Last week had the US CPI and PPI releases which would give guidance to how the Fed may react in the coming weeks. The CPI showed further inflation slowdown and the PPI also surprised on the lower side.

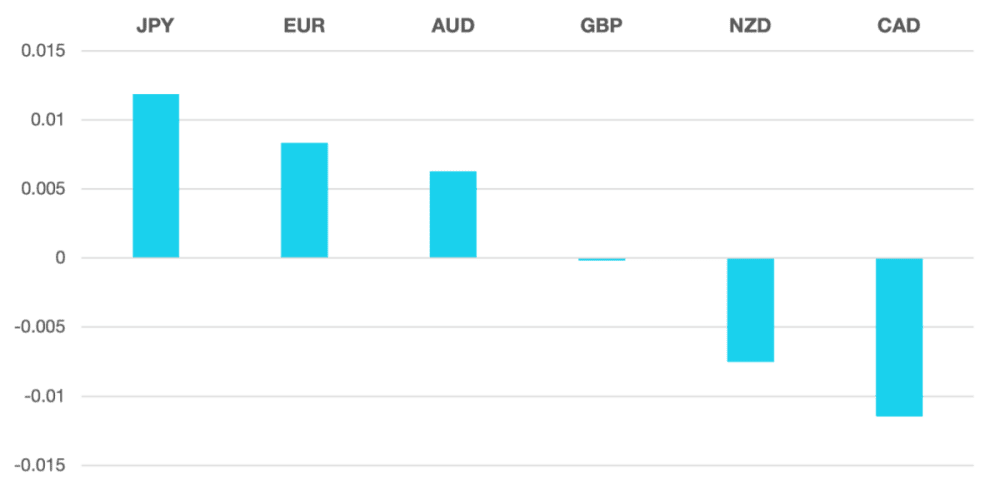

This moved the US Dollar lower through the week, but Friday saw the expected relief rally. DXY lost 0.5% to close around 101.5 having been as low as 100.8 before rebounding.

Euro continues to see positive moves as the ECB has become more hawkish than the Fed. The EUR briefly breaking the 1.10 level and closed the week almost 1% stronger vs the USD.

GBP ended the week flat consolidating the previous week’s gains. GBP traders will be looking towards next week CPI and PMI data which could push the GBP higher.

Commodity currencies had a mixed week. In general risk assets moved higher which helped AUD which gained around 0.75% but NZD was the loose of the week falling 1.2%.

Oil was still riding on the wave of the previous weeks OPEC+ cuts and supply does remain tight. WTI rallied a further 2.8% closing around $82.50.

The week ahead is data heavy especially for inflation numbers. the Eurozone, UK, Canada and New Zealand all have inflation related numbers along with UK PMI and employment numbers.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Are We Reaching Pivot? first appeared on trademakers.

The post Are We Reaching Pivot? first appeared on JP Fund Services.

The post Are We Reaching Pivot? appeared first on JP Fund Services.