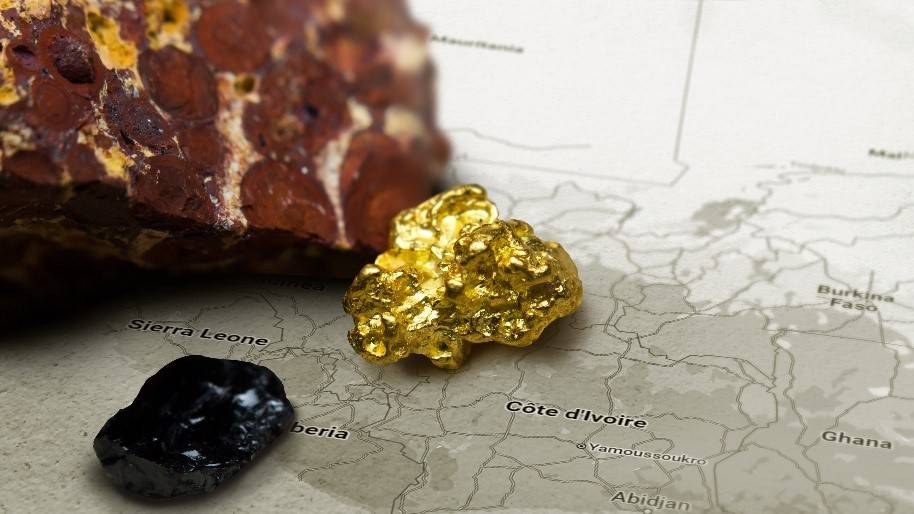

Increasing US Focus on Metal and Mineral Supply Chain Will Drive Growth

Investment opportunities in West Africa’s gold and critical metals mining sector are poised to become increasingly appealing, according to recent research conducted by Tresor Gold. The New York City-based mining company focuses on exploration and development projects in West Africa, and conducted an international study involving global institutional investors managing $307.5 billion. The findings revealed that 41% of respondents believe investment in the sector will significantly gain attractiveness over the next five years.

One of the key factors attracting investors to the metals and mining sector in the region is its growing stability and relative underdevelopment. The research findings indicate that an additional 52% of respondents expect investment to become slightly more attractive over the same time period, while only 2% anticipate decreased attractiveness.

However, the study conducted by Tresor Gold highlights geopolitical concerns as a major issue for investors. Nearly all participants (99%) agreed that the United States and its allies will intensify their focus on African investment within the next three to five years, partly to safeguard the resilience of their metals and minerals supply chain. About 37% strongly agreed with this view, pointing to recent visits by senior US politicians, including President Biden, to the region as evidence.

Concerns Over Chinese and Russian Mining Activities

Despite the optimistic outlook for investment in West Africa’s gold and critical metals sector, the research conducted by Tresor Gold sounded an alarm about Chinese and Russian mining activities in Africa. The research unveiled a significant and increasing percentage of metals and minerals mined in Africa by these countries, heightening the perceived risk to the US and its allies in accessing vital natural resources. Approximately 90% of respondents believe this risk will surge over the next three years, with nearly a quarter (24%) warning of a substantial increase in the risk level. The findings underscore the importance for investors and stakeholders to closely monitor the growing influence of China and Russia in the African mining sector, navigate the evolving landscape, and capitalize on its promising opportunities.

Tony Lawson, CEO of Tresor Gold, remarked, “West Africa’s metals and mining sector, with its relative underdevelopment, attracts investors who find reassurance in the region’s growing stability. This is further evidenced by the increased interest shown by senior US politicians who recognize its pivotal role in securing metal and mineral supply chains amidst rising competition from Russia and China.”

The Unique Appeal of West Africa’s Mining Sector

West Africa stands as an exceptional jurisdiction for gold and critical metal mining, offering a unique value proposition. The region boasts transparent mining policies and streamlined licensing processes, ensuring efficiency in operations. It maintains standard corporate taxes and royalties on par with major mining jurisdictions. Notably, West Africa’s track record of consistent 1-3 million ounce gold discoveries, spanning over a decade, surpasses that of any other region globally. With a recent history of being the top gold-producing region for several years, producing over 14 million ounces annually, West Africa showcases its abundant mineral wealth. Supported by stable and mining-friendly governments, along with accessible infrastructure, West Africa presents a compelling opportunity for investors seeking solid prospects in the gold and critical metal mining sector.

Tresor Gold is currently raising capital to scale its gold projects in Sierra Leone for production within 18 months, while also pursuing strategic acquisitions of critical metal projects in West Africa. Leveraging geotechnical data, predictive analytics, and local expertise, the company identifies areas of favorable mineralization. Through diligent research of artisanal activity and soil sampling, Tresor Gold structures effective drilling programs. Committed to sustainable practices and positive impact, Tresor Gold adheres to the World Gold Council’s Responsible Mining Principles and the UN’s Sustainable Development Goals. As an accredited US Federal Government contractor, Tresor Gold provides a strategic solution for public and private sector interests seeking sustainable metal investments in West Africa.

In summary, West Africa’s gold and critical metals sectors are attracting increased investor interest, bolstered by the region’s stability, underexplored opportunities, and its crucial role in global supply chains. As geopolitical dynamics evolve, investors must remain vigilant about the influence of Russian and Chinese mining activities. Nonetheless, junior mining companies like Tresor Gold are actively capitalizing on the region’s potential, prioritizing sustainability, and contributing to responsible mining practices.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals