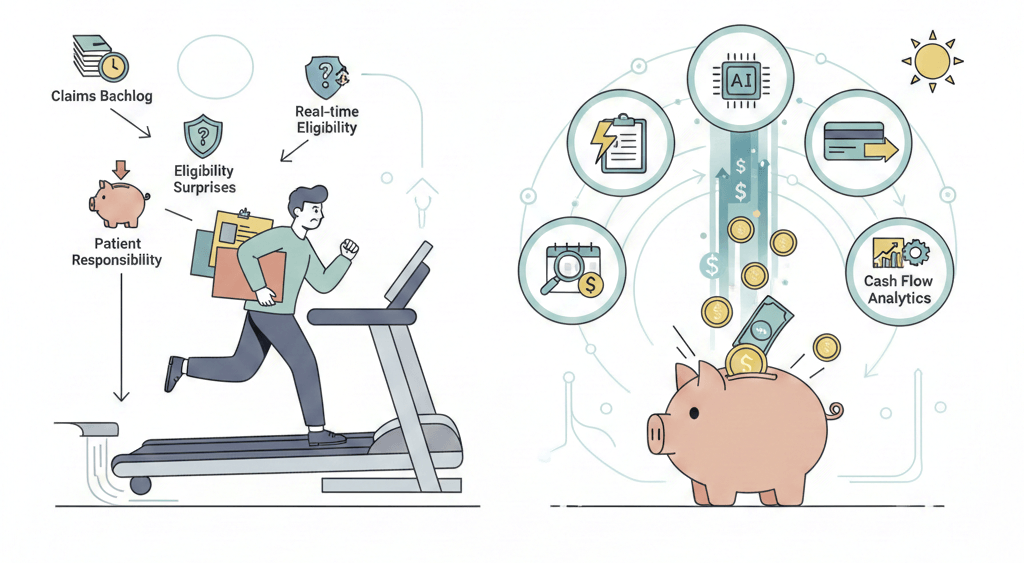

Keeping a small healthcare practice financially healthy can feel like running on a treadmill that slowly speeds up every month. Claims backlog, eligibility surprises, and rising patient responsibility all hit cash flow simultaneously.

The good news is that modern fintech tools can make a real difference without requiring a huge IT department or giant budget. Here are four practical fixes that small practices can roll out to speed up cash conversion and reduce the day to day stress of revenue cycle management.

1. AI Claim Scrubbing That Reduces Errors Before Submission

AI powered claim scrubbing tools are getting better each year at catching coding mistakes, mismatched modifiers, and missing documentation before a claim ever leaves the building. They do more than run static rules. They learn from past denied claims and patterns across specialties. This means fewer repeat errors and faster payouts.

Insights from platforms highlighted by Business Insider show that many of the fastest growing healthcare startups are now offering AI assisted RCM tools that can slot into existing workflows. For a small practice, a good scrubbing tool should be easy to configure, integrate with the EHR, and present every flag with a clear explanation rather than a cryptic code.

2. RPA for Charge Capture and 835 Posting

Robotic process automation helps staff avoid repetitive clicks that drain hours from the work week. Charge capture is an ideal fit because it often depends on the same structured steps. RPA bots can pull encounters, check for missing data, and route drafts for approval. They can also post 835 remittances into the practice management system and flag exceptions for manual review.

One way to place these tools on solid footing is to pair automation with strong human oversight. Staff who understand coding fundamentals catch the nuanced exceptions that automation can miss.

This is where training helps. Many teams sharpen these skills at South Texas Vocational Technical Institute which offers practical instruction in medical billing and coding through its medical billing and coding program. Having people who can supervise RPA workflows keeps the practice safe and compliant while still gaining the efficiency of automation.

A few quick advantages of RPA for small practices:

- Consistent capture of required encounter details

- Faster remittance posting with fewer keystrokes

- Clearer identification of denial trends for follow up

3. Real Time Eligibility APIs That Prevent Eligibility Surprises

Nothing slows down cash flow like discovering a patient was not eligible after the claim returns. Real time eligibility APIs solve this by checking benefits before the encounter. Instead of navigation fatigue through multiple payer portals, staff can get copay, deductible, and plan status responses in seconds inside their usual software.

These tools are highlighted by revenue cycle trend reports such as those shared by LinkedIn industry analysts. What makes them especially valuable for small practices is the immediate reduction in downstream corrections. When eligibility is confirmed before care, clean claims go out faster and fewer reworks eat up staff time.

4. Patient Financing Paired With Upfront Cost Estimates

As patient responsibility grows, so does the risk of delayed or incomplete payments. Fintech driven payment tools that offer upfront estimates and transparent financing options help patients understand their costs and choose a manageable plan.

Cost estimator APIs use payer contracts and eligibility responses to generate realistic estimates within seconds. When paired with payment plans, they create a smooth path from service to payment without pressure or confusion. Practices benefit because the payment timeline becomes more predictable and far less reliant on collections.

Making These Tools Work in the Real World

Before choosing vendors, small practices should review data security, contract length, interoperability, and service level terms. ROI benchmarks worth checking include reduction in days in AR, denial rate changes, and staff hours saved. Change management is also essential. Start with a pilot group, collect feedback, and avoid rolling out everything at once.

These four fintech fixes give practices practical ways to speed up cash conversion and reduce administrative strain. With the right mix of automation, training, and patient engagement, even small teams can keep their cash flow steady while delivering great care.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.