It has been mentioned often by market commentators about the difficult & volatile trading conditions in 2022. This is how the 2022 market looked graphically.

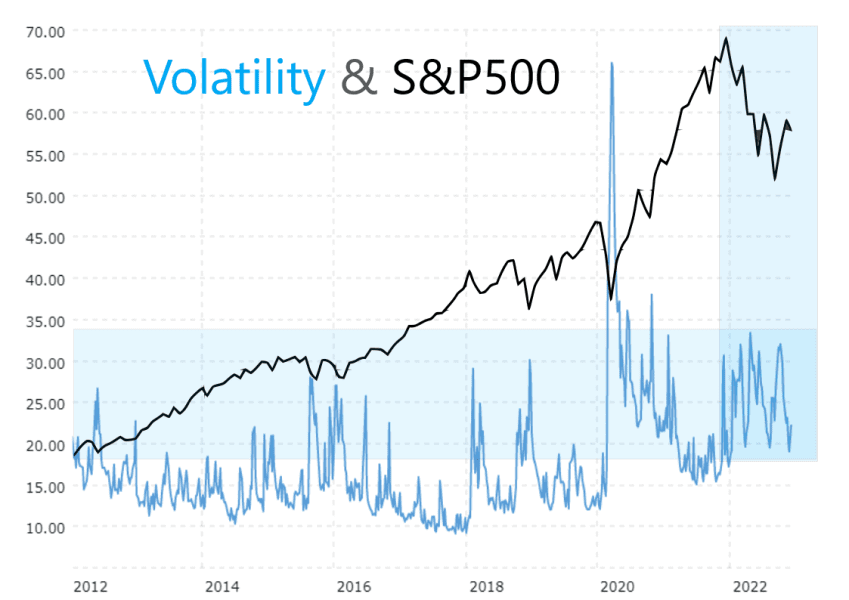

In the chart below the black line is the S&P 500 and the blue line is a volatility measurement from a basket of indexes and currency pairs:

The verticle blue highlighted area is the year 2020.

The horizontal blue highlighted area is this years volatility range.

Of note is the volatility spike thanks to the Covid crash in early 2020. That downturn occurred within a couple of weeks and spiked the volatility measurement. Afterwards as that shock came through the statistics volatility returned to a normal range in 2021 before greatly increasing again in 2022.

The volatility range in 2022 is not only higher than (excluding Covid) any time in the past 10 years, but the difference between high and low(er) volatility periods was also higher than historically.

Historically the volatility measurement was below 20 for the majority of the time, apart from more brief periods of major news and/or market movements. However in 2022, the minimum volatility was above 20 for the entire year. So even at its least volatile 2022 was more volatile than much of the pervious 10 years.

The difficulty with volatile markets is that they are harder to predict. An analogy is the sea. A volatile market has waves which are more choppy and violent making boats harder to sail on the rough seas; or for a surfer the waves are much harder to catch because they are not rolling big waves, but violent shorter waves.

In addition to this the 2022 was a bear market. Again incomparable to any market seen in the past 10 years. Covid had a dramatic crash, but it occurred over the course of a few weeks, where are 2022 had a bear market for the entire year. Not only a bear market, but a bear market with sizeable ‘dead-cat’ rebounds.

So volatility is at a level higher than we have regularly seen in the past and the market is in an extended bear period which we have no seen in the past 10 years. These two things combined make the markets difficult to predict using past behaviour.

Even though this year has been difficult, bMAMS has made a profit when many other systems and markets have not. We pride ourselves on our risk management, so when markets are hard our client’s funds are secure and safe.

Hopefully once the interest rises are finished and inflation begins to reduce we will see a market with lower volatility, as the market won’t have as many external shocks coming through it. This will allow our algorithms to better predict the market and profits that should follow. That is why protecting capital in the difficult times is important, it allows us then to take full advantage of the good times.

Originally posted on https://www.bmams.com.au/

The post bMAMS: Market Volatility in 2022 first appeared on trademakers.

The post bMAMS: Market Volatility in 2022 first appeared on JP Fund Services.

The post bMAMS: Market Volatility in 2022 appeared first on JP Fund Services.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.