Introduction

The stock analysis scene has experienced an amazing surge of innovative offerings, each declaring its power to change the way you analyze your investment and reach your financial goals. It can be overwhelming to choose which one will actually do what it says on the packaging and give you a return on your investment with so many choices out there.

To help you in making the best pick, our experts have sifted through numerous Stock Analysis options and also worked out for the best 8 stock analysis products (2025). In this detailed guide, we’ll cover what features you need, who offers accurate data and how much everything costs (plus our first hand experience using dozens of investing tools).You’ll have the inside scoop on choosing tools that will actually make you more productive and help you succeed with stock market analysis.

Website List

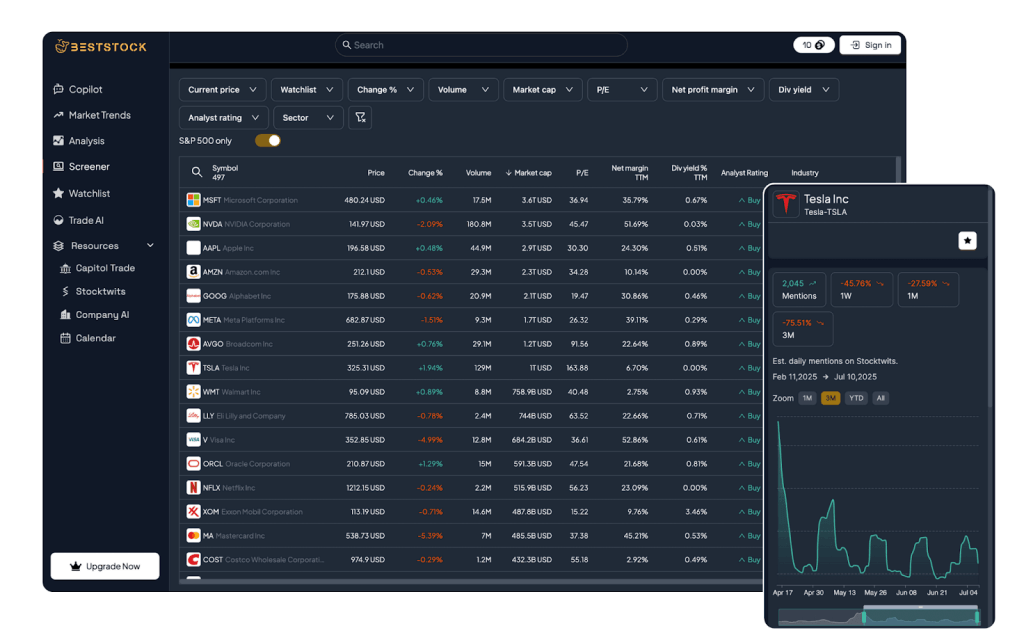

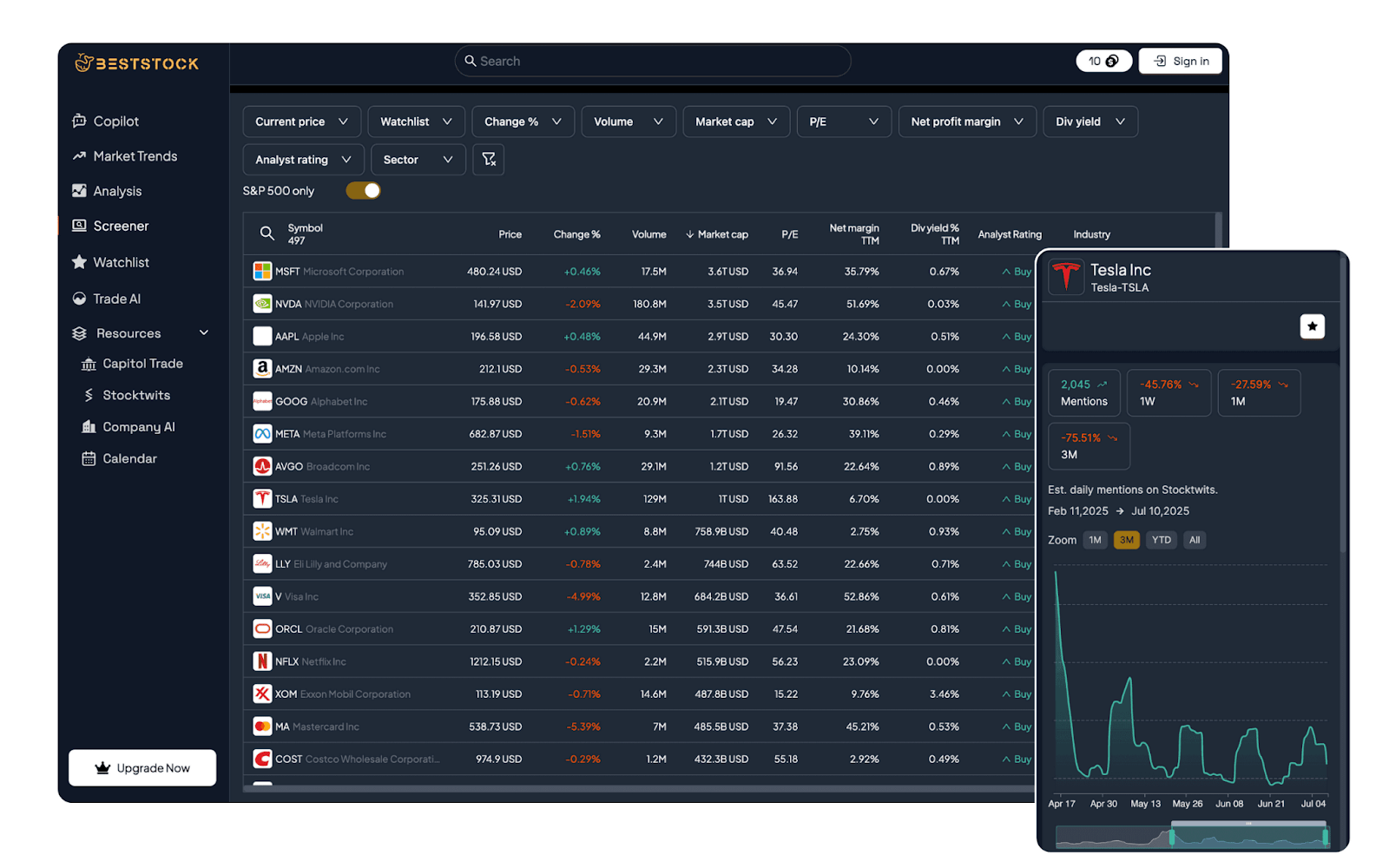

1. BestStock AI

What is BestStock AI

BestStock AI is a artificial-intelligence driven stock analysis service, with an objective to bring clean and credible market data and investing ideas readily available to investors, professionals at finance. It is supposed to calculate FOR you and therefore should have no data input other than what it asks for in the manner that the program allows. BestStock AI, providing all the corporate financial intelligence and artificial intelligence produced market insights With BestStock AI access to most current information in connection with decision-making investment. It also has stock average calculator that combines stocks multiple fills and considers commissions and splits, to come out with its past true average price and at what price you need the stock to achieve on remaining shares in order to break even.

Features

- AI-financial analysis that 80 makes data processing for actionable knowledge as simple as preparing a cup of tea.

- Deep corporate financial intelligence including US stock financials and earnings transcripts

- Both daily AI-driven insights and weekly curated research to facilitate smarter investment decisions

- Enhanced statistical, financial, and business analysis options with additional new data visualization tools

- Simple interface that improves the research process for professional or long-term investors

Pros and Cons

Pros:

- Machine learning-based finance analysis automate data processing to help you take actionable decisions

- Access to US stock financials and earnings transcripts

- Curated research improves long-term investors’ decision-making

