bMAMS uses different statistical methods to demonstrate or prove that our trading systems will perform in a real, unknown trading environment.

One method used is trade reordering- also known as Monte Carlo analysis.

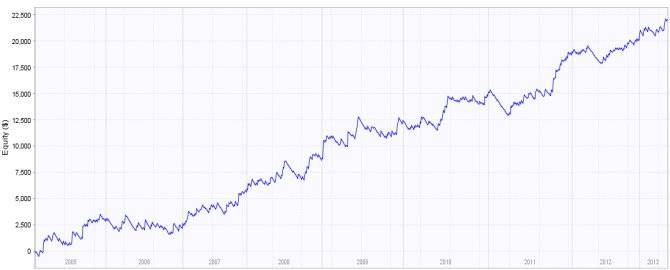

Say we have the following trading system:

A decent system, which generally, over time, trends upwards. It has a win rate of 60% (loses 40% of trades).

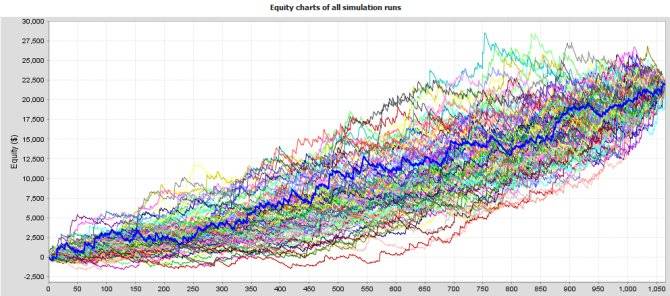

Now we reorder the trades randomly. While we do this many thousands of times the graph below for simplicity shows 100 different trade reorderings:

All the trades begin at the same point (profit of zero) and end at the same profit (because they are the same trades, just in different order).

The thick blue line is the original trading system from the first picture.

Notice how just by changing the order of trades how different the paths from the same beginning to the same end are. Some begin strongly and go worse at the end and others begin poorly but then end strongly- compared to the original blue system.

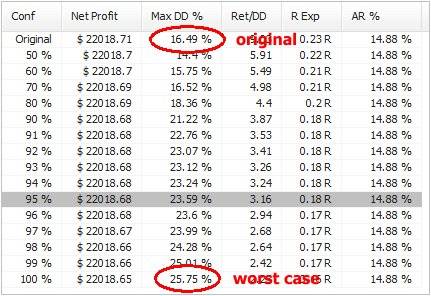

When we judge the outcome of the test, we use numbers not graphs and this is an example statistical summary:

Here the original system is the first line, and down the bottom is the worst drawdown. Notice that net profit remains the same (its the same trades) but the maximum drawdown and return to drawdown gets worst as we go down the table.

The trades ordered to produce their worst possible drawdown are displayed at the bottom line. 100% of all other trade orders have a lower drawdown.

In this case changing the order of the trades could take our system’s 16.49% drawdown and have it reach 25.75% drawdown. This allows us to get a full picture of the potential risks this trading system poses.

The ‘better’ the system the closer the original to the maximum possible drawdown. A better system will also have its drawdown below a larger percentage of systems; in this case the 16.49% drawdown is lower than 70% of all re-ordered systems.

So when bMAMS talks about keeping client funds safe, it isn’t just nice words. We back this up with statistical tests which are at the fundamental core of our work.

We saw in late 2023 a very difficult market which we navigated with exceptionally low drawdown compared to many other financial instruments and funds. This isn’t by accident, but by statistical rigour.

Originally posted on https://www.bmams.com.au/

The post bMAMS: Using maths to make your funds safer – Trade reordering first appeared on trademakers.

The post bMAMS: Using maths to make your funds safer – Trade reordering first appeared on JP Fund Services.

The post bMAMS: Using maths to make your funds safer – Trade reordering appeared first on JP Fund Services.