PwC and Elwood Asset Management (“Elwood”) have today published a report examining the global crypto hedge fund landscape. The report is based on data from research in the first quarter of the year on 100 of the largest global crypto hedge funds by AuM.

Commenting on the report, Henri Arslanian, PwC Global Crypto Leader said: “The crypto hedge fund industry today is probably where the traditional hedge fund industry was in the early 1990s. We expect the industry to go through a rapid period of institutionalisation and implementation of sound practices over the coming years.”

AuM

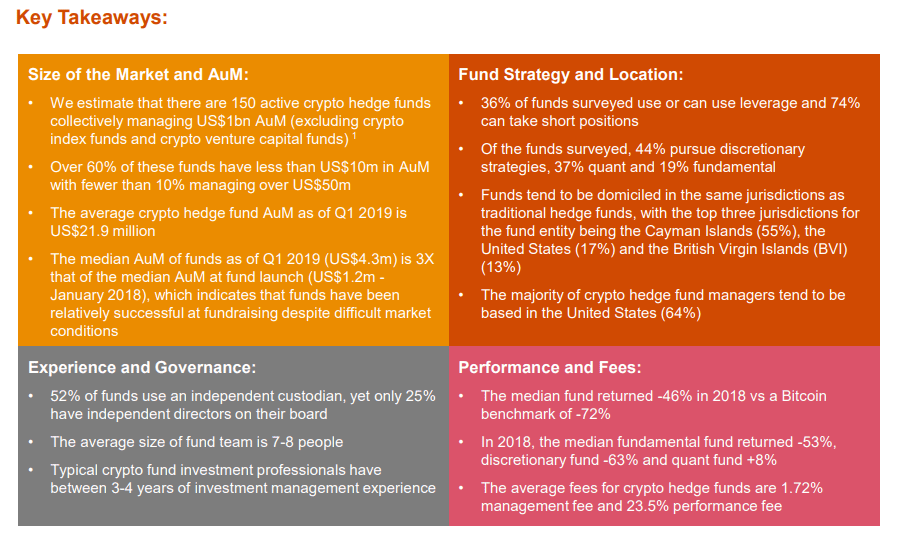

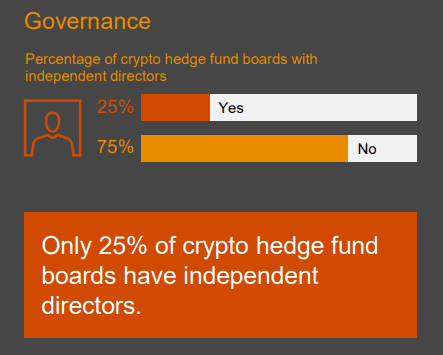

The report highlights that the average crypto hedge fund AuM as of Q1 2019 is US$21.9 million. Over 60% of crypto hedge funds have less than US$10 million in AuM with fewer than 10% managing over US$50 million.

The data highlights that crypto hedge funds have been able to increase their AuM three times in 2018 despite market conditions, with the median crypto hedge fund AuM having grown from US$1.2 million as of January 2018 (the median launch date for crypto hedge funds) to US$4.3 million at the end of Q1 2019.

Fund Performance and Fees

By evaluating performance in this sector, the report finds that while 2018 saw a 72% fall in the price of Bitcoin, the median crypto hedge fund returned -46% over the same period, indicating that these managers were successfully able to outperform their benchmark. However, performance differed based on the type of strategy pursued. The median quantitative fund returned 8% in 2018. The median fundamental and discretionary funds performed less well, with returns in 2018 of -53% and -63% respectively.

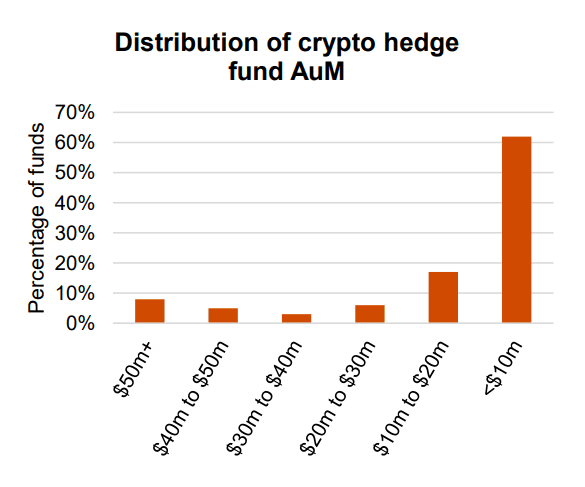

The report found that the average fees for crypto hedge funds are 1.72% management fee and 23.5% performance fee.

Experience and Governance

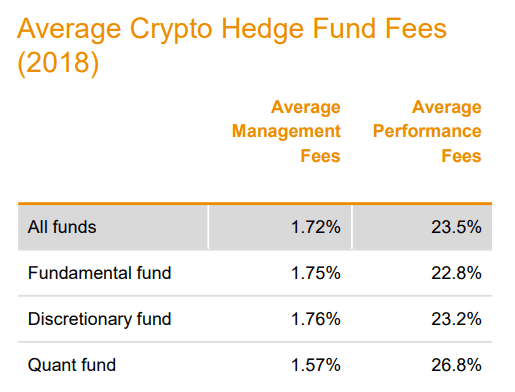

The report also captures data on the level of experience and governance among crypto hedge funds. It was found that the average crypto hedge fund investment professional has 3 to 4 years’ investment management experience, with the average fund team consisting of 7 to 8 people. However, only 25% of crypto hedge funds’ boards have independent directors and 52% use an independent custodian. The report also found that the majority of crypto hedge funds (64%) are based in the United States.

Also commenting, Bin Ren, CEO of Elwood said: “The crypto hedge fund space is just one part of a much broader ecosystem of digital assets, around which there is increasing evidence of institutionalisation. This broader interest from investors and regulators is undoubtedly a positive step towards digital assets being recognised as an asset class with true viability and longevity. However, in order for that progress to continue it needs to be accompanied by greater transparency and education, and this report is a step towards achieving that.”

Read More:

how to reconcile your bank account to avoid spending more than you have

how is having a security system for your home a risk management strategybarclayhedge

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals