What does it take to maintain financial connections across distance? For many with strong ties to Mexico, sending money is part of everyday responsibility. It helps keep households running and supports important needs back home. As financial routines become more mobile, digital tools have started to play a larger role. These platforms offer structured, reliable ways to manage transfers while aligning with how people live and plan today.

How Digital Tools Improve Access

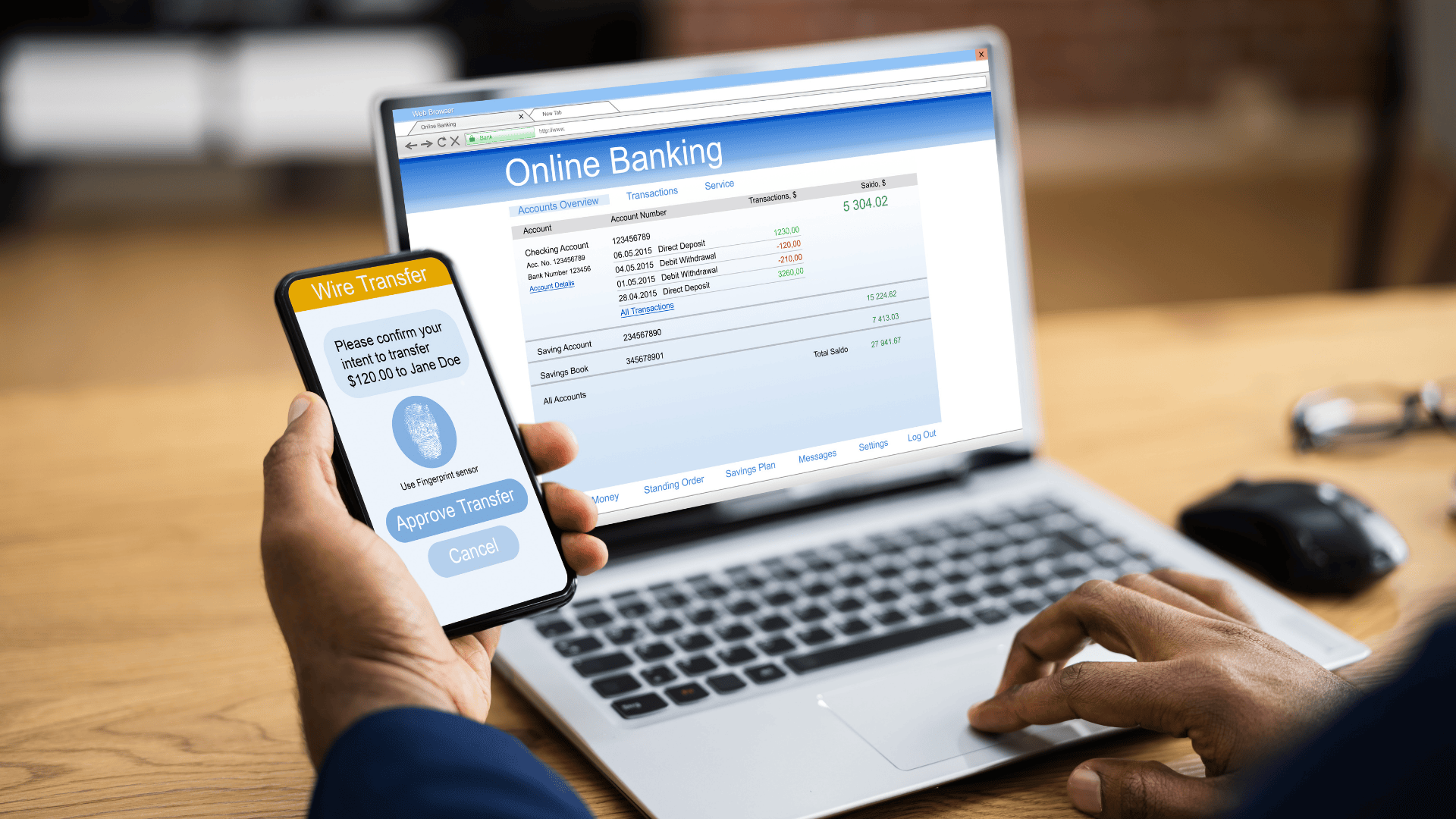

More individuals now rely on digital tools for money transfers to Mexico, using mobile apps and online platforms for greater convenience. These services reduce the need for in-person visits and help avoid long wait times. Transfers can be completed at any time, without depending on business hours or physical locations. This shift supports a consistent financial connection between families, regardless of distance.

Integration with Local Banking Channels

Digital services are now widely compatible with major banks and financial networks in Mexico. This compatibility allows for smoother movement of funds from digital platforms to local accounts. Linking these systems helps reduce delays and confusion when money arrives. It also improves how easily transactions can be tracked and confirmed. Such integration creates a more dependable experience for both those sending and receiving funds.

Real-Time Updates and Notifications

A key improvement in digital tools is the ability to track every step of a transaction. From the moment it is sent until it is received, users can monitor its progress. This visibility helps reduce confusion and allows recipients to prepare for incoming funds. Built-in notifications keep everyone updated without needing to check manually. These real-time updates are especially useful when coordinating with family members across different regions of Mexico.

Language Options and Local Currency Support

Digital platforms are now more localized to meet specific regional needs. This includes full Spanish-language interfaces and automatic conversion to Mexican pesos at the current exchange rate. The use of local terms, icons, and familiar layouts makes navigation more intuitive. These adjustments support smoother experiences for those sending funds to Mexico. Clear language and familiar design also help reduce transaction errors by improving user understanding.

Key Features That Support Better Money Management

Here are a few features that have proven helpful for those sending funds to Mexico:

- Balance alerts after every transaction

- Exchange rate displays for better timing decisions

- Digital receipts that can be saved or forwarded

- Secure log-in methods like biometrics or codes

- Integration with digital wallets for added flexibility

These features make it easier to monitor activity and stay organized.

Role of Customer Support and Platform Guidance

Some digital services include multilingual help centers with resources tailored to users in Mexico. Support materials often address common questions about sending, receiving, and tracking transfers. When available, these tools can reduce confusion and provide guidance directly within the platform or through linked channels. Access to clear, region-specific information contributes to a more organized transfer experience.

The adoption of digital platforms has a significant impact on how financial support is sent across borders. Features like tracking tools, language-friendly design, and mobile compatibility are tailored to meet local needs. Before selecting a service provider for money transfers to Mexico, it is helpful to understand how each platform functions within the country’s financial environment. The rise of mobile and digital solutions reflects a growing shift toward simplified, user-focused services throughout Mexico.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.