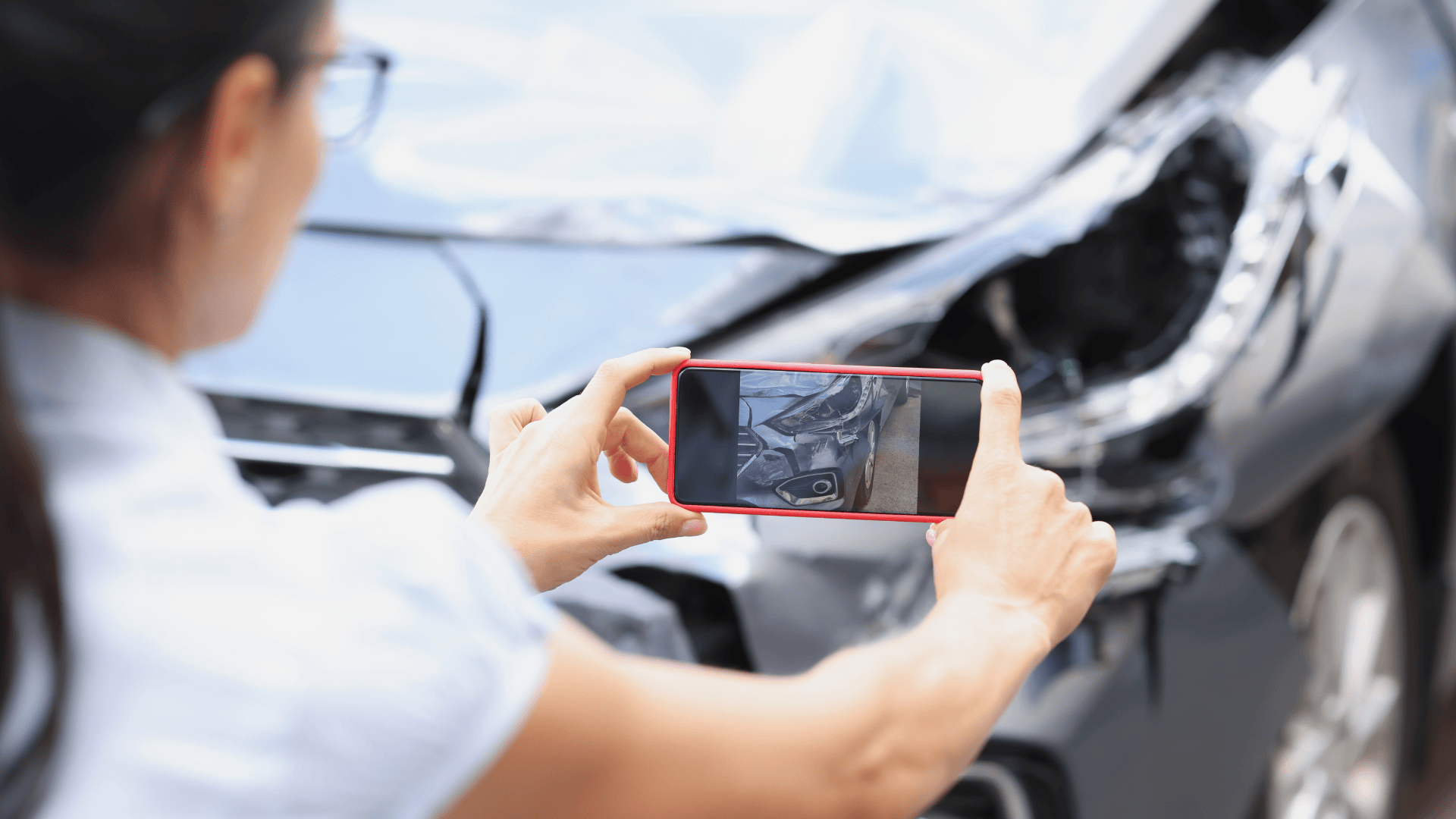

Many Kentuckians work hard to build investments and savings for the future, but sudden life events can put those assets at risk. A single car accident has the potential to threaten personal finances, especially if significant damages or liability concerns arise. Individuals may not realize how one incident could impact their retirement accounts, savings, or other holdings.

Even in straightforward situations, financial stability can be affected by legal claims or unexpected expenses tied to an incident. Those seeking reliable protection for their wealth need to understand how incidents on the road, including those described in various car accidents, may have lasting consequences.

By being informed, local drivers can better prepare and take steps to reduce the financial risks connected with these sudden events. Get practical insight into protecting what you’ve built before a single moment on the road changes everything.