- Easy- Use design make it a user friendly experience

Cons:

- Possible increased charges for premium features vs. rivals

- Mobile app could be missing some features found in the desktop version

- Limited ability to access market data and analysis tools offline

2. RockFlow

What is RockFlow

RockFlow is a first of its kind AI based fintech platform that streamlines the investment process and makes it efficient, accessible and fun for everyone. Utilizing cutting-edge algorithms and data analytics, RockFlow’s virtual assistant, Bobby AI, facilitates the creation of segmented investment portfolios, execute trades and spotting market trends as they develop. Packed with tools that simplify trading and managing trades, RockFlow helps new and experienced investors make intelligent decisions and plan their strategies with ease.

Features

- AI power portfolios that are easy to both invest in and avoid decision fatigue

- Live market analysis with 1000 streams of data so you can make smart trades

- 24/7 AI trading that will never let you miss any market opportunity

- Intelligent risk management that surfaces trends and alerts you to potential threats to your investments

- Trade Italian traders with a Network of the best and focus on your performance.

Pros and Cons

Pros:

- Portfolio management that draws on artificial intelligence to make investing easier

- Have $1000 real-time streaming data to make informed decisions

- Powerful trading and risk management features for active traders

- Capability of reaching out to top traders for optimized trading strategies

Cons:

- Some users may lose touch with the market’s human nuances if they rely exclusively on AI

- Limited fine-tuning or selections for particular trading strategies and styles

- Potential difficulty for users who are not AI tool friendly to adapt to the technology

3. Stockpulse

What is Stockpulse

Stockpulse is the first high end processing service conveying social media and extracting market-moving sentiment indications for financial institutions using deep learning algorithms and big data mining. By tracking online chats, it assists clients such as Deutsche Börse AG, Moodys and Refinitiv in making better trades, doing deeper market analysis and adhering to regulatory requirements. And while others have written more analytic code, and data scientists here at CloudQuant can certainly improve on that if they wish, the real value is in understanding what to do with English language Tweets to make better financial decisions across sentiment.

