Financial-services data managers have spent the last decade modernizing warehouses, taming data lineage, and experimenting with AI sandboxes. In 2024-2025, the conversation finally shifted from “Should we migrate?” to “How do we exploit data as quickly and safely as possible?” Looking ahead to 2026, three forces will shape every bank, insurer, and asset manager roadmap: architectural agility, embedded trust, and regulatory-grade transparency.

1. Moving Beyond the Monolith: Building an Agile Data Backbone

Legacy hub-and-spoke warehouses still power daily reports, yet they can’t keep pace with streaming payments or AI-driven risk models. As a result, architecture is morphing into a flexible backbone that supports both central governance and local innovation.

Data Fabric Goes From “Nice To Have” To Mission-Critical

A data fabric provides the connective tissue, like metadata, policy, lineage, and access, in a distributed world of on-prem, multi-cloud, and edge sources. Gartner now predicts that by 2026, 80 % of data-fabric deployments will be considered business-critical, not experimental. That single data point says a lot: senior executives are betting that unified metadata and automated governance will underpin growth initiatives, not just compliance.

What makes the fabric indispensable is its ability to surface authoritative reference data, risk metrics, or customer attributes regardless of where the underlying tables live. A credit-risk analyst can ask, “Give me yesterday’s limit utilization for the Asia portfolio,” and the fabric resolves where that metric is stored, applies masking rules, and returns it in seconds – no ticket, no Excel shuffle.

Domain-Driven Data Mesh Turns Producers Into Product Owners

While the fabric standardizes rules, the data mesh principle decentralizes ownership. Each business domain – treasury, cards, wealth – publishes data products with well-defined contracts (schema, freshness, and quality SLA), and many organizations look to https://dxc.com/industries/financial-services for guidance on implementing these structures effectively. The fabric enforces security and lineage, but the domain team decides how to model and evolve its dataset.

This combination solves an age-old tension: central teams want control; business lines want speed. In practice, it looks like this:

- A central catalog exposes all certified data products.

- Versioning tools track every column change.

- FinOps dashboards link compute costs to the owning domain, driving accountability.

The result is a living ecosystem where innovation doesn’t break governance – exactly what regulators and boards are demanding for 2026.

2. Privacy and Trust as Design Principles, Not Afterthoughts

Customer trust sits at the heart of every payment, mortgage, or wealth-management interaction. New privacy laws: Europe’s Data Act, multiple U.S. state statutes, and fast-moving APAC cross-border rules, raise the bar further. Forward-looking firms are therefore infusing privacy directly into data pipelines.

Privacy-Enhancing Technologies Graduate To Mainstream

Homomorphic encryption, secure multi-party computation, and confidential computing were once academic curiosities. Today, they enable joint analytics between banks and fintech partners without ever exposing raw account data. Early adopters use them to share fraud-prevention models or KYC signals across borders where data residency normally blocks collaboration.

The practical approach for 2026 is incremental: isolate one high-risk analytics use case, say, cross-border credit scoring, wrap it with a PET framework, and integrate the controls into your catalogue and access-management stack. When auditors arrive, you can show end-to-end lineage, even for encrypted workloads.

Zero-Copy Analytics With Synthetic Data

Financial data is sensitive, imbalanced, and often too small for robust AI. Enter high-fidelity synthetic data. According to SAS, 75% of businesses are projected to use generative AI to create synthetic customer data by 2026, up from under 5% in 2023. The leap from prototype to production is being driven by two benefits:

- It removes personal identifiers, easing privacy compliance.

- It lets engineers oversample rare events such as fraud, improving model accuracy.

Implementation advice for 2026:

- Integrate synthetic-data generators into your DevOps pipeline.

- Archive synthetic data in the same catalog as real data, but distinguish them in some way so that the end-users of the data can tell the origin.

- Set quality gates for establishing statistical similarity tests before the synthetic data is introduced into model training.

By considering privacy and data quality as one and the same thing, companies gain trust among customers, government agencies, and internal stakeholders in a single move.

3. Compliance at the Speed of Streaming

Regulatory reporting used to be a batch affair; T+1 or even T+2 was standard. No longer. Supervisors now request intraday liquidity views, instant trade reconstructions, and near-real-time AML alerts. The only way to keep up is to weave compliance logic into streaming data pipelines from the outset.

Real-Time Regulatory Dashboards Become Table Stakes

Modern event buses like Kafka, Pulsar, or Kinesis carry trade confirmations, payment messages, and risk metrics as individual events. Payload validations are done by schema registries, whereas a policy engine annotates an event with retention time, data-subject, and geographic policies. When auditors inquire as to how a certain payment was screened against sanctions, a replay engine recreates the entire compliance trail within a few seconds.

Beyond satisfying regulators, this architecture slashes operational risk. Misconfigured risk thresholds surface immediately, not during a quarterly review. Customer-onboarding teams get instant feedback if KYC documents are missing, reducing drop-offs and manual rework.

Compliance-as-a-Service Transforms a Cost Centre Into a Revenue Line

Once you build real-time pipelines for your own needs, productizing them is straightforward. Global banks already sell API-based watchlist screening or transaction-monitoring feeds to smaller institutions. Typical buyers are regional lenders and crypto exchanges that cannot afford full in-house teams but must still meet the same regulatory bar.

