The International Monetary Fund has warned that the world might experience its worst recession since the Great Depression of the 1930s but stock markets seem to be fixated on a potential recovery.

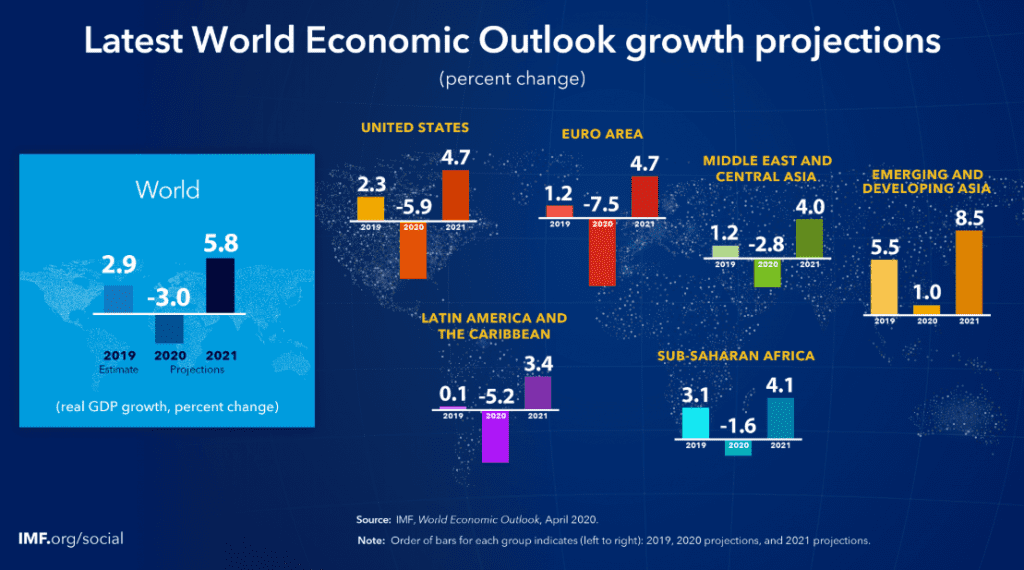

Lockdowns imposed by governments have forced many companies to close and dismiss staff. The UN said in a study that 81% of the world’s workforce of 3.3 billion people had their place of work fully or partially closed because of the outbreak. IMF also predicted in its World Economic Outlook that the global economy will shrink by nearly 3 percent this year due to the Covid-19 pandemic and far worse than its 0.1% dip in the Great Recession year of 2009. The world economy is then expected to rebound in 2021 with 5.8 percent growth and 8.4% growth in the international trade, the IMF said. However, it acknowledged that scenarios for the turnaround next year would be clouded by uncertainty.

The IMF usually issues its global financial stability report and the earlier economic forecasts ahead of its spring meetings, but this year they have been replaced by virtual meetings. The organization also expects a global trade drop of 11 percent in 2020 and an increase of 8.4 percent in 2021.

The world hasn’t seen a recession this bad since the 1930s

The coronavirus pandemic is dropping the global economy into its deepest collapse since the Great Depression of the 1930s and governments and health officials must work together to avoid an even worse outcome. That’s the sheer warning from the International Monetary Fund, there was a risk of the recession extending into 2021 if policymakers fail to manage a global response to the virus.

In the United States, where lawmakers have approved over $2 trillion in stimulus and where the Federal Reserve has unleashed trillions more to keep the financial system from seizing up, the IMF expects the economy to shrink by 5.9% this year. Recovery will come next year when the economy is expected to grow by 4.7 percent, leaving it still worse off at the end of next year than the fund had expected in January.

“By the end of this week, 25 million Americans will have filed for unemployment benefits since the sudden pandemic crash in mid-March, obliterating all 22 million jobs created since the end of the last recession in 2009”, said Torsten Slok, chief economist Deutsche Bank Securities.

That would be the worst collapse since 1946, but a smaller decay in output than some European countries are likely to experience. The outlook is bleak even in countries where governments and central banks have responded forcefully in an effort to help workers and businesses. The IMF expects Germany’s economy, the largest in Europe and heavily exposed to global trade, to contract by 7% in 2020.

Though the IMF expects a punishing global recession, the downturn will not be as severe as in the 1930s, when the worldwide economy shrank by an estimated 10 percent. While the fund expects the pandemic to peak by midyear, the United States will remain below its pre-crisis growth trend through 2021. And the fund acknowledged that its forecast could prove overly optimistic if the pandemic lingers.

Bank of America Forecasts a ‘Deep Plunge’

Bank of America U.S. economist Michelle Meyer wrote in a note to clients, published in March, “We are officially declaring that the economy has fallen into a recession, and it is a deep plunge.” The economist detailed, “Jobs will be lost, wealth will be destroyed and confidence depressed,” emphasizing that it is only going to get worse.

