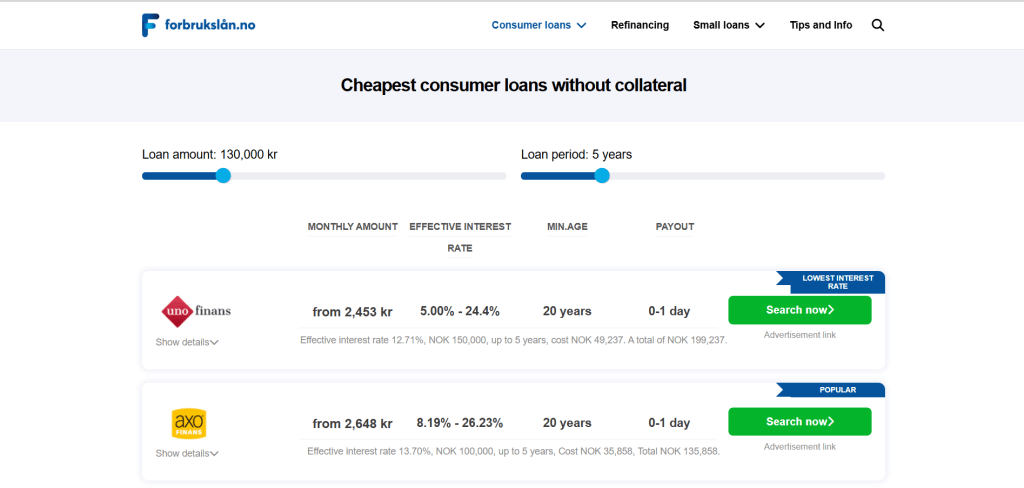

With rising borrowing trends, how can individuals make smarter choices when borrowing money? Platforms like Forbrukslån.no help compare offers from banks, while Husbanken supports affordable homeownership through government-backed housing loans focused on sustainability and social inclusion.

Borrowing money can be an important part of managing personal finances. People often need loans for home improvement, buying a vehicle, consolidating debt, or handling other personal expenses.

In Norway, unsecured loans, which are loans without collateral, have grown in popularity. This trend shows the country’s high levels of wealth and access to credit.

In 2024, Norway’s total loan debt was about USD 733.8 billion. This shows a steady rise in borrowing activities in different sectors. Personal loans without collateral have gained popularity among Norwegian households. By July 2025, domestic loan debt for the general public increased by 4.1% compared to the previous year, reaching NOK 7.71 billion.

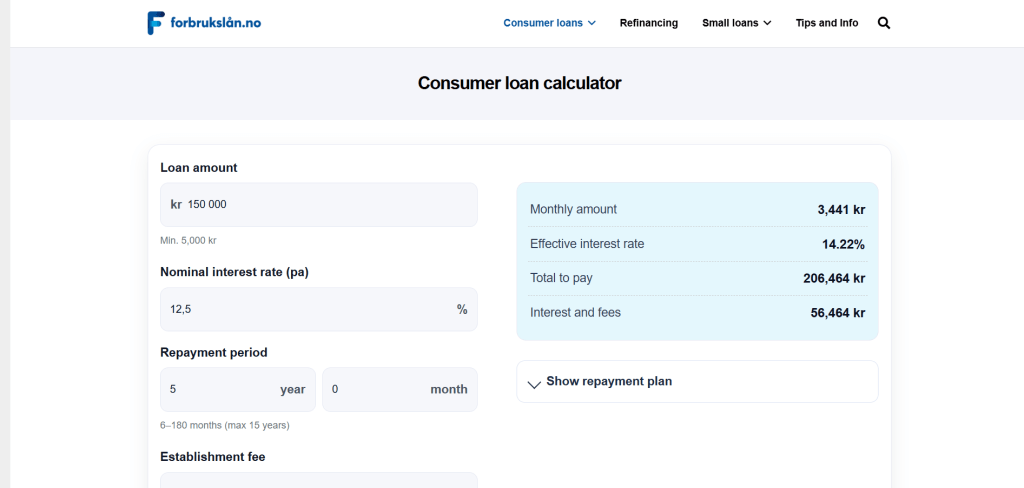

You can compare multiple offers for låne penger efficiently using platforms like Forbrukslån.no, where you can find the best rates and terms for your situation.

Borrowing money without collateral

Unsecured loans offer borrowers the freedom to choose how to spend their money. Unlike mortgages or car loans, these loans are not connected to specific assets. The main advantages of unsecured loans include:

- Flexibility: Borrowers can use the money for any purpose they want.

- Accessibility: Banks do not require collateral, so renters and non-homeowners can get loans.

- Competitive rates: Borrowers with high credit scores can access relatively low interest rates.

However, there are some downsides:

- Higher interest rates: To offset the risk, unsecured loans usually have higher rates than secured loans.

- Credit dependency: Borrowers with low credit scores may face higher rates or be turned down.

- Debt risk: Taking out multiple unsecured loans at once can lower borrowing capacity and lead to repayment issues.

How much money can you borrow?

Since unsecured loans do not require collateral, loan amounts are usually lower than those of secured loans. Typical ranges include:

- Minimum loan amount: NOK 5,000 to NOK 30,000

- Maximum loan amount: NOK 500,000 (Bank Norwegian offers up to NOK 600,000)

- Repayment period: Up to 5 years, with exceptions for refinancing.

Costs of borrowing money without collateral

Borrowing money without collateral can cost more than secured loans. However, Norwegian borrowers get a 22% tax deduction on interest from debt. Interest rates differ based on the bank, loan amount, and credit score. Typical effective interest rates are:

| Loan amount | Interest rates |

| 0–50,000 | 18%–30% |

| 50,000–100,000 | 9%–22% |

| 100,000–300,000 | 7%–22% |

| 300,000–600,000 | 5%–18% |

Most borrowers use banks like Santander Consumer Bank, Bank Norwegian, Opp Finans, and Easybank. One-time setup fees of about NOK 900 are common. Monthly invoice fees usually range from NOK 40 to 50. Extra fees might apply for loan extensions, payment deferrals, or late payments.

For those seeking loans for housing or home improvements, Husbanken provides state-backed loan options. Unlike unsecured consumer loans, Husbanken loans are tied to specific purposes, such as home purchases or renovations.

Requirements for borrowing money without collateral

Before applying for an unsecured loan, it’s important to know the banks’ minimum requirements. While details can differ, all banks look at the following:

- Age requirements

- Income requirements

- Residency and nationality requirements

- Payment history requirements

Age requirements

Borrowers need to be at least 18 years old, though many banks ask for a minimum age of 20. The upper age limit usually ranges from 70 to 75 years.

Income requirements

Banks might ask for a steady income or an annual minimum of up to NOK 250,000. Borrowers wanting larger loans (NOK 100,000 and above) typically need to show stable earnings between NOK 150,000 and NOK 250,000 each year. Self-employed borrowers must present approved accounts that show income for the past three years.

Residency and nationality requirements

Norwegian citizenship is often required, but foreign residents with at least three years of residency and taxable income may also qualify. Temporary living abroad does not disqualify Norwegian citizens as long as it isn’t reported to the Population Register.

Payment history requirements

Applicants with payment notices often face rejection. To clear a payment notice, the related debt must be paid off. Ongoing debt collection cases can also lead to loan denial.

If you want to explore multiple options for borrowing money, you can visit Forbrukslån.no to compare unsecured loan offers from different banks.

Common reasons for loan rejection

Even when applicants meet the minimum requirements, lenders can reject applications for several reasons:

- Age limitations

- Insufficient income

- Unstable self-employment income

- Payment notices or ongoing debt collection cases

- Loan amounts that exceed responsible limits based on income

How banks determine interest rates

Interest rates for unsecured loans depend on:

- Credit score: Higher scores receive lower rates.

- Loan amount: Larger loans may have lower rates according to bank policy.

- Bank risk assessment: Banks adjust rates to balance potential defaults and earnings.

Application and disbursement process

The process is usually simple:

- Submit an application with income documentation.

- Receive loan offers, often within 24 hours.

- Review interest rates and total costs.

- Sign the loan agreement using BankID.

- Funds are typically transferred within 2 to 3 days.

Final thoughts

Borrowing money without collateral in Norway is easy, flexible, and often used for things like spending, buying vehicles, and refinancing. Interest rates tend to be higher than for secured loans, but with careful planning, comparison, and payment strategies, you can reduce costs. A platform like Forbrukslån.no helps you find the best deals from various banks for free.

For borrowers looking for state-backed options, Husbanken offers structured loans for housing projects. Commercial banks provide more flexibility for general purposes when you want to borrow money.

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.