Small business owners who rely on delivery vehicles face real risks every time a driver hits the road in California. A delivery accident can potentially threaten your business assets if you are not properly prepared with the correct insurance and safety measures. Liability issues are often more significant for businesses than for private individuals because claims might target both personal and company assets, making preparation essential. Here’s what you should consider.

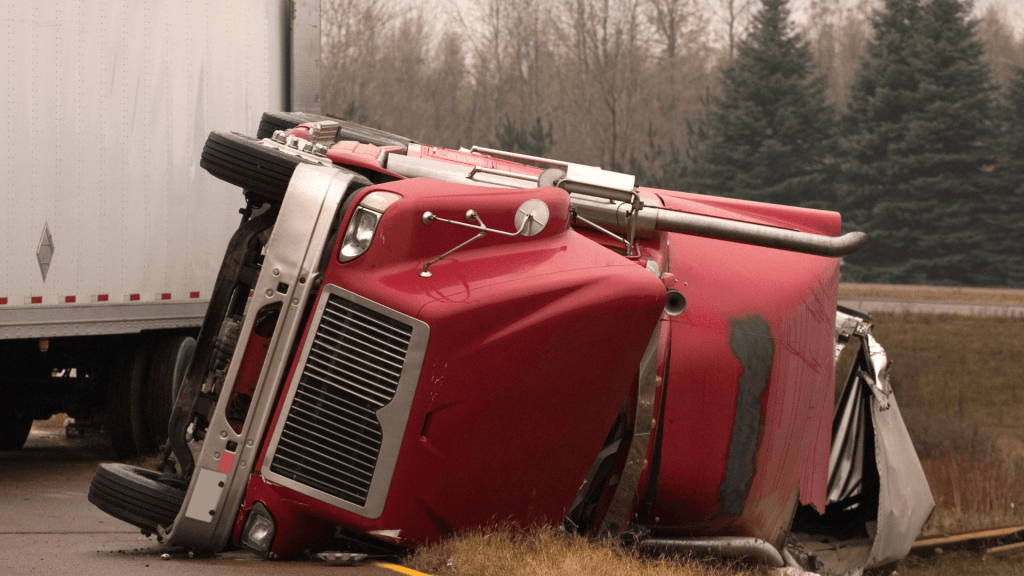

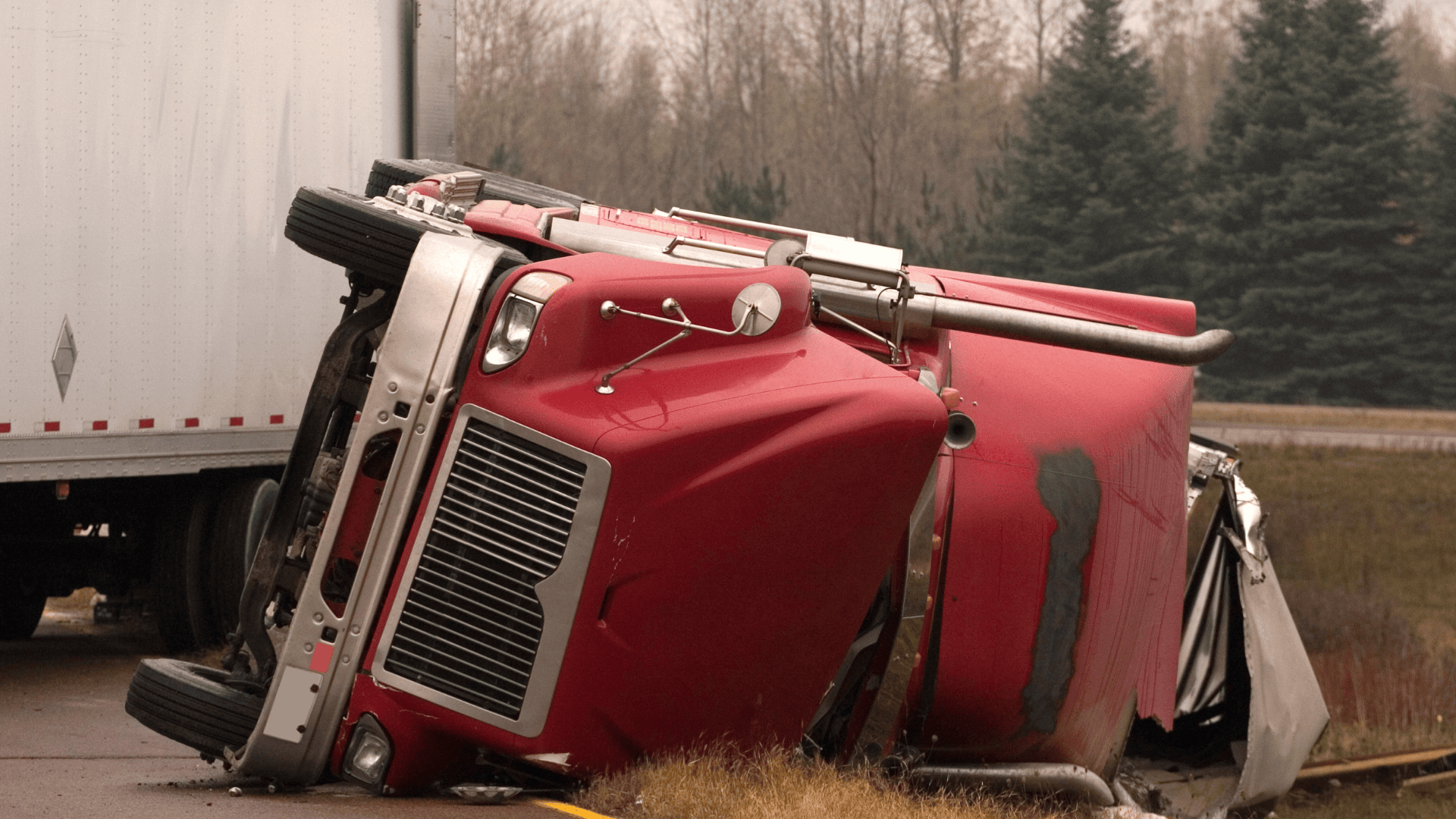

California law places responsibility on employers when accidents occur during work-related tasks, including incidents involving fleet vehicles or large company trucks. Larger companies, such as those that use Amazon delivery trucks, often contend with these risks and may face significant claims after an event on the road. When a catastrophe happens, understanding the financial threats tied to serious truck incidents can be the difference between safeguarding your company’s future and suffering major financial loss.

For anyone who owns or manages a business with delivery vehicles, knowing what’s at stake and how liability could extend beyond insurance is crucial. By understanding the potential consequences of a delivery accident, business owners put themselves in a stronger position to protect their livelihood and overall financial stability.

How a Delivery Accident Can Jeopardize Your California Business Assets

Liability after a delivery crash in California can quickly become a financial nightmare for companies, especially when injuries or major losses occur. Without proper insurance arrangements or awareness of legal duties, business owners could face lawsuits or settlements that directly tap into their company’s resources.

Legal Responsibility and Negligence

California law holds companies potentially answerable if their drivers are at fault during work hours, including both direct employees and, in some instances, independent contractors. If a worker causes harm while performing job tasks, the company could be brought into legal disputes over alleged carelessness.

Firms must demonstrate adequate supervision, screening, and training of their delivery force. Negligence claims often center around whether reasonable measures were taken to prevent harm, such as checking driving records or enforcing safe driving policies. Businesses lacking these routine checks may find themselves liable if a judge or jury decides they failed in their duty of care.

Even hiring practices and background investigations matter. If a company overlooks red flags, it increases the odds their own resources will be at risk in a personal injury lawsuit.

Personal Injury and Property Damage Risks

Delivery incidents often lead to harm not just for other motorists but also for pedestrians or property owners. When large vehicles or trucks are involved, outcomes can include severe physical harm, high hospital expenses, and destroyed property. Victims of these events may submit claims for setbacks such as bodily harm, vehicle repairs, or damage to other possessions.

Truck operators must follow strict service hour regulations, and breaking these rules can make liability even more clear-cut in a court case. Slip and fall events occurring on private or commercial sites during deliveries may also give rise to legal issues; dangerous surfaces or other hazardous conditions could trigger allegations of insufficient care by property possessors or their staff.

Firms exposed to repeated situations where their personnel create risky situations could see not only higher premiums but also payouts from their assets if insurance falls short. Defending against such liability claims typically requires clear documentation and up-to-date insurance coverage.

Types of Damages and Potential Compensation

Individuals impacted by a delivery mishap may seek restitution for a wide array of expenses and hardships. Common types of damages asserted include recovery for medical bills, lost earnings due to missed work, repairs or replacement of property, and physical or mental distress. Legal cases can also seek ongoing payments if long-term care or future wage loss is expected.

A typical settlement can include both straightforward monetary losses (like medical expenses and auto repairs) and more subjective categories such as pain and suffering. The scale of the payout or judgment primarily depends on the seriousness of the injuries and the coverage limits within the business’s insurance policy. For companies, lacking adequate general liability or auto coverage could mean directly paying claimants from company accounts.

Insurers may handle claims up to coverage limits, but costs beyond those numbers may put business holdings at risk.

Protecting Your Business: Legal Strategies and Insurance Solutions

Business owners face real risks if their delivery drivers are involved in collisions or incidents on California roads. Careful legal planning and smart insurance decisions are essential to safeguard property, revenue, and reputation.

Insurance Policies Every Business Should Have

California delivery businesses should maintain multiple types of coverage. At minimum, this includes general liability, commercial auto, and property insurance. General liability shields against injury or property claims from third parties; commercial auto protects vehicles, drivers, and cargo in case of on-the-job accidents.

A Business Owner’s Policy (BOP) bundles several benefits, including coverage for physical assets and loss from interruptions. Product liability can be vital if damaged goods result in third-party claims. For protection against employment-related risks, businesses are advised to maintain workers’ compensation.

Specialty insurance, such as cyber liability or professional indemnity, is also worth considering for businesses handling sensitive information or high-value products. Using a licensed insurance agent or insurance adjuster can help owners identify what is needed for their operation.

Legal Defense Options in Lawsuits

A collision involving a delivery driver can trigger lawsuits from other drivers, pedestrians, or even employees. Rapid response is critical. Retaining a personal injury attorney with experience in traffic law and, ideally, business law is strongly advised as soon as a claim emerges.

Legal strategies might include challenging liability, seeking settlements, or protecting business assets from seizure. Professionals versed in bankruptcy law, consumer protection law, and real estate law may be needed if creditors try to collect. Estate law and intellectual property law become relevant if business assets at risk include patents or trademarks.

While larger firms may have in-house counsel, small businesses should build relationships with trusted attorneys ahead of time. Having contacts in immigration law and family law can also prove valuable, particularly if employees face issues related to their legal status after an accident.

Minimizing Risk and Responding After an Accident

Prevention is the most reliable form of protection. Businesses should adopt strict vehicle maintenance schedules and enforce safe driving protocols for staff. Regular training and review of employment law standards reduce the chance of legal issues.

If an incident occurs, reporting the situation clearly to authorities and insurance representatives is crucial. Promptly gather evidence photos, witness details, statements for use by a fraud examiner or legal team. Notify the insurance company without delay to start the claims process and limit liability.

Maintain accurate business records, especially if renting property or vehicles, as landlord-tenant agreements and real estate matters may impact liability and recovery. By addressing issues quickly and relying on appropriate professionals, a company can minimize damage and expenses after an accident.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.