The commercial upside changes the budgeting conversation. Instead of arguing for “mandatory compliance spend,” data executives pitch a profit-generating platform that also keeps regulators happy. With margins in traditional lending under pressure, expect more institutions to monetize compliance infrastructure by 2026.

Crucially, none of these initiatives should start or end with a list of rules alone. Success hinges on cultural alignment: data engineers owning code quality, risk teams codifying policies in machine-readable form, and finance leaders measuring return on data investment.

4. ESG and Climate Data Become Operational, Not Aspirational

Sustainability disclosure has evolved from glossy CSR brochures to capital-allocation criteria. Treasury desks now consider carbon intensity before buying bonds; risk committees model flood exposure alongside credit scores. To support such decisions, financial institutions need a trusted, versioned, and auditable ESG data store.

Building a Golden Source for ESG Metrics

The first step is resolving identifiers. Corporates often publish emissions using varying units and periods, while third-party vendors offer competing scores. A canonical entity ID – mapped to legal-entity identifiers (LEIs), exchange tickers, and internal counterparty codes – anchors everything.

Next comes data quality. Similar to credit-risk factors, ESG attributes require freshness, completeness, and consistency checks. Failed rules trigger automated escalations to domain stewards, not an ad hoc email chain. When a bank restates its Scope 3 numbers, the system logs the change, replays impact analyses, and updates downstream models automatically.

Embedding ESG Into Risk and Pricing Engines

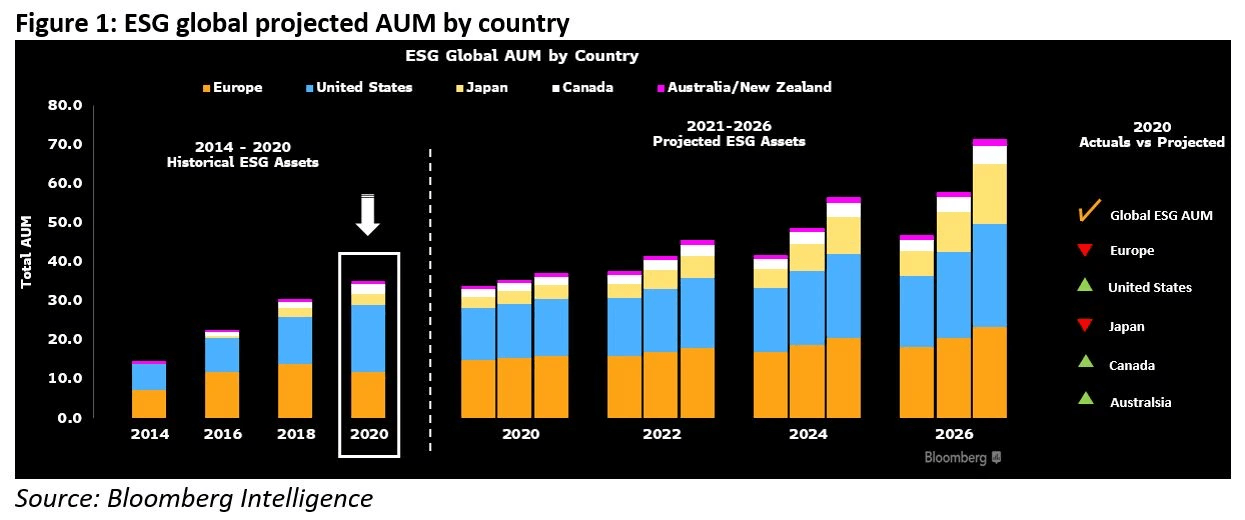

Bloomberg Intelligence estimates that global ESG assets will hit $50 trillion by 2025, or roughly a third of all professionally managed assets. Whether you personally cheer or challenge ESG investing, that capital pool pulls data management with it.

Practical 2026 initiatives include:

- Feeding verified climate scenarios into stress-testing models, alongside macroeconomic variables.

- Adjusting loan pricing for transition risk, using facility-level emissions data.

- Powering client dashboards that show portfolio alignment with net-zero pathways, turning regulatory burden into a value-added advisory tool.

The lesson is clear: treat ESG data as “just another domain” within your mesh. If you attach owners, lineage, and SLAs, the inevitable data-quality firefights around climate disclosure become manageable, not catastrophic.

Conclusion: Turning Data Management Into a Competitive Weapon

The most striking data management trends in financial services heading into 2026 have one theme in common: they convert mandatory plumbing into strategic leverage. A hybrid mesh-fabric backbone offers real-time controlled access to any data. Privacy-by-design technology and synthetic data encourage innovation but do not undermine trust. Compliance pipelines that are streamed please the regulators and open up new streams of revenue. Capital and risk choices are now made based on ESG data, which used to be on the margins.

Executives who align architecture, people, and process around these trends will not only avoid regulatory headaches; they will create new profit pools and improve resilience. Those who wait risk running yesterday’s playbook in a market that moves by the millisecond.

The roadmap is demanding, yet the payoff is clear: a data ecosystem that is secure, transparent, and adaptable enough to support whatever products – tokenized assets, green bonds, embedded finance – emerge next. In an industry where speed, trust, and insight converge, that is the edge that will matter most in 2026 and beyond

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.