Features

- Sophisticated AI sentiment analysis for making efficient and more informed financial decisions

- Real-time social media monitoring for market manipulation and fraud to comply with regulations

- 24/7 news coverage focusing on actionable research information and insights for increased market analysis and risk assessment.committe .

- Easy integration with existing trading platforms to increase operational efficiencies

- Enormous help to financial institutions for incorporating social media trends in their investment decisions

Pros and Cons

Pros:

- Cutting-edge AI technology delivers real-time social media insights for informed investment decisions

- Improves compliance and market integrity by detecting manipulation of markets

- Provides succinct daily commentary to assist with both market analysis and risk management

- Effortless incorporation into current financial workflows for a hassle-free operation

Cons:

- May take significant funding to fully develop and be practised at larger institutions

- Reliance on social media data could introduce bias, cause inaccuracies in sentiment analysis

- Dependency on online could create disadvantageous transfer pricing decisions in offline mode or in low-connection mode.

4. Transparently

What is Transparently

Transparently AI is a pioneering AI platform to detect financial misstatements for accounting fraud and manipulation which otherwise fit within the rules. Its main function is to increase the transparency and trust of the international market by assisting users (e.g. portfolio managers) with the most relevant financial risk and vulnerability alerts. With the help of its Risk Engine powered by AI and forensic accounting assistant GenAI – Luca, it enables people to easily address some issues or take unprejudiced decisions.

Features

- Advanced AI technology developed to identify accounting manipulation and fraud in corporate financial statements

- Risk Engine powered by AI that provides fast identification of potential financial risk for better decision making

- The revolutionary GenAI forensic accounting assistant Luca sheds light on financial soft spots

- Is equipped with analytic tools to examine manipulation of a business and abnormal movement in inventory

- Impartial and transparent delivery of information to domestic and global markets downstream

Pros and Cons

Pros:

- Cutting-edge AI technology serves to bring transparency to financial markets

- Risk engine powered by artificial intelligence for instant financial risk judgments

- Revolutionary GenAI forensic accounting assistant provides in-depth practice on weaknesses

- Independent report allows clients to make an informed investment decision

Cons:

- Implementation can be time-consuming and costly

- Dependence on algorithms might miss out on the subjective, human judgment

- Not a lot of information about mobile access and app features

5. AlphaInsider

What is AlphaInsider

AlphaInsider is a trading strategy marketplace based on intelligent designs to allow consumers of stock and options trading algorithms to buy, sell, and share the many different methods that are reported. Its primary function is to open access to profitable trading methods to any individual regardless of their experience, who wants improved investment performance. Through collaboration and knowledge sharing, AlphaInsider enables users to gain the confidence to trade effectively and maximize their investment potential.

Features

- Very easy to use with an intuitive user interface for simple layout editing and ultimate effects control and great experience.

- Live analytics and reporting to make decisions based on data

- Scaleble enterprise-level architecture to support your growing business requirements

- Excellent collaboration functions to encourage teamwork and ease of communication

- Extensive training and documentation to make a successful deployment

Pros and Cons

Pros:

- Insider-focused edge: Aggregates Form 4 buys/sells, option grants, and 10b5-1 plans to surface conviction signals and governance red flags.

- Strong filtering and anomaly detection: Filter by role, transaction size, ownership change, sector/industry; heatmaps/clustering flag anomalous activities.

- Contextual performance analysis: Post-trade return studies, sector/market baselines, and insider hit-rate statistics serve to quantify signal strength.

- Well-timed workflows: Real-time alerts, watchlists, and lockup/blackout calendars enhance monitoring and preparation for execution.

- Integrations and ease of use: CSV/API exports, alerts (even sent to your email/Slack/webhook) to let you react as needed, clean dashboards for research and automation.

Cons:

- Signal noise and ambiguity: Most insider trades represent diversification, taxes, liquidity or pre-set 10b5-1 schedules – weak as individual buy/sell signals.

- Coverage and latency limitations: Filing delays, amendments, heavy U.S. focus; thinner small-cap and international coverage vs other news wire platforms.

- Narrower depth beyond insiders: Weaker on deep fundamentals, alternative data and premium news than all-in-one research terminals.

- Learning curve and context needs: Must know rules from inside, what type of roles fits what, Bharathnatyam history else meanings can be lost.

- Pricing tiers: Advanced filters, more history and API access are frequently available on the higher-priced plans, making them not as good of a value for casual users.

