Your bank statement is more than just numbers, it’s the ultimate financial storytelling tool. From spotting hidden fees to unlocking loan approvals, this overlooked document holds the key to smarter money moves. How to decode its secrets and transform your financial health?

When was the last time you checked your bank statement? For many of us, it’s one of those things we either glance at quickly or completely ignore, until something seems off with our money.

The truth is, a bank statement isn’t just a bland piece of paper or a dull PDF attachment, it’s essentially a diary of your financial life. It tells the story of how you earn, spend, save, and manage your money.

Whether you are a student, a working professional, or running a business, understanding your bank statement can make a massive difference in how well you handle your finances.

What is a bank statement?

It is essentially an official summary provided by your financial institution that outlines all the transactions in your account over a specific period typically a month. Think of it as your money’s story, with each deposit, withdrawal, and fee representing a chapter in your financial narrative.

It’s like having a personal financial detective that tracks every penny coming in and going out, leaving no transaction unturned.

These statements aren’t a modern invention, they’ve been around for decades, evolving from dense, paper-based documents to sleek digital formats accessible with a tap on your smartphone.

Historically, banks produced these statements monthly, quarterly, or annually, but since the computerisation of banking in the 1960s, monthly statements have become the standard. Today, you might receive a physical statement in the mail (though these are becoming rarer) or, more commonly, an electronic version through your bank’s online portal or mobile app.

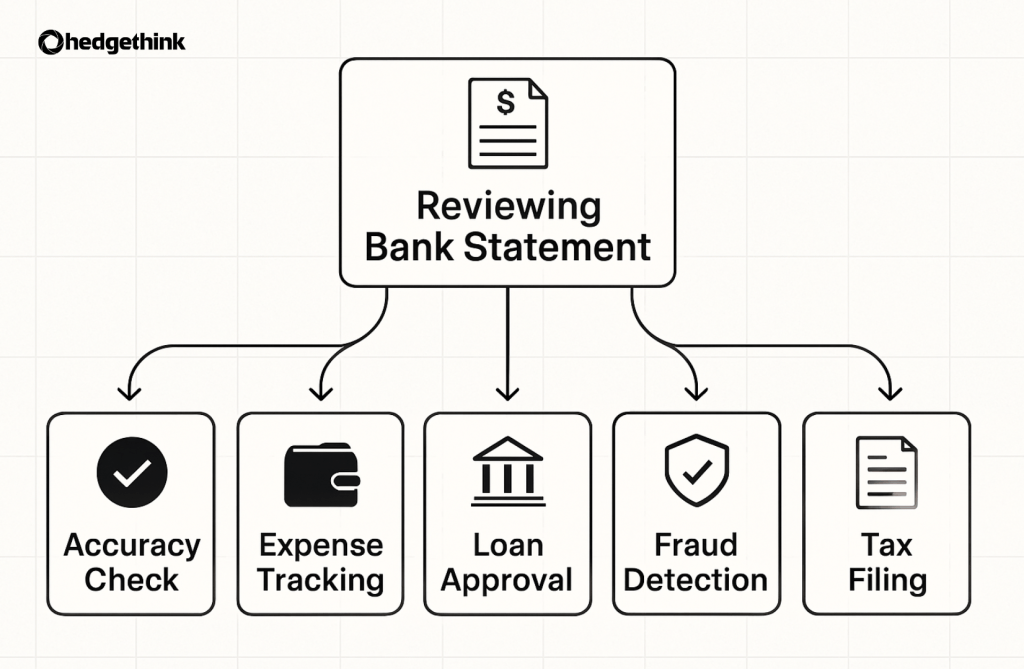

Why does a bank statement matter?

You might wonder: isn’t online banking enough? After all, you can always peek into your mobile app and see your balance or check a few transactions. That’s true, but a bank statement goes several steps further. Here’s why it’s worth valuing:

- Accuracy checkpoint: Mistakes do happen. Banks are usually reliable, but errors in transaction processing, missed deposits, or unauthorised charges can slip in. Your bank statement functions as a watchdog, helping you confirm everything adds up.

- Expense tracking: Ever wondered why your savings plan isn’t working quite as you expected? A statement lays it out plainly, it shows how much you spend on essentials versus the little extras (like coffees or online shopping splurges). With it, you can spot patterns that an app notification won’t reveal at a glance.

- Loan and mortgage applications: If you plan on applying for a mortgage, a personal loan, or even renting a property, your bank will often ask for several months of statements. Why? Because they want proof of your income stability and financial reliability.

- Fraud detection: Imagine a small fraudulent transaction sneaks into your account—a minor debit that you overlook. Fraudsters often test accounts with small amounts before attempting larger withdrawals. Regularly reviewing your statement can help you nip that in the bud.

- Proof of income: Freelancers and self-employed professionals often use their bank statements as official proof of income. For many institutions, it carries more weight than self-declared invoices alone.

- Tax filing made easier: It can act like a trail of breadcrumbs when you’re preparing tax documents. They make it simple to cross-check income, business expenses, and deductible items.

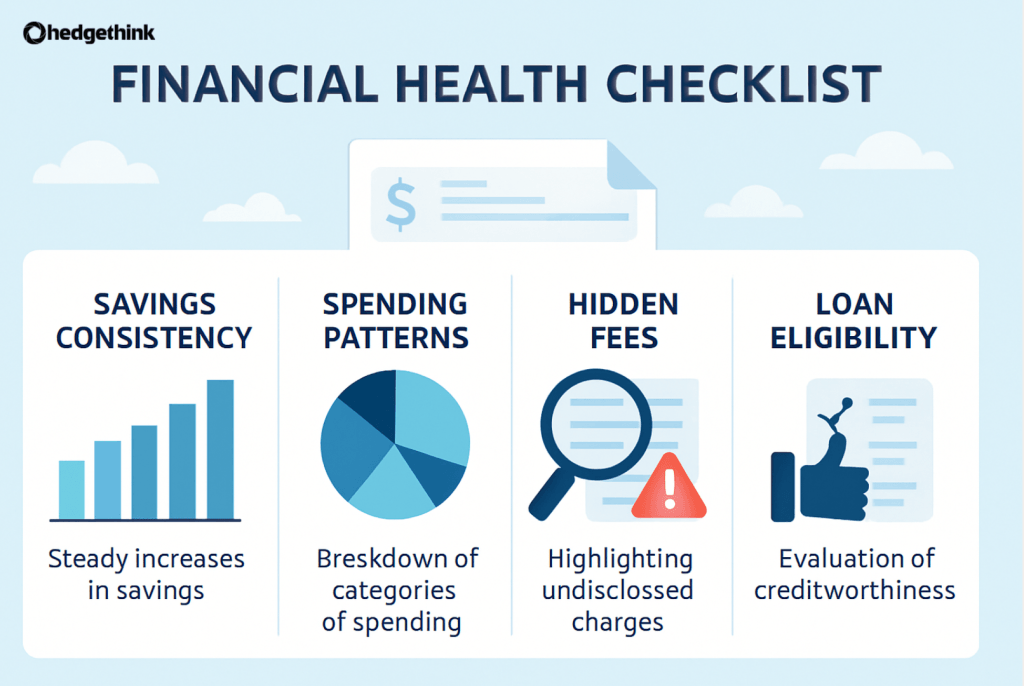

Benefits of regularly reviewing your statement

While most of us treat statements as admin chores, the reality is they’re incredibly useful if you make a habit of checking them. Here’s how:

- Helps you budget better: With a clear picture of where money trickles away, you can set realistic budgets. It’s much easier to cut unnecessary expenses when you see them right in front of you.

- Strengthens your financial awareness: Financial literacy starts with awareness. The more familiar you are with reading statements, the more comfortable you’ll get with your money language.

- Spotting hidden fees: Sometimes we subscribe to services we’ve forgotten about—like streaming platforms or magazine subscriptions. It exposes these stealthy deductions, letting you cancel what you don’t need.

- Reduces anxiety around money: Believe it or not, facing your finances directly can be empowering. Instead of worrying about whether you’ve spent too much, a bank statement settles the question with facts.

Read More:

Bank Statement: 7 Things Your Statement Reveals About Your Finances

Key components of your financial snapshot

Now that we know what a bank statement is, let’s break down what actually goes into this financial report card. While the exact layout might vary between institutions, most statements contain similar building blocks that work together to tell your money’s story.

1. Account information:

At the top of your statement, you’ll typically find your personal details and account information. This includes your full name, address, account number, and sometimes your sort code. It’s crucial to check this section regularly to ensure all information is correct—any discrepancies could lead to issues down the line or might even be a red flag for fraudulent activity.

2. Statement period:

This indicates the specific time frame covered by the statement—usually starting the day after your previous statement ended and running for approximately one month. For example, your statement might run from the 13th of April to the 12th of May rather than following the calendar month. Knowing this timeframe helps you contextualise the transactions and balances reported.

3. Opening and closing balances:

Your opening balance is the amount in your account at the start of the statement period, while the closing balance is what remains at the end. These two figures act as financial bookends, helping you quickly gauge whether your balance trended up or down during the period. Some statements might also include your average daily balance, which can be useful for understanding your typical cash flow.

4. Transaction history:

This is typically the most detailed section, a chronological list of all transactions that occurred during the statement period. Each entry includes:

- The date the transaction was processed

- A description (which might include the payee’s name, transaction type, or location)

- The amount deducted or added

Transactions are generally categorised as credits (money coming in) or debits (money going out). Credits might include salary deposits, transfers received, or interest earned. Debits could encompass ATM withdrawals, debit card purchases, automatic payments, or bank fees.

5. Fees and interest:

Here, the bank outlines any charges applied to your account during the statement period, think maintenance fees, overdraft charges, or ATM fees. If you have an interest-bearing account, this section will also show any interest you’ve earned. Regularly reviewing this part can help you spot unnecessary fees and potentially negotiate them away or switch to accounts with better terms.

6. Overdraft information:

If your account has an arranged overdraft facility, your statement will show your limit and whether you’ve used it during the period. An arranged overdraft is essentially a agreed-upon borrowing limit that kicks in when your balance hits zero, acting as a short-term financial buffer. If you’ve exceeded this limit, you’ll see charges for an unarranged overdraft, which typically come with heftier fees.

Beyond personal use: When bank statements become official documents

Your bank statement’s usefulness extends far beyond personal money management. They often serve as required documentation for various important life events and applications:

- Loan and mortgage applications: Lenders typically require several months’ worth of statements to assess your income, spending habits, and financial stability

- Rental applications: Landlords may request statements to verify your ability to pay rent consistently

- Visa and immigration processes: Many countries require it as proof of financial resources when applying for visas or residency

- Legal proceedings: In disputes or divorce cases, statements might be subpoenaed as evidence of financial behavior

- Self-employment verification: For those without traditional payslips, it serve as proof of income

Final thoughts

Your bank statement is far more than a boring monthly routine. It’s a tool, a roadmap of your money habits. By understanding its components, embracing its benefits, and reviewing it regularly, you can take better control of your financial well-being.

Think of it like this: it is not just numbers on a page. It’s your financial journal, helping you see where you’ve been, where you stand today, and where you could go tomorrow. Ignoring it is like skipping chapters of your own story, without reading it, you’ll never really know the full picture.

So the next time your bank sends over a statement, don’t just file it away. Open it, read it, and see what story your money is telling you.

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.