The global market for cycling clothing and apparel has shifted gears—moving beyond niche sportwear into a vibrant, fashion-forward, and sustainability-conscious industry. While it may not rival traditional blue-chip sectors in scale, the cycling apparel ecosystem intersects with consumer health trends, urban infrastructure investment, and ESG-aligned growth themes, making it increasingly relevant to institutional investors and private capital allocators.

This article explores the evolution of cycling apparel from functional gear to lifestyle investment opportunity, identifying the key trends, risks, and growth levers in a rapidly expanding consumer category.

From Lycra to Lifestyle: Redefining the Market

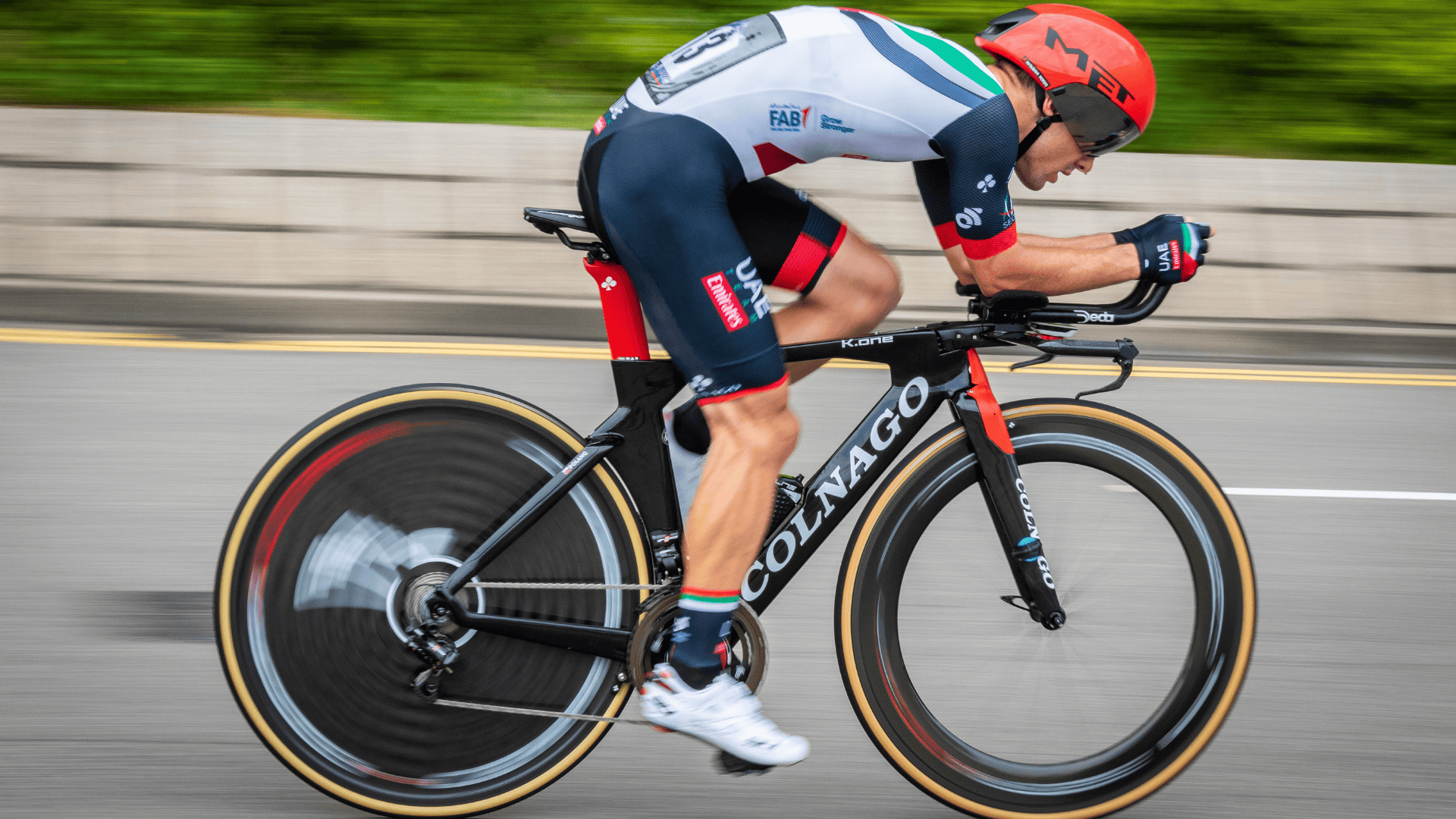

Once the domain of competitive athletes, cycling apparel is now mainstream. Spurred by the pandemic-era cycling boom and sustained by urban mobility trends, the category has evolved into a hybrid of performance sportswear, fashion, and commuter utility.