6. Tickeron

What is Tickeron

Tickeron is a financial technology, AI-platform built to help investors make more informed trading decisions throughout the stock market. Its primary focus is to give users current market data, AI powered predictions and powerful charting – aiding beginners and experienced traders in making informed decisions. Through the integration of advanced technology and intuitive user-friendly features, Tickeron wants to optimize investing strategies and results.

Features

- Intuitive interface has been organized so you can quickly access all of its resources.

- In-depth data analytics in real time for decision-making and strategic insights

- Scalable solutions that will continue to meet your business requirements and demands.

- Integrated training material, provided to enable your team for success

- Powerful collaboration tools to virtually bring together your team and help drive better communication across departments

Pros and Cons

Pros:

- A sturdy performance machine that doesn’t crack under pressure

- Wide array of capabilities to meet a variety of user requirements

- Responsive, informative customer support staff

- Affordable pricing options available with different plans

Cons:

- May take a long time to learn some advanced features

- Few customized options beyond normal production to accommodate specialized needs

- Possible slowdowns during peak hours

7. AAII

What is AAII

AAII (the American Association of Individual Investors) is a non-profit organization dedicated to providing individual investors with the resources and education they need. It primarily functions as a means of affording members with resources, research and information to make well-considered investments; thereby allowing for a better comprehension of the stock market and personal finance. Through a variety of off-line and online resources, including our website, AAII.com, we aim to provide you with the tools and analysis to make smart investment decisions and build a fulfilling lifelong relationship with their investments.

Features

- More secure way to ensure user privacy and data integrity

- Intuitive interface that provides a simple, easy navigation experience

- Comprehensive material for immediate troubleshooting and guidance

- Multi browser support for cross platform compatibility

- Ongoing performance enhancements to improve user experience and productivity

Pros and Cons

Pros:

- JavaScript and cookie support is encouraged for this site to function optimally

- Clearly explains the possible access problems

- Provides troubleshooting and recovery resources

Cons:

- Could annoy readers who unexpectedly run into wall access

- Users must change browser settings, which might discourage the less tech-savvy

- Limited access by users with restricted privacy settings or browser addons

8. Earnings Whispers

What is Earnings Whispers

Earnings Whispers is the only provider of real, professional whisper numbers for professional traders and investors – the most reliable earnings expectation availabe anywhere. Its primary goal is provide investors with the most relevant earnings information collected from over 3000 analysts and 7000 stocks. Earnings Whispers: This service provides users the tools to evaluate and form their own opinion of the market sentiment or trend.

Features

- Earnings sentiment analysis to determine interest and trending sentiment behind your favorite stocks.

- Economical reminders when other stocks are in your ideal buy (“Great quotation!” – you.

- Headline Reading ease reporting with more detailed Discussion Tracking of earnings related conversations

- Earning reports with the most important information and analyst reactions from Wall Street

- Easy to use interface designed for quick navigation to important information

Pros and Cons

Pros:

- Offers timely reporting of earnings sentiment for investors

- Filters companies by meeting minimum liquidity levels, assisting in investment decision making

- Provides an extensive list of recent and upcoming positive earnings

- Discusses earnings, bringing together a diverse group of qualified investors

Cons:

- The amount of customization for tracking individual stocks or sectors is a bit limited

- Could need updating often to keep current with rapidly changing market conditions

- Interface may not be as user-friendly for complex data sets

Key Takeaways

The best stock analysis method for you may vary, depending on your investment goals and risk tolerance as well as whether you’re a day trader or long-term investor.

- Complacent investors should not rely too much on prior returns or up-market trends but rather see the essence from both perspectives.

- Integration ability with financial news feeds, trading platforms and analytical software’s are definitely things you will need to like.

- UX and the accessibility of analytics tools are very important to achieve mass adoption, particularly amongst new investors who might be frightened by complex interfaces.

- The timely updates and constant enhancement in the stock analysis tools reflect dedication for bringing in recent market data and analytics to provide better user experience.

- Security and regulation: given the sensitive nature of financial information, It’s important to ensure that your broker has sufficient security measures in place when you opt for stock trading online.

- Community support and the quality of educational resources can be a game-changer to your stock analysis experience by giving you plenty of input and guidance whether you are a newbie or an experienced investor.

Conclusion

In conclusion So there you have it, our comprehensive overview of the best 8 stock analysis solutions all out there doing their thing. The key to success here is knowing what you are looking for in an investing platform, and finding the one that has the right mix of tools, user-friendliness and price point in relation to your own specific goals.

Whether you are a first-time investor or an experienced trader, these solutions provide best-in-class options for carrying out the trades. Each platform has special strengths and caters to all types of investors, from day traders to retirees.

These considerations should be something you base your own exploration on, but in the end try everything out to figure out what really works for you. The future of stock analysis is bright, and choosing the right solution today can provide you with the confidence to act on information that represents success in years. Get in there, check them out and elevate your investing game!

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.