The week was dominated by the build up of forces and eventual invasion of Ukraine. Though not unexpected by the markets the actual event still took them by surprise.

Risk assets initially tumbled on Thursday as reports of the invasion broke but by late on Thursday staged a complete comeback and had turned positive on the day. The initial sanctions imposed by the west seemed to be less stringent with the decision to remove the Russian economy from Swift held for another day.

Oil moved higher as Russian forces entered Ukraine, fearing the worst for further global escalation and oil supply problems. WTI hit intra-week highs above $100 for the first time since mid-2014, but then fell dramatically back to last week’s levels. WTI finally closed the week broadly unchanged, just below $92.

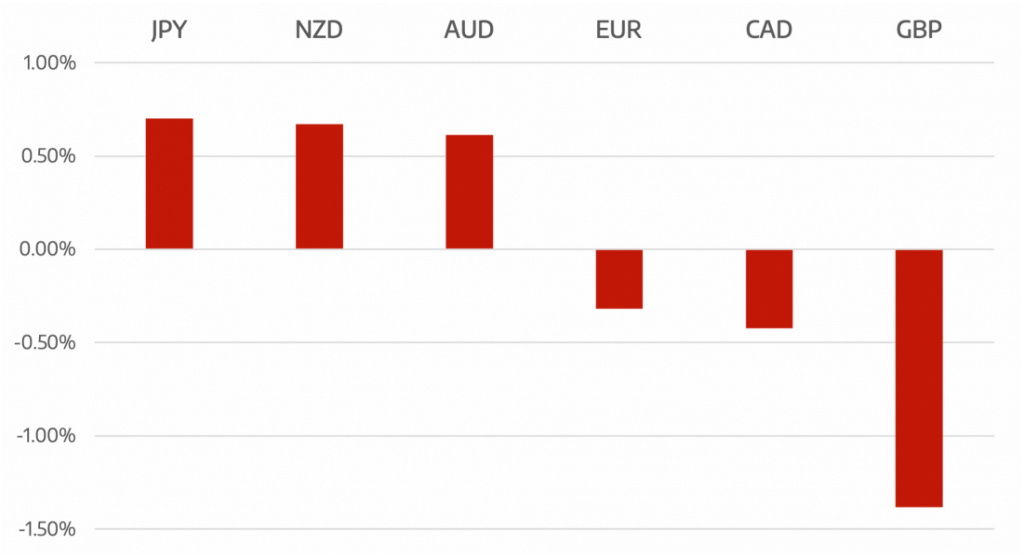

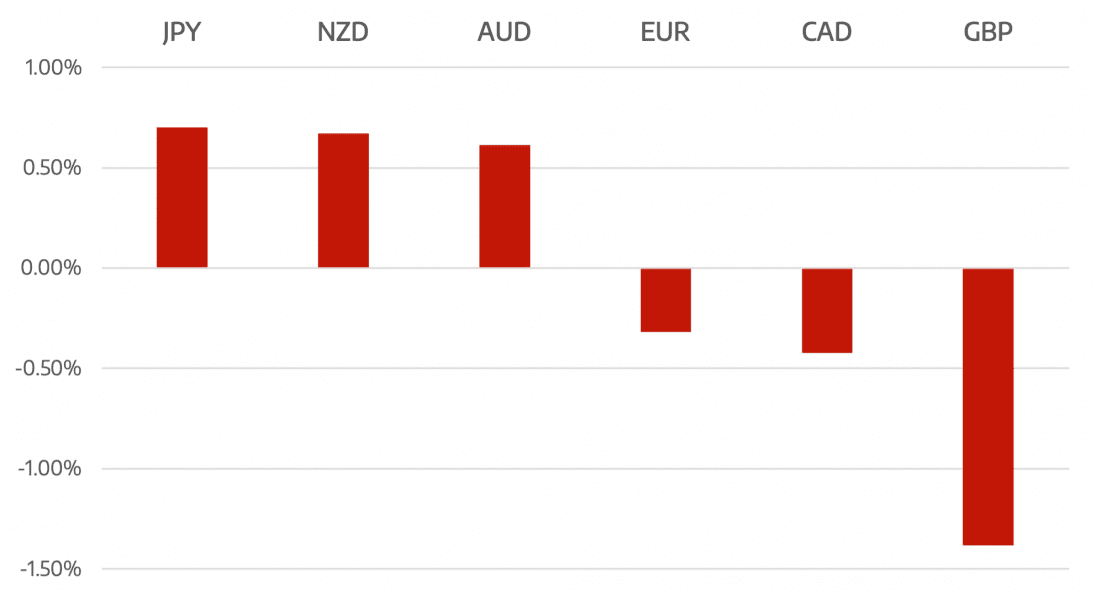

Commodity currencies ended the week strongest however Sterling ended the week worst of all.

The week ahead economic announcements will probably take a back seat to the evolving situation in Eastern Europe. The week see’s the Fed chair Powell’s testimony to congress and US payrolls on Friday.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post <h5>Cromwell FX Market View</h5> <h3>Putin’s War Begins</h3> appeared first on JP Fund Services.