Moreover, Bank of America expects the economy to “collapse” in the second quarter of this year, shrinking by 12%. The economist opined, “Although the decline is severe, we believe it will be fairly short lived.”

The coronavirus pandemic has closed US schools, restaurants, and factories as the nation rushes to curb the spread of COVID-19, the illness the virus causes. The shock has also pushed the US economy into a recession, economists from Bank of America said.

The economists forecast that US gross domestic product will collapse in the second quarter, falling 12% on a seasonally adjusted annual rate basis – the biggest quarterly decline in post-war history after growing only 0.5% in the first quarter of 2020. For the full year, the bank is forecasting a contraction of 0.8%. Markets have also been roiled by the coronavirus pandemic, ending the longest ever bull market in history. Bank of America’s recession call comes as a growing number of industry watchers are warning that there is likely to be severe damage to the US economy as the outbreak slows consumer activity and dampens confidence.

Bank of America expects that approximately 3.5 million jobs will be lost, with the biggest hit of 1 million per month in the second quarter. This will send the unemployment rate nearly doubling to 6.3%. Industries such as leisure, hospitality, and retail will likely be hit the hardest, as they have the largest shares of hourly workers who struggle to work from home, according to the note.

Deutsche Bank Predicts ‘Severe Recession’

Deutsche Bank’s economists have forecasted a “severe recession” due to the coronavirus pandemic, according to the company’s report published on March 18. The bank’s team of global economists, led by Peter Hooper, is predicting a severe global recession occurring in the first half of this year, with aggregate demand plunging by about 32% in China in the first quarter. In the second quarter, the economists expect aggregated demand to fall by 24% in the eurozone and 13% in the U.S.

In China, where the outbreak originated late last year, the Deutsche Bank economists said the economy fell at about a 9% quarterly rate or 30% annual rate in the first quarter. They predicted 13% drop in the gross domestic product of the United States.

Markets around the world continue to slide despite interventions from governments and central banks including huge economic and financial stimulus packages designed to calm investor panic. The travel and leisure industries are feeling the brunt of the pain, with airlines in particular talking about the need for government bailouts.

Morgan Stanley economists said earlier this week that they expect global growth to shrink to 0.9% this year, and Goldman Sachs is expecting growth to weaken to 1.25%, according to a Bloomberg report. Deutsche has adjusted its global growth forecast to 0.8% for 2020, down from 3.2% last year.

Deutsche’s team added: “We cannot stress enough the degree of uncertainty surrounding these projections. These are truly unprecedented events with no adequate historical example with which to precisely anchor our forecast.”

However, Deutsche’s researchers said in their 13-page report that levels of global output “should be back close to normal by next year” and are anticipating a so-called V-shaped recovery in the economy. This echoes comments made by Ana Botín, chair of Spanish lender Santander, who has also predicted a V-shaped scenario of sharp decline followed by a recovery, according to a report in the Financial Times.

Simon Pearson is an independent financial innovation, fintech, asset management, investment trading researcher and writer in the website blog simonpearson.net.

Simon Pearson is finishing his new book Financial Innovation 360. In this upcoming book, he describes the 360 impact of financial innovation and Fintech in the financial world. The book researches how the 4IR digital transformation revolution is changing the financial industry with mobile APP new payment solutions, AI chatbots and data learning, open APIs, blockchain digital assets new possibilities and 5G technologies among others. These technologies are changing the face of finance, trading and investment industries in building a new financial digital ID driven world of value.

Simon Pearson believes that as a result of the emerging innovation we will have increasing disruption and different velocities in financial services. Financial clubs and communities will lead the new emergent financial markets. The upcoming emergence of a financial ecosystem interlinked and divided at the same time by geopolitics will create increasing digital-driven value, new emerging community fintech club banks, stock exchanges creating elite ecosystems, trading houses having to become schools of investment and trading. Simon Pearson believes particular in continuous learning, education and close digital and offline clubs driving the world financial ecosystem and economy divided in increasing digital velocities and geopolitics/populism as at the same time the world population gets older and countries, central banks face the biggest challenge with the present and future of money and finance.

Simon Pearson has studied financial markets for over 20 years and is particularly interested in how to use research, education and digital innovation tools to increase value creation and preservation of wealth and at the same time create value. He trades and invests and loves to learn and look at trends and best ways to innovate in financial markets 360.

Simon Pearson is a prolific writer of articles and research for a variety of organisations including the hedgethink.com. He has a Medium profile, is on twitter https://twitter.com/simonpearson

Simon Pearson writing generally takes two forms – opinion pieces and research papers. His first book Financial Innovation 360 will come in 2020.