]What Are Hedge Funds and Why They Are So Popular?

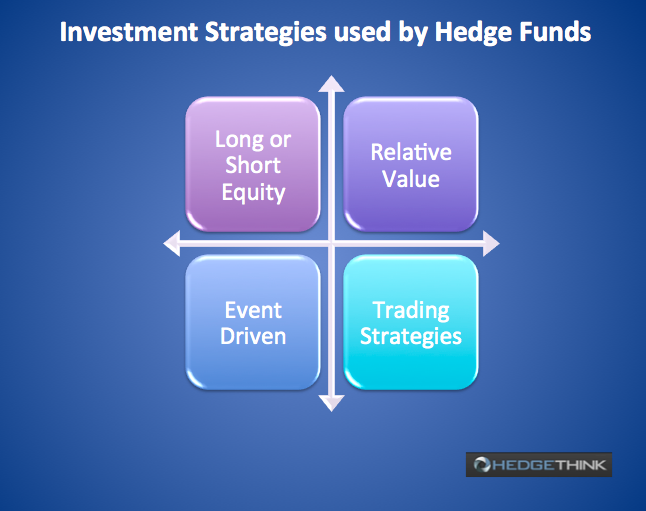

A hedge fund is simply a fund that enables the investor to generate a healthy rate of return by hedging or protecting against the prevalent market risk. The two defining investment strategies used by hedge fund managers initially were short selling and leveraging to generate high profits for the initial investment, however, these techniques have evolved drastically in the recent times as hedge funds have continued to thrive. Some of the more varied and commonly used investment strategies used by hedge funds are:

- Long or Short Equity: By implementing sophisticated research and stock selection skills via purchase of the best ideas and reducing the imminent stock market exposure by short selling those stocks believed to perform less profitably, the hedge fund managers can reap high returns.

- Relative Value: Hedge funds make use of sophisticated and state-of-the-art computer systems to calculate the fair value of one asset relative to another and then shorting the relatively more expensive asset and then purchasing the cheaper one.

- Event Driven: Hedge fund managers seek lucrative investment opportunities that surround specific corporate events for instance, investment in mergers, acquisitions or bankrupt companies.

- Trading Strategies: These entail taking positions on the direction of markets, any currencies or commodities to generate a high rate of return on the investment.

The reason hedge funds are so popular is that although they are risky investments, they have the potential to really succeed and garner huge and staggering profit returns. Since the success of the hedge fund is largely dependent on the managers ability to implement the correct strategy at the right time for instance, rather than on the prevailing economic or overall market conditions, hedge fund success can be controlled largely. This also implies that they offer potential positive investment returns with a relatively low volatility and substantially unrelated to the investment market scenario.

Other reasons for the success of hedge funds include:

- Since they are unrestricted and uncontrolled by the Securities and Exchange Commission (SEC), the hedge fund managers have greater flexibility to utilize their skills and garner high rates of return.

- The main aim of the hedge fund managers is typically to remove a proportion of the market exposure and generate a positive return regardless of the direction of the market. This can usually entail making an offsetting bet to hedge against losing money on the initial investment position.

- Since hedge funds operate in largely smaller areas, they are able to invest in a number of funds that can reduce the volatility via the integral advantages of diversification.

Common Features of Hedge Funds

Some common characteristics of hedge funds are:

- Hedge funds are largely illiquid: Hedge funds usually vary in their extent to which an investor can redeem his or her interests. The share redemption policy would be mentioned in the hedge fund policy and may include some provisions that may prevent the investor from redeeming their shares. The most common of these provisions is the lock up period; this entitles the investor to lock in his or her investment for a stipulated period (usually 3 months to 3 years) where he cant withdraw his capital.

- Hedge funds are unregulated: Hedge funds unlike many other investment partnerships do not have to register with the SEC, the Financial Industry Regulatory Authority or even the Commodities Futures Trading Commission. These are some of the major investment regulatory institutions and so hedge funds can avoid dealing with them if they want, however, some still register with these bodies to generate a sense of trust with its clients.

- Success of the hedge fund depends on the efficacy of the investment strategies used: An array of aggressive investment strategies are employed by a hedge fund manager as opposed to a conventional money manager.

- Hedge fund managers: Hedge fund managers receive a performance fee of 2 percent and a further 20 percent in profits incurred by the hedge fund for the year. This is the convention most of the time and can prove costly for the investor.

History of Hedge Funds

The term hedge fund was first used in 1949 by Alfred Winslow Jones, a sociologist and financial journalist to describe an investment strategy that would forever change the financial industry. Jones used to work for the Fortune Magazine where he used to pen articles on various financial techniques and strategies. The exposure to various kinds of financial strategies gave him an idea to combine speculative strategies to create a conservative investment scheme. These two speculative tools were name leverage to purchase more shares and short selling to evade the market risk. This innovative approach earned him a large $100,000 of which he had invested $40,000 of his own money, and thus earning him a return of 17.3%. Other investors began to pay attention to these hedge funds mainly because of its negligible correlation to the market.

Nowadays, there are around 10,000 active hedge funds with approximately $3 trillion in assets that are under management. However, the techniques used for hedge funds have moved past the staple leverage and short selling, and on to a host of more complex and modifiable strategies.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals