As political uncertainty continues, fears that fundraising opportunities will worsen in the Private Equity industry have increased, according to the latest annual industry report from IQ-EQ, a global investor services provider. The research, based on a survey of over 120 fund professionals globally, shows that despite the industry remaining resilient overall, fund managers will need to prepare for an increasingly competitive environment.

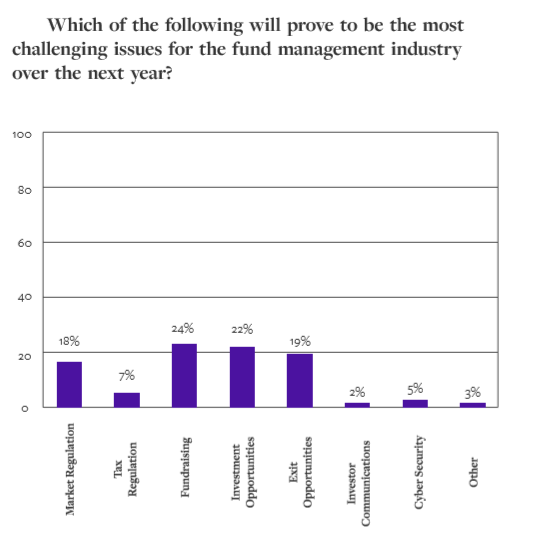

Last year half of all money raised was directed to the 50 largest funds in the industry, suggesting that competition to attract capital will be fierce, particularly for the smaller players. This is reflected in concerns from fund managers around fundraising as 30% of respondents reported that they felt fundraising would becoming more challenging in 2019 compared with 19% the year before. Similar sentiment is also seen in managers’ views on what they predict to be the most challenging issues facing the industry in 2019. Both fundraising and investment opportunities held the top spot, suggesting that stiff competition in the UK private equity market will continue.

Speaking at IQ-EQ’s recent thought leadership event, following the publication of these results, Justin Partington, Group Head of Funds, said: “The UK is still a promising sector for long-term private equity investing. Although confidence in the market is slightly lower compared with previous years, and investors are becoming increasingly cautious, there is still an opportunity for firms to stand out. It is clear from the survey findings that building and developing strong investor relationships will need to become a priority. Improving this through class-leading transparent financial reporting and access to portfolio data will put managers in good stead to gain that crucial edge in an unpredictable environment.”

Professor Richard Taffler of Warwick Business School, also speaking at the event, commented on the results from the perspective of the investor. Taffler, who focuses on the role of emotions to explain investor and market behaviour also highlighted the importance of investor relations. He commented: “To invest is to trust and investors will stay with fund managers where this has been built. Investment decisions are inherently emotional and managers need to understand this both in dealing with their clients and the uncertain environment more generally.”

Interestingly, the data shows that the issue of investor communications has slipped under the radar for most fund managers. Only 2% of respondents mentioned this was a focus for 2019, suggesting the industry is underestimating the importance this holds during times of uncertainty.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.