising has declined during H1 2015. Only $253bn could be raised, lower than $272 in H1 2014. The number of private equity funds which raised funds also lower at 509 compared to 656 funds during corresponding period last year. The survey reveals only half of the investors went for private equity fund commitments in the first half of 2015.

Investors are selective in investing

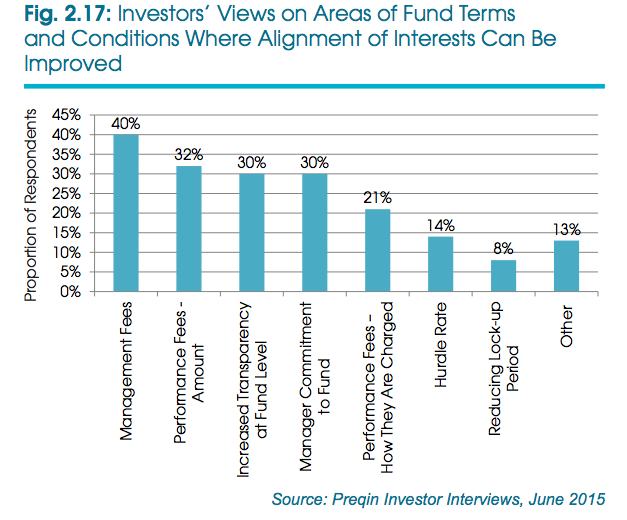

In particular Asia-based LPs have become most cautious towards due to growing uncertainties in Chinese stock markets and devaluation of its currency yuan. In the first six months of this year only 35% made fresh commitments to Asia-focused private equity funds compared to 75% in H1 2014. However the majority of investors based in North America and Europe committed fresh capital to private equity funds. The LPs generally prefer large Private Equity funds that have a good track record over a period of time. This puts first-time fund managers at a disadvantage in raising capital. In the survey, one out of every two LPs indicated that they would not commit to a debut fund managed by a new GP. The survey reveals that 70% of investors believe that LP and GP interests are properly aligned. However the fund terms and conditions the GP-LP relations can be improved further by addressing investors’ concern over some issues such as fees and transparency.

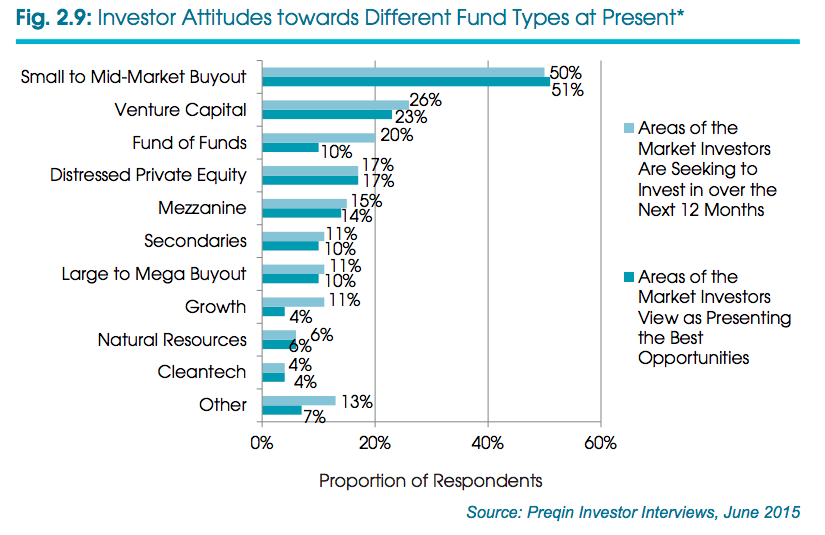

Buyout and Venture Capital Funds are favorite fund types

The majority of LPs and investors have shown their preference for small to mid-market buyouts. One out of every two investors would invest in this fund type in 2015. And one out of four private equity investors see venture capital funds as presenting the best opportunities. This is followed by distressed private equity and mezzanine funds.

To sum up, the outlook for private equity remains positive. PE managers and investors are optimistic about growth. But some challenges such as high dry powder, fund raising slowdown, high fees and lack of transparency are required to be looked into by the Private Equity Industry.

Read More:

hedge fund vs asset management

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.