The COVID-19 pandemic has disrupted the world, with its implications going much beyond global health. The truth is that it is going to have a far-reaching impact on financial markets, economies, and investments as well. Considering the damage it has already done to the global markets, investors must think and react now for reducing the harmful impact on their investment in the long run. Needless to say, while the markets appear unapproachable right now, investment is about the long term and things will take a turn for the better.

And history proves that the markets have a penchant for surviving and they will come back strong and victorious this time as well. If you are able to understand the peculiarities of trading and realign your investment in the existing situation, you may actually end up benefiting from the current challenges. Here are a few things that you need to know for realigning your strategy and emerging a winner.

Start by understanding the market behavior

If you have entered the market in the last decade, this will probably be the first major crash you will have seen. The temptation to get out and never be back will be strong, but that is the worst thing to do. Rather than quitting, this is the time to show resilience and understand the market behavior. In times of immense volatility like this one, markets tend to go up as well as down. However, this is not something that has happened for the first time. There have been crashes in history and investors have still survived to come back even stronger. Invest in some good research of such turbulent times and learn about the outcomes. Talk to experts and fellow investors to get their insights as well.

Stay invested despite the volatility

Right now, you may want to consider redeeming and re-entering the market later. However, this approach may land you into deeper trouble because it is hard to decide the right time to re-enter. In fact, you may end up losing more money in waiting for corrections rather than the corrections themselves. So it definitely makes sense to stay in the market rather than exit in the face of the crisis, with the plan to come back later. You have good chances of survival and revival if you are willing to ride out this tough period of volatility. Remember that sell-offs are a natural reaction to an unstable market behavior. Conversely, they can offer huge opportunities for investors with a steady mind and right approach.

Reassess your holdings

The situation sounds scary with the coronavirus spreading like fire and things getting worse with every passing day. But you shouldn’t panic over the situation; rather assess it actively and thoroughly in tandem with your holdings. This is the time to trade wisely, because hasty and apprehensive decisions to sell off may put you at loss. Conversely, investors engaged in long-term investments are most likely to gain. Therefore, a careful analysis of holdings and risk appetite is the smartest thing to do. Holding on to the stocks that have the potential to surge in the long run is the best approach at this point in time.

Invest now, but do it judiciously

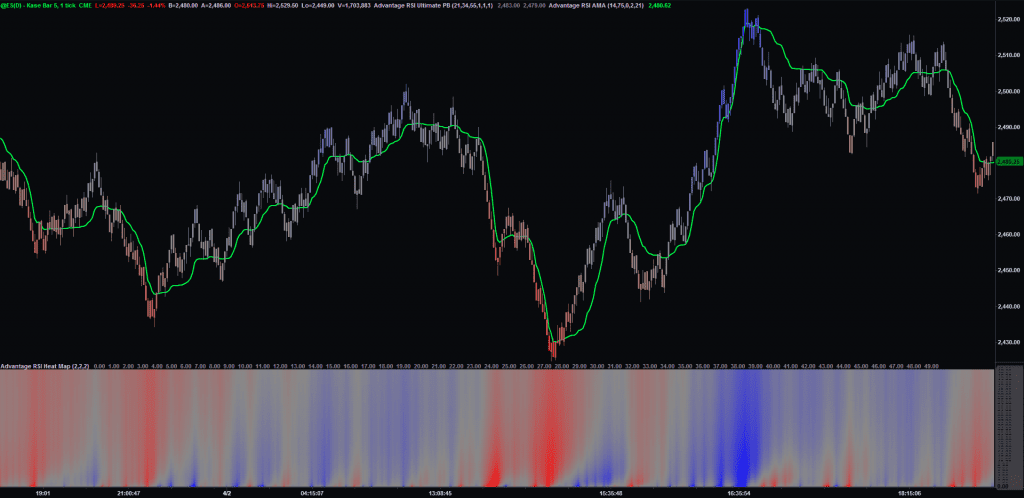

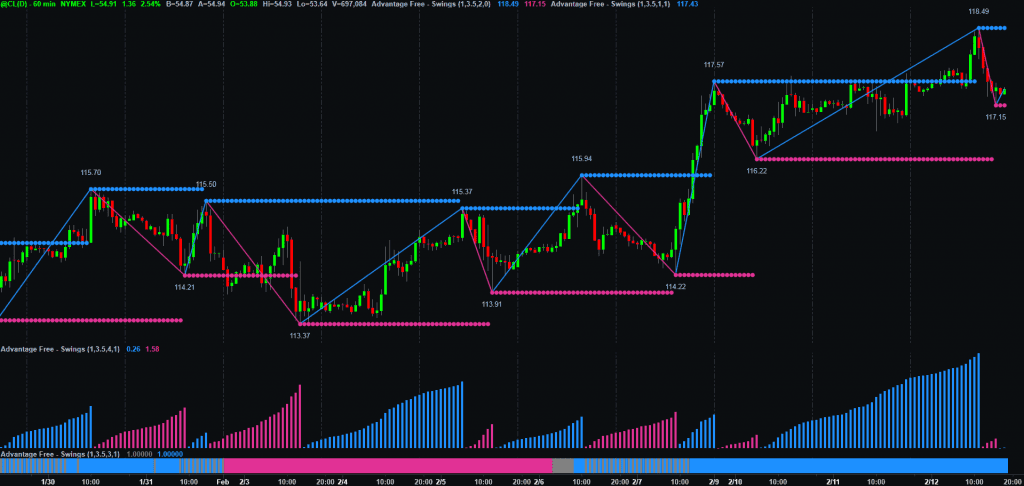

While you should think about not selling now, it doesn’t mean that you shouldn’t buy it as well. The truth is that now is the right time to increase your existing investment, provided that your asset allocation plan permits it. However, you must do it judiciously, after carefully looking at the Tradestation indicators as you would do regularly. For example, those who are under-invested in equities can now bring the mix to the desired level. Another fact to bear in mind is to invest with a vision of long-term profitability. For instance, you can expect pharma, healthcare, and FMCG to boom in the future, even after COVID-19 is dealt with. Investing in them, therefore, would be the right move.

Waiting for correction may not be a great idea

If your current asset allocation plant offers you plenty of room to invest more right now, waiting for correction may not be a good idea. This is because the sharp correction is often followed by an equally sharper rise. Waiting means that you may be deprived of the lower price and have to buy the same investment for more. You won’t really feel good after losing the chance because these come rarely in the market.

Being inactive is perfectly fine

Maybe you don’t have the cash to invest, so sitting around and doing nothing at this time could make you feel apprehensive. Remember that being inactive is perfectly fine and you need not worry even if everyone around seems to be busy buying and selling. If your money is already invested, you can rest assured that it is at work and making you more. Markets are bound to see a gradual recovery and you will earn the advantage of the investments you already have right now.

This too shall pass

Looking at the history of markets, you will realize that there have been crashes before. The reasons varied, from pandemics like COVID-19 to bursting of bubbles, global markets have endured much worse than it is bearing now. But they have always shown resilience and come back stronger. It is just a matter of time and holding on with patience and positivity will keep the markets and investors intact.

The best advice right now is to stay calm and think more than twice before redeeming your investments. Obviously, you would make a mistake if you fall prey to the temptation because things are bound to get better sooner or later. At the same time, make sure that you do not get over-enthusiastic and go overboard with investing. Consider your asset allocation carefully and rely on it for making any investment decisions. Crashes and all-time highs have happened to the markets before and will happen in the future as well. Only the ones who stay strong and judicious will prevail and be prosperous in the long run.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals