Stop overpaying for residential property. Commercial real estate offers superior returns through triple-net leases, where tenants cover your taxes and maintenance. We break down the four main CRE types and the specific investment strategies that generate stable, long-term cash flow without the landlord headaches.

Commercial Real Estate (CRE) offers a vast and diverse field of investment opportunities, each with its unique set of challenges and rewards. Whether you’re a seasoned investor or just starting to explore this market, understanding the different types of commercial properties, lease structures, and investment strategies can provide valuable insights into how you might benefit from this lucrative sector.

Commercial real estate (CRE) isn’t just about big buildings or office towers—it’s a global asset class with serious scale and significance. In 2024, the global commercial real estate market was valued at approximately US $1,358 billion (i.e., US$1.36 trillion) and is projected to grow to about US $1,915 billion by 2030, at a compound annual growth rate (CAGR) of around 6.1%.

What is commercial real estate (CRE)?

Commercial real estate (CRE) refers to properties that are used for business purposes instead of being lived in. These properties are typically leased out to businesses, which generate income through rent or business operations. CRE can range from a small shop to huge industrial buildings. The main thing that sets commercial properties apart is that they are meant to make money, either by renting out space to businesses or by increasing in value over time.

The world of CRE involves various activities like constructing, marketing, managing, and leasing properties for business use. Lots of industries rely on CRE, including retail, manufacturing, and healthcare.

Types of commercial real estate

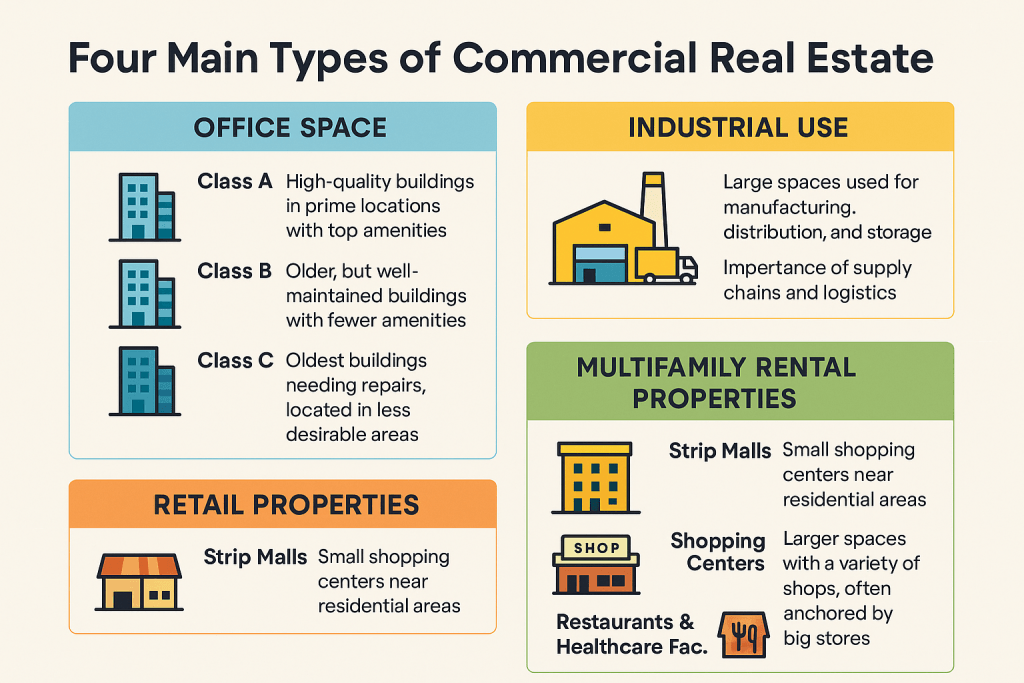

Understanding the types of commercial properties is essential for anyone thinking about investing in CRE. The commercial real estate market is broad, but it can be broken down into four main categories:

1. Office space

Office spaces are the most well-known type of commercial real estate. These buildings are used for work purposes, whether it’s for small businesses or large corporations. The properties can range from a small office building to huge skyscrapers.

Subtypes of Office Space:

- Class A: High-quality buildings in prime areas, with the best facilities and modern infrastructure.

- Class B: Older buildings, still in good condition but with fewer amenities than Class A.

- Class C: The oldest, typically needing a lot of repairs and often located in less desirable areas.

2. Industrial use

Industrial real estate is used for manufacturing, distribution, and storage purposes. These spaces are usually large and designed to accommodate machinery, goods, or even large-scale production lines. They’re important for supply chains, logistics, and other industries.

3. Multifamily rental properties

Multifamily properties have multiple units, like apartment buildings. In the world of CRE, multifamily real estate is considered commercial if the property has more than four units. These are often rented out to tenants for long-term living.

4. Retail properties

Retail spaces are used by businesses that sell products or services to the public. These properties can range from small retail shops to large shopping malls. Retail spaces are often leased to restaurants, clothing stores, supermarkets, and more.

Subtypes of retail properties:

- Strip malls: Small shopping centres with a variety of stores, usually found near residential areas.

- Shopping centres: Larger spaces with a broader range of shops, often anchored by a big department store.

- Restaurants and healthcare facilities: Restaurants and medical offices also fall under the retail category.

Distinguishing commercial from residential real estate

The main difference between commercial and residential real estate is their purpose:

- Residential properties: These are buildings where people live, like houses, apartments, or townhouses.

- Commercial properties: These are used for business purposes, such as offices, retail stores, or warehouses.

Commercial lease agreements

One of the most common ways for businesses to get space is by leasing commercial property. Unlike residential leases, which are short-term (usually month-to-month or one year), commercial leases are typically longer, often lasting five to ten years.

Types of commercial leases

- Single net lease: The tenant is responsible for paying property taxes.

- Double net lease (NN): The tenant is responsible for property taxes and insurance.

- Triple net lease (NNN): The tenant is responsible for property taxes, insurance, and maintenance costs.

- Gross lease: The tenant only pays rent, and the landlord covers taxes, insurance, and maintenance costs.

Managing commercial real estate

Owning commercial property means you need to manage it well, whether you do it yourself or hire a management company. Proper management includes keeping the property in good condition, managing tenants, and keeping costs low.

Strategies for effective property management

- Regular maintenance: Keeping the property in good shape is key for retaining tenants and maintaining its value.

- Tenant retention: Building long-term relationships with tenants can help reduce turnover and keep your property stable.

- Market research: Understanding the local market and adjusting rent to match demand is important for staying competitive.

Profit strategies in commercial real estate investment

Investing in CRE can be done in two ways: direct investment and indirect investment.

1. Direct investment

Direct investment involves buying a property and making money by leasing it out or selling it for a profit. This is best for high-net-worth individuals or anyone with enough capital and experience. While the rewards can be big, the risks are also high.

2. Indirect investment

For those who want to get exposure to CRE without actually owning property, options like Real Estate Investment Trusts (REITs) and Exchange-Traded Funds (ETFs) offer a way to invest in CRE stocks or funds. These options are more passive and don’t require as much capital.

Benefits of investing in commercial real estate

There are several advantages to investing in CRE:

- Stable cash flow: Long-term leases with tenants can provide a consistent cash flow.

- Capital appreciation: Over time, commercial properties can increase in value, providing a solid return.

- Diversification: Commercial real estate can add diversity to your investment portfolio, helping to balance other risks.

- Hedge against inflation: As property values rise, so do rents, which can protect against inflation.

Challenges in commercial real estate investment

Although CRE can be profitable, it does come with its challenges:

- High capital requirements: Commercial properties are expensive, and securing financing can be tough.

- Management complexity: Managing commercial properties can be complicated, especially when you have many tenants or a large building.

- Economic sensitivity: CRE is often affected by the economy. Economic downturns can lead to vacancies or reduced rental income.

- Tenant turnover: High turnover rates can be costly, especially if the space needs extensive renovations for new tenants.

Future trends in commercial real estate

Looking ahead, several trends are likely to shape the future of CRE:

- Remote work: With remote work becoming more common, the need for traditional office space may decline, but flexible workspaces might see an increase in demand.

- E-commerce growth: The ongoing growth of online shopping is expected to continue driving demand for industrial properties, particularly warehouses.

- Sustainability: Green buildings and eco-friendly practices will become more important as businesses focus on sustainability.

Is commercial real estate a good investment?

In conclusion, commercial real estate can be a good investment. It offers the potential for stable income, long-term growth, and capital appreciation. However, it requires substantial capital and expertise to manage effectively. Whether you choose to invest directly or indirectly through REITs, CRE offers various ways to grow your wealth.

For those new to the market, investing in REITs or ETFs can be a simpler way to enter the world of commercial real estate without the complexities of managing physical properties. However, as with any investment, it’s important to understand the risks and market conditions before diving in. By keeping an eye on these factors, you can make smart choices and potentially unlock significant returns from the commercial real estate market.

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.