How a Single Car Accident Can Affect Your Investments in Kentucky

A single-vehicle crash in Kentucky can do more than cause physical harm or property loss. It may threaten an individual’s financial stability, expose wealth to potential claims, and lower the overall market value of investment portfolios.

Liability and Financial Exposure

When someone is found responsible for a car accident, they can face lawsuits or claims that go beyond the insurance policy’s limits. In Kentucky, fault in a single-vehicle crash often falls on the driver, which means that personal assets could be at risk if damages are significant.

Many underestimate the financial consequences until legal actions target their personal holdings. For example, retirement savings, stocks, and even real estate assets might be affected if settlement amounts surpass coverage. This creates a situation where years of saving and investment management are jeopardized due to one incident.

Analytics show that insurance may not cover certain damages, especially if negligence, intoxication, or lack of consent for someone else to use the car is involved. Drivers should know their insurance policy details and consider umbrella coverage for additional protection.

Understanding Asset Protection Laws

Kentucky provides some safeguards for specific types of holdings, such as qualified retirement accounts and certain properties. However, these protections are limited. General investment portfolios, savings accounts, and non-qualifying real estate may still be available for creditor claims following a judgment.

It is vital for residents to consult with a financial or legal advisor to understand what shield applies to their situation. Without this planning, even properly managed portfolios could be seized to satisfy obligations from a crash.

Education about Kentucky’s asset protection statutes can help identify gaps and strengths in an individual or family’s financial defense. Asset protection strategies may include trusts, insurance upgrades, or moving non-exempt investments into more protected categories. Familiarize yourself with these laws by reviewing local estate planning resources and retaining proper documentation.

The Impact of Injuries and Damages on Personal Assets

Significant injuries or damages resulting from a single-vehicle collision can carry steep costs. Medical bills, lost income, and long-term care add financial pressure, especially if settlements or judgments aren’t fully paid by insurance.

If injuries occur and liability is established, personal accounts including brokerage and savings could be affected by court-ordered payments. The sale or liquidation of investments to pay for damages can lead to a reduction in market value, missed growth opportunities, and tax liabilities.

In such situations, analytics and forecasting are crucial tools. Reviewing potential losses and the likelihood of substantial claims can guide decisions on insurance, legal strategies, and even consent procedures for allowing others to drive one’s vehicle. Carefully planning and reviewing investment protections is strongly recommended after any major incident, especially in light of recent legal and technological trends affecting vehicle accident litigation in Kentucky.

Strategies to Safeguard Investments After a Car Accident

Protecting financial interests in Kentucky after a car wreck often takes thoughtful preparation. Individuals can minimize risks by understanding their insurance solutions, legal protections, and claim procedures to preserve their holdings and reduce unnecessary losses.

Insurance Coverage Options

In Kentucky, the minimum auto insurance requirements may leave substantial gaps when it comes to protecting investments, as lower coverage can expose personal assets if a claim surpasses policy limits. It’s advisable to review policies frequently to ensure that coverage is adequate, especially if investment accounts or properties exceed market averages.

Key add-ons include:

- Umbrella coverage: This provides additional protection beyond typical liability policies, shielding savings and investments from large court-awarded damages.

- Uninsured/underinsured motorist coverage: Essential to avoid financial gaps left when the other party lacks sufficient insurance.

- Full tort options: Opting for full tort instead of limited tort ensures rights to recover certain damages, potentially securing larger settlements.

Selecting suitable insurance policies helps mitigate risks to any accumulated wealth.

Legal Steps for Asset Protection in Kentucky

Once an accident happens, responding quickly can safeguard investments from claims or judgments. Refrain from making statements about liability at the scene. This reduces the chance of information being used against the asset holder in litigation.

Discuss options with a legal advisor to explore trusts or transfer ownership of specific assets, such as placing holdings in a revocable trust or titling property jointly, to prevent creditors from gaining access. In Kentucky, certain retirement accounts and some home equity may already have protection; knowing what is exempt is essential.

Managing Consent and Avoiding Abuse in Claims

Consent plays a significant role in claim management. Signing broad releases or making offhand statements can result in waiving certain rights or unintentionally granting access to financial records, which may impact investment security. Individuals should request clarity on any documents before signing.

Abuse of the claims process can occur if adjusters push for settlements or try to exploit a lack of education regarding financial and legal safeguards. Always consult with a professional before agreeing to terms. This reduces vulnerability to unfair practices.

Stay informed by regularly reading industry publications and staying current with legal reforms in Kentucky. Understanding current trends, such as those mentioned in the 2025 trends in vehicle accident litigation and how they affect Kentucky drivers, can increase confidence when interacting with insurance or opposing parties.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.