The latest Credit Consensus Indicator (CCI) data, a new monthly index of forward-looking credit opinions for the US, UK, and EU industrials has found that EU industrial sentiment has improved in the last few months while UK industrial sentiment has deteriorated in the same amount of time.

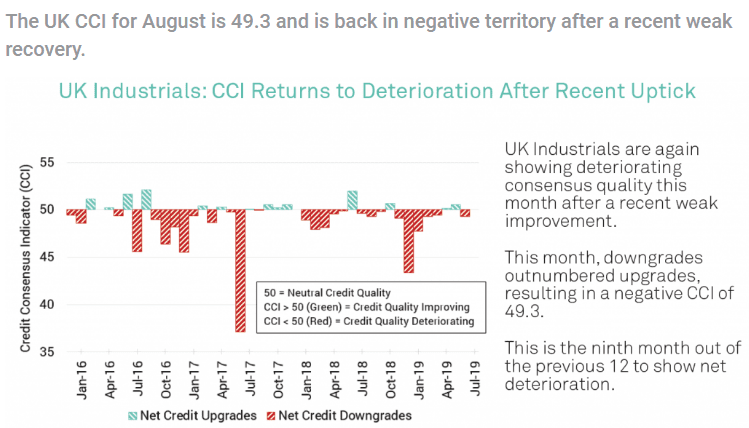

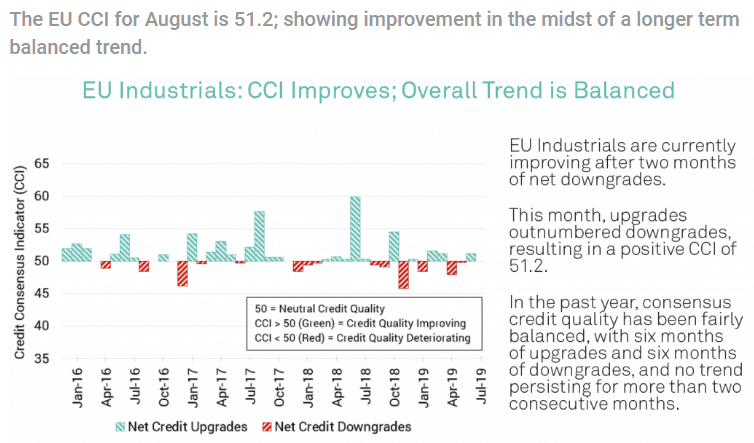

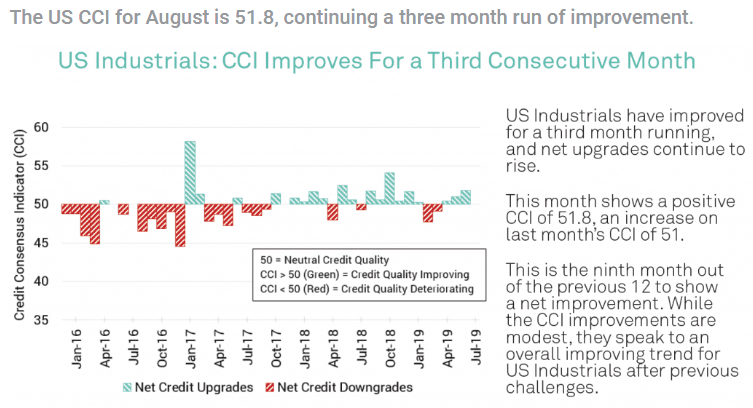

As such, the August CCI data show a return to credit deterioration for UK industrials from 50.3 to 49.3, but credit improvement for EU industrials has gone up from 50.8 to 51.2, and that US industrials maintain a positive trend, the score was 51.8 compared to 50.8 last month.

The index has been carried out by Credit Benchmark, the financial analytics firm that assesses credit risk using bank-sourced data and is similar to the IHS Markit PMIs, the CCI data is drawn from more than 800,000 contributed credit observations and tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month; below 50 means deterioration and above 50 means improvement.

The August CCI data show a return to credit deterioration for UK industrials but credit improvement for EU industrials, and that US industrials maintain a positive trend. Specifically, the score is 49.3 for UK industrials, compared to 50.3 last month, marking the ninth month out of the last 12 to show net deterioration. For EU industrials, the score is 51.2 compared to 50.8 last month. For the US, meanwhile, the score was 51.8 compared to 50.8 last month. This is the third straight month of improvement and makes the ninth month out of the last 12 to show improvement. You can see this in the charts below.

All of this comes amid ongoing economic uncertainty. Germany’s Bundesbank said that the German economy was likely to go in recession in Q3, given recent drops in exports and industrial production. Data from Q2 show the German economy shrank by 0.1%, even as the overall Eurozone’s GDP grew by 0.2%. The UK economy shrank by 0.2%, for the first time in about seven years. There are signs of trouble elsewhere in Europe as well as in the US. Central banks are cutting rates or planning to do so, and then there are the trade disputes.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals