Global risk sentiment strengthened last week, with major equity indices notching impressive gains.

The catalyst was a better-than-expected US non-farm payrolls report, which reassured investors that the initial economic impact from tariffs may be less damaging than feared. Markets also took comfort in signs of renewed momentum in trade negotiations, including a potential thaw between the US and China.

US stocks have now erased their April losses, with the S&P 500 marking a nine-day winning streak, its longest since 2004. A strong labour market and easing fears of an economic slowdown have helped reduce expectations for a Fed rate cut, with odds for a June cut dropping to 35% from 63% a week prior. Importantly, markets appear comfortable with a more patient Fed, even as inflation remains persistent.

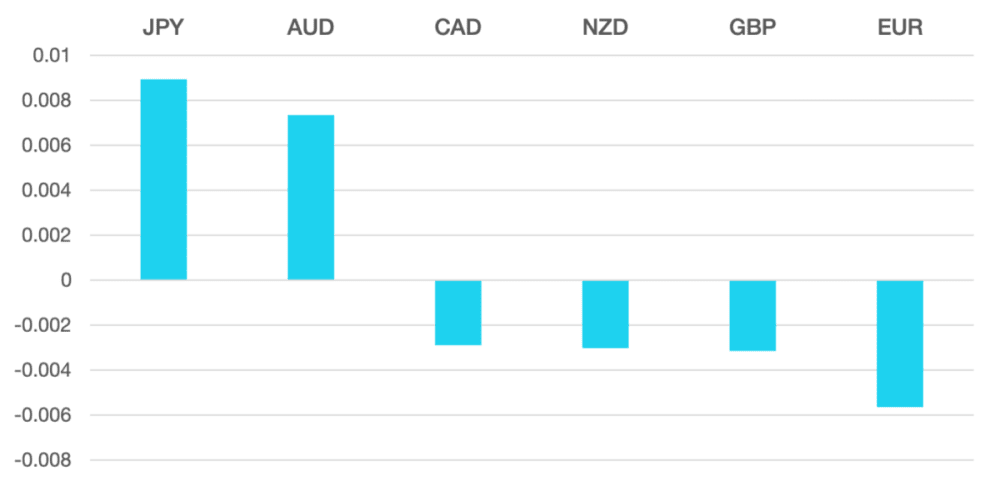

In FX, the US Dollar continued its recovery, rising 0.5% to close at 100.036 on the DXY index. The move solidified the bounce from key support, helped by the robust jobs print and tempered Fed expectations.

Aussie led the pack, gaining 0.8% as stronger-than-expected inflation data and solid risk sentiment boosted demand. CAD and NOK both rose 0.3%, while NZD lagged slightly, slipping 0.3% after weeks of strength.

On the weaker side, the Japanese Yen fell 0.9%, pressured by a dovish BoJ and downgraded growth outlook. Euro and Sterling both drifted lower, lacking support from data or central bank rhetoric. The Swiss Franc was flat, and the Mexican Peso fell 0.4%.

Oil markets broke down sharply, with WTI sliding more than 7% to close at $58.35.

Rising OPEC production was the key trigger, ending a fragile attempt at stabilization and confirming a bearish shift in crude sentiment.

The Week Ahead we except markets to remain highly sensitive to tariff-related headlines, especially as the July expiry of the 90-day truce approaches. While hopes for US-China progress remain, there’s no concrete breakthrough yet.

Key data events this week include:

- BoE Interest Rate Decision

- Inflation reports from Switzerland, Mexico, and Norway

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Risk Appetite Firms as Jobs Data Lifts Confidence and Dollar Extends Bounce first appeared on trademakers.

The post Risk Appetite Firms as Jobs Data Lifts Confidence and Dollar Extends Bounce first appeared on JP Fund Services.

The post Risk Appetite Firms as Jobs Data Lifts Confidence and Dollar Extends Bounce appeared first on JP Fund Services.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.