Market Snapshot:

- Global Market Size (2025 est.): $8.2 billion

- Growth Rate (CAGR): ~5.8% through 2030

- Top Growth Regions: Europe, North America, Asia-Pacific

- Key Segments: Jerseys, bib shorts, weatherproof outerwear, urban commuting gear

Investment Signals from the Peloton

1. Health and Wellness Convergence

Cycling is part of a broader consumer pivot toward active lifestyles, which is fueling apparel demand from both athletes and everyday commuters. Apparel is no longer just about aerodynamics—comfort, design, and visibility are equally important for urban riders.

2. Athleisure Cross-Over

Premium cycling brands are gaining traction among non-cyclists due to their sleek, minimalist aesthetic. Think of Rapha, Pas Normal Studios, and MAAP—now as much fashion as function. This mirrors the athleisure trend that helped brands like Lululemon scale into billion-dollar valuations.

3. Sustainability as a Differentiator

Cycling itself is inherently low-carbon, and brands are doubling down on this alignment by using recycled fabrics, closed-loop manufacturing, and carbon-neutral shipping. ESG-focused funds and green consumer portfolios are taking note.

Private Equity and M&A Activity: Gearing Up

The cycling apparel space has been quietly active on the private capital front, often flying under the radar compared to high-profile sportswear M&A.

- Rapha, one of the category’s premium players, was acquired in 2017 by RZC Investments (backed by the Walmart heirs), and has since scaled via DTC expansion and digital community engagement.

- Smaller regional brands are being rolled up by lifestyle conglomerates or sports-focused private equity firms, attracted by strong brand equity and recurring customer loyalty.

- Emerging DTC platforms are receiving VC funding to build vertically integrated brands with community-first business models.

Case Study: MAAP – Building a Global Cycling Fashion Brand

Founded in Australia, MAAP has become a global premium cycling apparel label—balancing performance with bold design. It represents a case study in brand-led growth, leveraging collaborations (e.g., with lifestyle and art labels) and limited drops to build exclusivity.

Their strategy highlights key investment themes:

- High margins via premium positioning

- Community engagement through ride clubs and ambassador programs

- Digital DTC dominance with minimal retail footprint

MAAP, like Rapha, is a likely target for future acquisition or minority investment as PE firms seek scalable consumer brands with niche loyalty.

Urban Cycling Infrastructure: An Indirect Exposure

Cities from London to Sydney are investing billions into cycling infrastructure—bike lanes, parking, and mobility hubs. This creates structural demand for cycling gear, particularly for commuter-oriented apparel with waterproofing, reflectivity, and multi-functionality.

Indirect Investment Themes:

- Mobility-as-a-Service (MaaS) integration with cycling platforms

- Real estate development near cycling corridors

- Insurtech and micro-mobility coverage providers

Cycling apparel sits at the consumer end of this investment web—suggesting that retail exposure to cycling gear can act as a lifestyle-forward, thematic proxy for urban mobility investment.

Risks and Challenges

- Fragmented Market: Low barriers to entry have created a crowded field with many subscale players.

- Seasonality: Sales fluctuate with weather and racing seasons, making inventory management critical.

- Logistics Cost Pressure: Many high-end brands rely on global manufacturing and face margin pressure from shipping and returns.

However, brands with strong digital moats and community loyalty tend to outperform, maintaining pricing power and repeat purchase behavior.

Strategic Implications for Investors

1. Consumer Growth Equity

Late-stage VC or growth PE funds can target premium cycling brands showing >25% YoY growth, strong DTC economics, and recurring customer cohorts.

2. Public Market Proxy Plays

Larger listed sportswear companies (e.g., Shimano, Adidas) are expanding their cycling divisions. While indirect, these provide lower-risk exposure to the category.

3. Impact Investing

Funds with sustainability mandates may find alignment in backing apparel brands using recycled textiles, localized production, and carbon reduction programs.

Conclusion: Cycling Apparel as a Lifestyle-Linked Asset

The cycling clothing and apparel market is more than just sportswear—it’s a bellwether for urban transformation, health-centric consumer behavior, and ESG-aligned fashion. With strong fundamentals, branding potential, and low correlation to traditional sectors, it represents an increasingly viable target for mid-market private equity, growth capital, and impact-focused funds.

In a world where alpha often lies in overlooked corners of consumer culture, cycling apparel offers a compelling intersection of brand, behavior, and infrastructure tailwinds—a ride worth taking for the right investor.