Facebook recently pulled the ability for users to pay their friends via Messenger, due to its lack of popularity among users in France and UK. Moreover, this fiasco has led the company to drop for now this loose approach to banking.

The feature was very simple and it worked as a common wallet model integrated within the messenger functionality: it allowed users to set up a payment account enabling them to both send and receive money via the app and using the Facebook network system. As it has been seen, the offering didn’t quite take off among the social media users and the company has been ultimately forced to cancel it. Specially reluctant were users from the UK and France, according to the latest Globaldata report.

Precisely a Banking Analyst at GlobalData, Oliver Wintle, has talked about how Facebook incursion has ended in a dead end: “The Facebook messenger functionality got all of the major UK banks on board when it was launched in 2017, but consumer uptake never took off. GlobalData’s 2018 Retail Banking Insight Survey found that 55% of users in France and 71% of users in the UK have never used Instant messaging to complete banking tasks.”

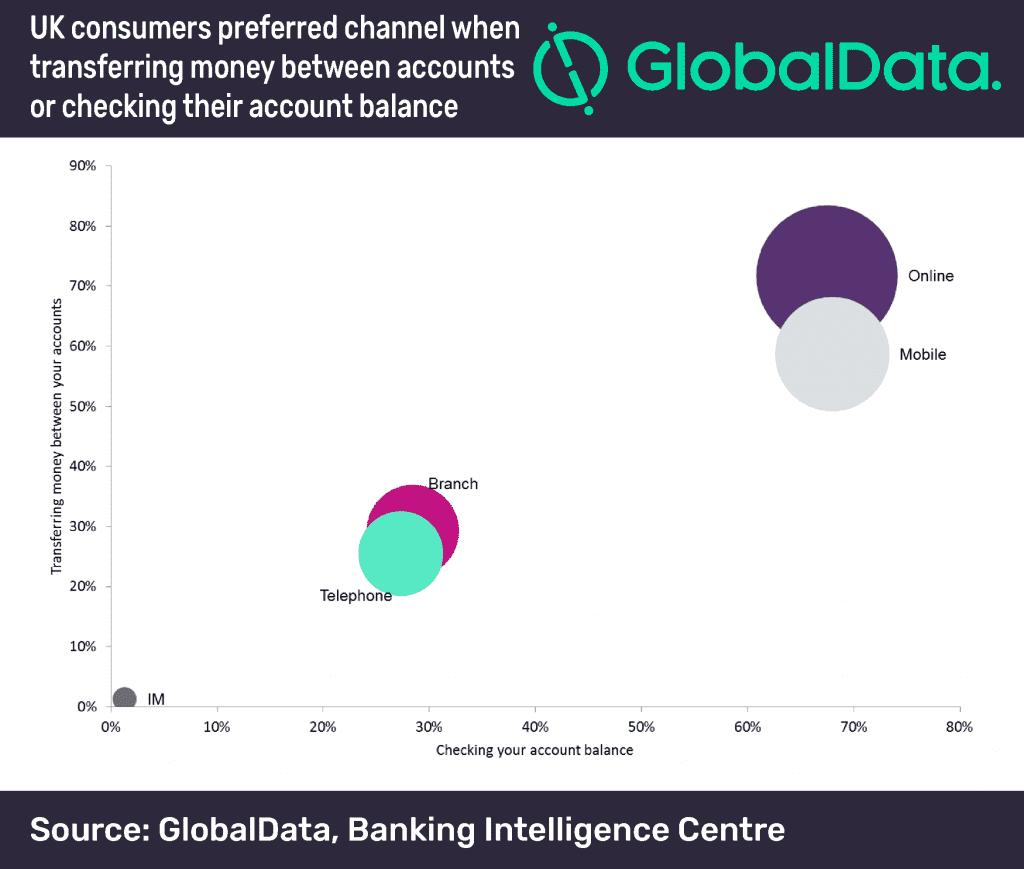

Likewise, the GlobalData’s survey found that users who actively use online banking, at least once a month, state that it is their preferred channel to complete different banking tasks – including checking their balance, paying bills, and depositing cheques.

Mobile banking users also show loyalty in terms of their preferred channel; with mobile banking favoured for conducting activities such as checking their balance, viewing transactions and statements, and transferring money to other people.

Wintle continues, “On paper, banking via Facebook messaging sounds like a useful innovation, but in practice the functionality lags too far behind other channels to drive consumer adoption. With both online and mobile banking allowing users to carry out a wider range of tasks, users do not typically stray far from their banking preferences – something banks must keep in mind when formulating their channel strategy.”

Read More:

best hedge fund managers of all time

best performing hedge funds 10 years

top 10 biggest hedge funds us 2024

richest hedge funds in the world

biggest hedge funds in san francisco

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.