European deep tech company Guardtime believes the Coronavirus crisis has accelerated the development of Central Bank Digital Currencies (CBDCs) by up to five years, and it believes the first major CBDC could launch within three years.

Guardtime, which is working with several central banks around the world in exploring the development of CBDCs, believes these currencies are now closer to being launched because the Coronavirus crisis has helped to further digitise all aspects of society. Also, improved networking and teleconferencing during the pandemic has increased levels of collaboration and discussion amongst central banks.

Luukas Ilves, Head of Strategy, Guardtime said: “There is an increasing sense of a ‘race to the moon’ regarding central banks launching their own digital currencies, because this could radically enhance their country’s and currency’s positions on the global economic stage. First-time movers could win long-term geopolitical advantages.

“Not only has Coronavirus accelerated the digitisation of society, it has also further transformed how we use money. It has limited physical interaction and reduced the use of physical cash, all of which has resulted in a surge in online sales and transactions and made CBDCs more viable.

“Government-led digital transformation is usually slow, gradual and fragmented. That makes the rapid and coordinated moves by Central Banks on CBDC across the world all the more remarkable. In their moves toward CBDC, Central Banks are showing how digital transformation can be done right.”

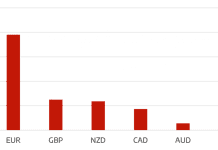

Interest in CBDCs has grown in response to changes in payments, finance and technology, as well as the disruption caused by Covid-19. Research (1) from earlier this year revealed that 86% of central banks are actively researching the potential for CBDCs, 60% were experimenting with the technology and 14% were deploying pilot projects.

Guardtime believes the introduction of central bank digital currencies could upend the global economic order. This technology could bring a multitude of benefits such as more efficient trade, greater financial access for millions of people, and a reduction in crime. But there are important technological barriers to overcome regarding scalability and security, and it is on these points that Guardtime is in discussion with some central banks.

Guardtime has developed KSI Cash, a breakthrough digital cash, payment and settlement infrastructure designed to meet the scalability, reliability and security requirements of the next quarter century.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals