According to a recent report authored by Greenwich Associates (GA), hedge funds could cut the cost of portfolio analysis-related computing costs by 50% if they were to move these operations to the cloud.

A changing environment

The report, entitled “Cloud Computing for the Buy Side: Moving Beyond the Myths” demonstrates that, far from being a new phenomenon, cloud computing and the technologies that preceded it have been under discussion at Wall Street firms since the early 1990s. Since then, many firms in the financial services sector have adopted variations on cloud computing technology such as software as a service and vendor hosted solutions to replace local installations.

Although the benefits of such a move in terms of increased efficiency and reduced cost were obvious to every firm that looked into moving operations to the cloud, there were some concerns about cloud technology that prevented wider adoption in the finance industry. These concerns, claims the report, have now been addressed, although there is still some uncertainty within the industry that the short term costs of switching to the cloud will be compensated for in terms of the long term benefits.

The budgetary argument

Among the institutional investors that took part in the 2013 Greenwich Associates study, the average technology budget was around the US$5.5 million mark. By comparison, hedge funds spent far more on technology, with an average budget of $7.9 million making them by far the biggest spenders on technology as a group.

Annual technology budgets among the institutional investors taking part in a 2013 Greenwich Associates study averaged USD5.5 million. Hedge funds were the biggest spenders, with annual budgets averaging USD7.9 million. But with budgets holding steady or shrinking, many firms still do not see a guarantee that the long term benefits of switching to the cloud will outweigh the short term costs.

The demand for more and more computing power on the part of hedge funds has been driven by factors such as increasing regulatory certainty, a resurgence of structured products, and a widespread acceptance that many tried-and-trusted investment strategies have changed for good. At the same time, IT budgets have still yet to recover from their pre-crisis levels, and cloud computing could provide a solution to the need for increasing amounts of computing power on a decreasing budget.

Given the potential savings, the contraction of Wall Street IT budgets, improved cloud offerings, and a market that requires more complex calculations to be completed in ever-shortening timeframes with ever-greater accuracy, Greenwich Associates believes the financial service industry needs to embrace cloud technology on a much expanded scale, said Kevin McPartland, head of research at GA’s market structure and technology practice.

Cloud computing: the early days

Although cloud technologies and their predecessors, includinggrid and utility computing, application service provision (ASP), and Software as a Service (SaaS), have been used in some capacity in financial services and other business sectors since the 1990s, the concept of delivering computing resources through a global network dates back as far as the 1960s.

The man chiefly responsible for introducing and developing the idea was computing legend J.C.R. Licklider, who was was one of the main drivers behind the development of ARPANET (Advanced Research Projects Agency Network) in 1969.

His vision for the future of computing – which involved everyone in the world being interconnected and accessing programs and data wherever they were – proved to be remarkably prescient, and sounds a lot like what we now call cloud computing.

Licklider wasn’t alone in having this vision, with computer scientist John McCarthy being thought of by many as the true father of cloud computing. His idea was that computer power could be delivered as a public utility much like water or electricity, and his model seemed a natural progression from the service bureaus which date back to the 1960s.

But although the idea has been kicking around for a while, it wasn’t until the internet started to offer significant bandwidth through technologies such as ISDN, ADSL, and broadband in the 1990s that these ideas could be put into practice.

Salesforce.com changes the game

The real game-changer for businesses was the arrival of Salesforce.com in 1999, a service that pioneered the concept of delivering enterprise applications via a website. It proved to be a successful model, and one that paved the way for an onslaught of similar services, mainly targeted at business.

However, it was only when e-commerce giant Amazon entered the market in 2002 with Amazon Web Services that cloud computing began to enter into a state of relative maturity. This suite of cloud-based services including storage, computation, and even human intelligence via a skills marketplace called the Amazon Mechanical Turk, based on the famous chess-playing ‘robot’ of the 18th century, which was secretly controlled by a human inside the box.

Amazon redrew the cloud computing map in 2006 with its Elastic Compute cloud (EC2) – a commercial web service that enables small companies and individuals to rent computers on which to run their own computer applications. The evolution of web technologies that came to be known as Web 2.0 brought cloud computing into the mainstream, with firms such as Google and Microsoft beginning to offer browser-based enterprise applications such as Google Docs (now re-badged as Google Drive) and Office 365.

Since then, the pace of evolution has been rapid, with the development of high-speed bandwidth, universal software interoperability standards, and the maturing of virtualisation technology.

One thing holding back the tide of cloud computing – particularly in ultra-sensitive industries such as financial services – were concerns about the security of corporate data held in the cloud. To a large extent, these issues have been resolved, although many firms will still opt to keep the most sensitive data within their own company ‘firewall’, which means that there will still be a need for firms to have their own servers.

However, there are plenty of less security-intensive tasks that can benefit hugely from cloud computing technologies – particularly analysis techniques that rely heavily on computational power and storage. Cloud computing makes this a lot cheaper, and enables them to add capacity whenever they need to.

Intel’s vision for the future of cloud in financial services

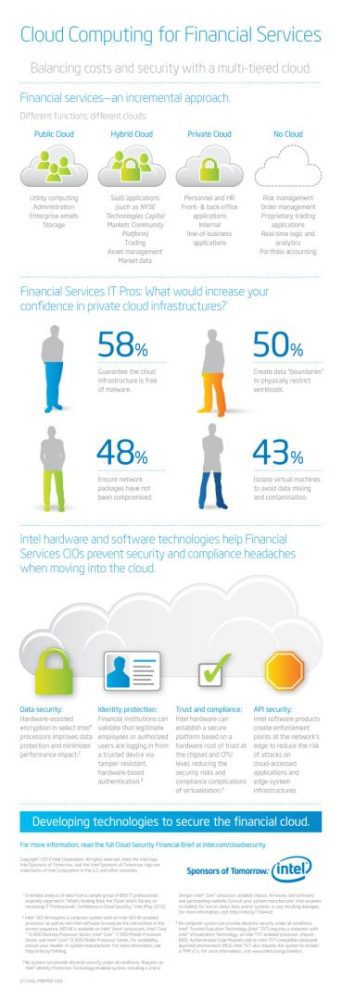

Recently, the chipmaking and cloud computing giant intel produced an infographic highlighting the potential benefits – and concerns – for the financial services industry with regards to cloud computing technologies, which can be viewed below:

I am a writer based in London, specialising in finance, trading, investment, and forex. Aside from the articles and content I write for IntelligentHQ, I also write for euroinvestor.com, and I have also written educational trading and investment guides for various websites including tradingquarter.com. Before specialising in finance, I worked as a writer for various digital marketing firms, specialising in online SEO-friendly content. I grew up in Aberdeen, Scotland, and I have an MA in English Literature from the University of Glasgow and I am a lead musician in a band. You can find me on twitter @pmilne100.