It depends on the circumstances and the capital. In the United States, there is no minimum capital requirement, so a company can be formed in about less than 10 minutes on the internet with a starting capital of $120. Generally, the average U.S. hedge fund creation takes about 4-5 weeks, considering the time to organize and prepare legal documents, setting up the brokerage accounts and formation of the management team.

Things to Consider

There are several things that the hedge managers need to consider before creating a hedge fund. Below is the list of the most important things that significantly impact a hedge fund business:

Raising capital

Capital is undoubtedly the most crucial element of a hedge fund business plan. To have a strong business position, it is important to have ample investment. In general, the capital needs depend on the four main things:

- Size of the management team

- Complexity of the funds

- Type of investment partners

- Cost structure

Many successful hedge fund managers claim that a fund must manage around $80 to $100 million in assets in order to become a serious fund business. However, many other hedge fund managers have claimed to make substantial profits with only $10 million in assets. This proves that every business is unique; you can make high return with low investment and vice versa, depending upon the market conditions and the demand for the particular investment service.

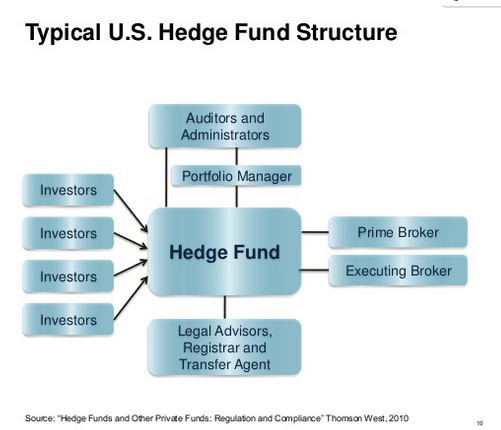

Choosing the Appropriate Service Provider

It is easy for the hedge fund managers to choose the wrong service providers. Hedge funds usually require a fund placement agent, an auditor, an experienced attorney, an administrator and a prime broker. The service providers represent the company to the prospective investors, which is why it is crucial to select experienced service providers. Hiring inexperienced service providers usually carries a negative reputation which can hurt the company’s image. On the other hand, experienced and reputable service providers easily attain investors’ loyalty and interest which ultimately leads to higher returns.

Selecting the Right Internal Team

Starting and managing a hedge fund is no small task and it is definitely not something that can be run as a one man show. You are most certainly going to need a group of staff to perform various kinds of duties for you. Only a competent internal team is capable of implementing the company’s product strategy effectively, which is why the team selection is one of the most crucial steps. Traders are the most important people of the team as they bring substantial expertise and knowledge to the company that can help the company grow.

Hedge fund managers should look for traders that have ample experience regarding the industry and account management. Hedge fund managers should review the traders’ performance before letting them on the team. The external administrative team can be a great help when it comes to determining the competencies of the internal team.

Choosing an Appropriate Name for the Hedge Fund

Every hedge fund has to have a name, so this is good a place to start brainstorming. You can name it anything but it should be kept in mind that it should sound professional. This must also be one of the first things you do for another reason and that is because only once this has been decided can you move forward and get the hedge fund registered. Although you can choose to get your fund registered anywhere, a majority chunk of hedge funds are registered in the Cayman Islands or Bermuda.

There is a very logical reasoning behind this which prompts people to do so. This way, they have to pay lesser taxes, as the tax regulations in these places are much more relaxed than those of the United States or the United Kingdom. You will also be under less observation if you were to register here, which would give you greater freedom and control over the way you run the fund and this can indeed be a huge advantage.

Choosing the Right Location

You will of course also need a place to work out of and that you can list as your address. Do not get carried away trying to rent the biggest place in the fanciest of locations hoping to attract the correct clientele. Yes indeed it is true that this does matter but only up to a certain point. If anyone is going to decide to invest millions of dollars with you then an office alone will not be enough to do the trick. You will have to impress them with your knowledge, skills and strategy to win them over. That being said, it is important that you have a reasonable space where you can invite potential clients and converse with them in a comfortable and conducive environment.

Now that we have looked at some of the things that you will need to have functioning in the backdrop, let’s move onto things that are more closely related to the fund itself. Once the fund is up and running, you will also need to decide upon a decent percentage which you will charge as your fee. Typically, a small percentage is applicable on the amount that an investor contributes and then another larger percentage is charged over the total profit that the hedge fund makes at the end of a financial year.

Deciding the Fee structure

The current trends show that people are charging 2% and 20% respectively for both categories but this is by no means a hard and fast rule. The only rule that you should technically be following is not to overcharge for the obvious reason of driving potential investors away. Indeed some hedge funds do charge a fee much higher than what we have mentioned, but then this is only practical and feasible when they have a great track record which speaks for itself. Remember that charging higher than the average percentage will only work if you can prove to your clients that your methods will work and hopefully turnover a higher than average profit.

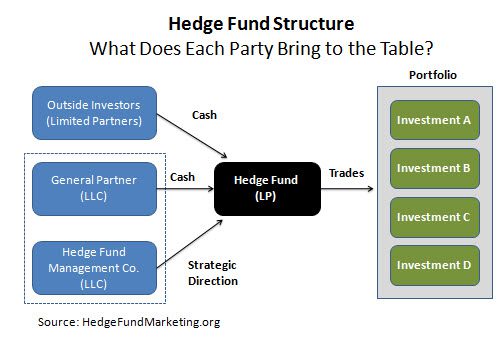

This brings us to the actual investments. As you are already aware of, a hedge fund simply cannot be started if there are not sufficient funds, and by sufficient we mean millions of dollars at the very least. So the question arises, where is one to get all this funding from and how?

Dealing with the Inevitable

We can also not stress enough on the fact that no matter how well you plan and try, there will always be some things which will be beyond your control. There are thousands of external factors that affect the returns and growth of a hedge fund such as the prices of commodities, governmental regulations and prohibitions and the general economy of the country as well as globally. It is imperative that individuals who run a hedge fund know how to deal with stress because it is guaranteed that they will have to go through some very tough and testing times. They should know how to keep their cool and should have a good mental capacity to remain steadfast even in the worst kinds of crisis.

Similarly, they should be alert and quick to think because they will not always have a lot of time to make drastic decisions which can literally determine the life and death of the fund. The bottom line is that luck has a huge role to play so you should not expect a direct input and output relationship.

Study the recent market conditions and track all kinds of commodities for at least a couple of months before you even narrow down to a few choices. Making a mistake here is can cost you the entire game thus you can never be too cautious. Secondly, do not just blindly follow someone else’s patterns thinking things will turn out just the same for you. This is because it is just not possible that two people have the same level of skill and understanding when it comes to a particular strategy or approach. You have to be fully aware of your strengths and weaknesses. Do what comes to you naturally and do try to find a methodology that seems to click with you, keeping in mind your talents as this is the only approach which will most likely suit you.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals