A survey of institutional investors and wealth managers who already engage with Bitcoin reveals that 85% plan to increase their investment in the cryptocurrency over the next two years. The survey, which was commissioned by Nickel Digital Asset Management (Nickel), the regulated and award-winning investment manager connecting traditional finance with the digital assets market, also reveals that between now and 2023, 72% expect professional investors in general to invest in Bitcoin for the first time or increase their exposure.

50 institutional investors and 50 wealth managers from the US, UK, Germany and Switzerland were interviewed for the study in January 2021. Collectively they have approximately $110 billion in assets under management.

When asked why they think professional investors will increase their exposure to cryptocurrencies, the main reason given was anticipated growth in valuations – highlighted by 56% of those surveyed. One in five (21%) expect the value of Bitcoin to rise dramatically this year, and a further 56% think there will be a slight rise in valuation.

The second most popular reason given for why investors will increase their exposure to the digital assets is their ability to provide a tail hedge against excess monetary supply and currency debasement, as well as a hedge against inflation – a view expressed by 40% of respondents. This is followed by 40% who said the size of the market crossed minimum threshold for mainstream institutional investors to start allocating to this market, followed by 38% who cited an improvement in the regulatory infrastructure for cryptoassets.

Anatoly Crachilov, co-Founder and CEO of Nickel Digital, commented:

“Our research shows that institutional investors and wealth managers are set to increase their exposure to Bitcoin and other cryptoassets, and it is not just the recent dramatic rise in valuations that is fuelling this. Cryptoassets provide a range of benefits for investors from protection against inflation and currency debasement, to portfolio diversification.

“There is also growing optimism about the sector’s infrastructure improving, and this too will result in more mainstream investors entering this market. However, there will be continued large swings in valuations, and this is an expected behaviour for a new technology in the early stage of its adoption curve. The price action for such assets is never meant to be a straight line. Only professional investors with a long-term view on the underlying technology should have exposure to this asset class. They also need high-risk tolerance levels and, importantly, to never lose sight of the forest for the trees at times of interim volatility.

“Given the immutable monetary policy of Bitcoin protocol, its powerful store-of-value function, and increasing acceptance by the institutional investors, this market is positioned for a fundamental expansion cycle as bitcoin increasingly becomes part of institutional portfolio allocations.”

Michael Hall, co-Founder and CIO of Nickel Digital, commented:

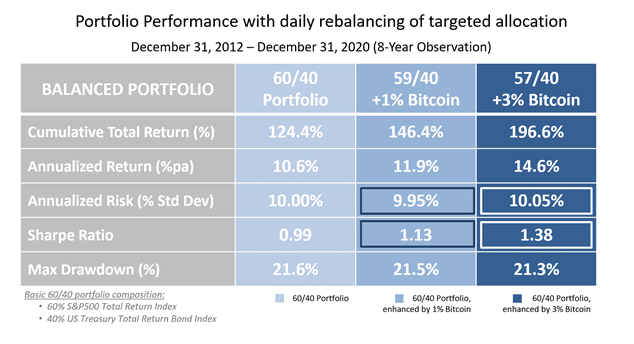

“Bitcoin is now increasingly owned by longer-term investors, weighted towards Europe and North America, looking to buy and hold within multi-asset portfolios. However, Bitcoin exposure must be carefully managed to low single digit percentages in multi-asset portfolios, within a professional risk management framework and with regular rebalancing. We recommend that investors only have between 1% and 3% of their portfolios in cryptoassets.”

Recent analysis from Nickel Digital shows the benefits of this approach, not only from a portfolio returns point of view, but also in regard to portfolio risk characteristics as measured by volatility and maximum drawdown. Counterintuitively, adding a small allocation to bitcoin does not lead to a spike in portfolio volatility, which largely reflects the uncorrelated nature of this asset class.”

Long term portfolio allocation

Nickel’s analysis reveals that a 1% allocation to Bitcoin within a well-diversified portfolio over a statistically significant 8-year period (Dec 2012 – Dec 2020) confirms a critical diversification effect offered by this uncorrelated asset. Indeed, such allocation offered an important return contribution, without imposing a negative impact on the risk characteristics (irrespective of numerous drawdowns which took place over that period of time). The table below summarises this effect:

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals