Funds in the Asia-Pacific region now have more than $145 billion in assets under management. That, and more good news for funds in the region, from the Preqin March 2015 special report on the Asia-Pacific region. Those assets grew by more than 30% in 2014, the year in which the Chinese stock market opened to the world at large.

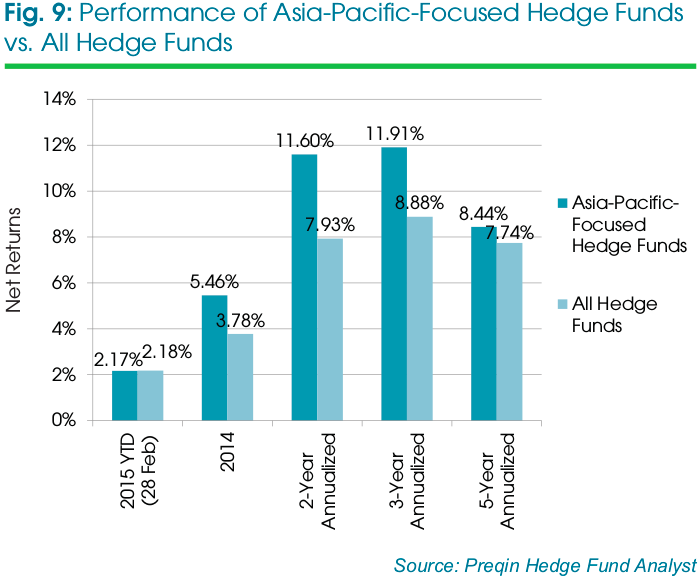

According to the report there are not 2,213 hedge funds operating in Asia-Pacific, and 556 institutional investors in the region invest in the vehicles. The funds are also surging ahead on performance, with an annualized return of close to 11.9% over the last three years. There may be some temporarily about those performance numbers, but it’s clear that the region is of growing importance to the industry as a whole.

Performance amazes in Asia-Pacific

The top funds in the Asia Pacific region in 2014 could compete with hedge funds from around the world toe-to-toe. The best performer was the Alchemy India Long-Term Fund from Alchemy Investment management. The fund managed to net a total return of 60.6% in 2014 by focusing on equities in the world’s second most populous country.

The Merchant Commodity Fund, from Singapore based RCMA Asset Management, manger to return 59.29%. That fund invests in physical commodities through its networks of warehouses and other infrastructure through the region. Redart Capital managed to return 57.45% with its Redart Focus fund, which focuses on value oriented equity investments in India.

Rounding out the top five were the ArthVeda Alpha India L50 and the AFC Asia Frontier Fund from ArthVeda Fund Management and Asia Frontier Capital. Those funds managed to return 39.09% and 36.98% to their investors, net of fees, respectively.

The Preqin report found that firms with headquarters inside the region tended to perform better than those with headquarters outside of the region.

Asia-pacific benefits from government stimulus

The 30% increase in assets and the amazing performance of some of the regions’ fund shouldn’t hide the fact that the entire Asia Pacific region benefited massively from government stimulus programs across the continent. The Chinese, Japanese and Indian governments were all supporting their economies through direct action during 2014, an atmosphere that hedge funds tend to thrive in.

That doesn’t take away from the performance of those funds, after all hedge funds in the United States have benefited from the same kind of support over the last seven years, but it does go some way toward explaining the outsized performance numbers that have emerged as part of this report.

Equity-focused, single manager funds dominate

The Preqin report found that 62% of the funds based in Asia-Pacific were equity focused while 82% of them were ran by a single manager. Of those funds based outside the area but investing in it, the survey found that 55% were equity focused while they tended to use more complicated structures.

The novelty of the industry in Asia and the fact that it is benefiting massively from government stimulus should mean little is surprising about the structure of the industry. The funds operating from inside the region are generally new, and they’re generally taking advantage of a boost in equity markets.

Those based outside the region tend to be representatives of the larger hedge funds from the US and Europe, offering investors a way to get exposure to the high growth of international equity markets through a hedge fund vehicle.

Investors still aren’t happy

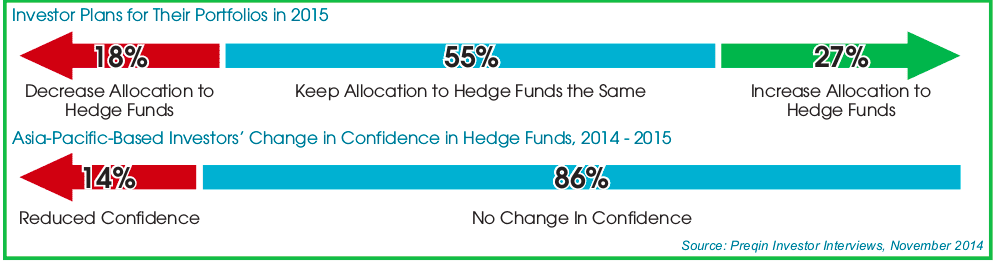

Despite the great headline numbers, a large number of institutional investors are not happy with the way their hedge fund investments in Asia have gone. According to a Preqin survey 43% of those investors said that their investments fell short of their expectations last year. Despite that 82% of those interviewed planned to maintain or increase their allocation to hedge funds through 2015.

The Preqin analysts speculate on one possibility that explains that contradiction: it may be true that investors from the region simply have higher return expectations from their investments. Hedge fund in Asia did better than those in the rest of the world in 2014. The fact that 12% average returns left investors dissatisfied is certainly cause to pause.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.