As Auctions of Collectibles Soar, Fractional Ownership Draws Interest

Fractional ownership draws interest. The auction of high-end collectibles soared in 2021.

- A 1937 British coin of Edward VIII sold for $2.28 million in March 2021, and then again for $2.45 million in October — both sales setting new records for British coins.

- Another record was broken with the sale of Amazing Fantasy #15 — the first appearance of Spider-Man — for $3.6 million.

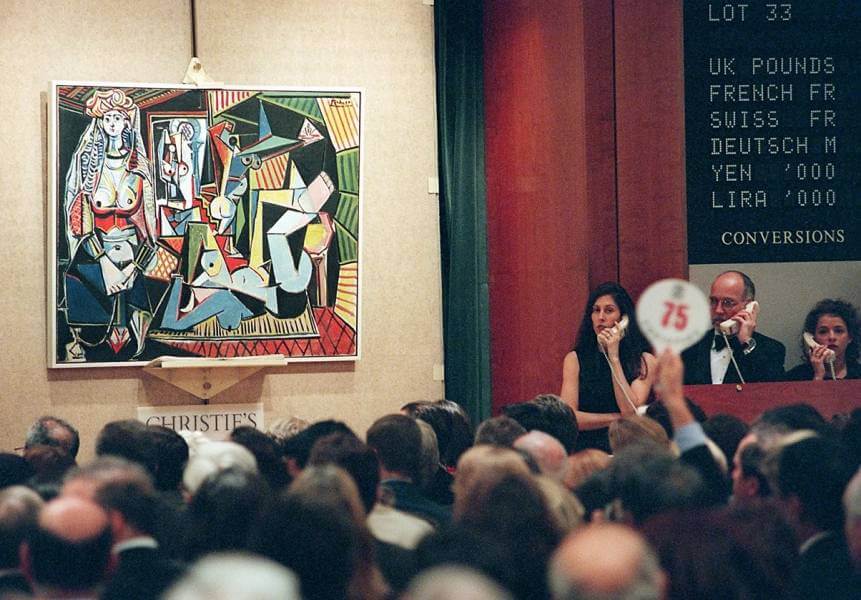

- And many people have now read about the groundbreaking $69.3 million sale of an NFT by Beeple at Christie’s, which set a new benchmark for NFTs and cryptocurrency.

The record-breaking sales of collectibles in 2021 suggest that investing in rare and sought-after items has never been more popular — or more attractive to investors looking to cash in on the trend.

Thanks to an economy increasingly driven by the internet and the rise of blockchain technology, crypto currency and NFTs, collectibles have become more accessible and fungible, allowing more collectors — and investors — to dive into the marketplace.

One of the most interesting trends surrounding collectibles has been the rise of fractional ownership, which leverages the power of the blockchain to sell part of a collectible to someone who can’t afford $3 million for a comic book.

Many new companies have emerged to offer fractional ownership of high-end collectibles, including comic books, paintings, trading cards, sports cards, and countless other examples. After all, any item becomes a collectible when enough people are willing to pay top-dollar for it.

KOIA

The London-based company KOIA started with a very specific niche: watches. KOIA’s initial angle was to allow people to invest in luxury watches like ROLEX by selling fractional ownership “tokens.”

Investors believe the company could succeed. In January 2022, the company secured $1.4 million in a pre-seed funding round led by Seedcamp.

“Our mission is to make alternative assets accessible to anyone, via fractional ownership, and allow anyone to invest in assets they understand and are truly passionate about,” KOIA said in a statement. “We’re launching with collectibles like watches, fine wine and Pokémon Cards with a vision to ultimately be able to fractionalise any kind of physical or digital asset.”

Liquid Marketplace Inc.

Another new kid on the block, Liquid Marketplace Inc. aims for the same goal as KOIA: to offer fractional ownership of high-end items, and a secondary marketplace where the owners can sell their shares at a profit — if and when the item increases in value.

The Toronto-based company received an investment of $400,000 in October 2021 from ThreeD Capital, a venture capital firm always looking for early-stage companies likely to succeed.

“We are very excited to increase our holdings in Liquid Marketplace and believe this is a company that solves a liquidity problem with collectibles,” said Sheldon Inwentash, CEO and Chairman of ThreeD Capital. “The secure and reliable platform used by Liquid Marketplace offers a new way of owning, trading, and liquidating collectible assets by creating a new marketplace for users of all demographics to access and take advantage of.”

Mythic Markets

Depending on your perspective, Mythic Markets is either primed for success — or another cautionary tale about the risks of embracing an industry that still has to prove itself.

The San Francisco-based investing platform began as a place where people could buy and sell fractional shares in rare pop culture collectibles, especially vintage Magic: The Gathering cards. In November 2021, the company announced a halt to trading on their platform while claiming that “big changes” are coming. As of March 1, 2022, the marketplace was still closed.

“We’ve learned a lot about the inner workings and opportunities of this new industry,” the company said in the announcement. “And now we’re applying those learnings to a big new project, which we’ll be able to share more about soon. Let’s just say, if you’re one of the (many) people who wanted to see more assets and liquidity – we’ve got you, in a big way.”

It remains to be seen if the fractional ownership marketplace can become a sustainable and profitable industry, but it’s clear that many investors believe these companies have a chance at becoming another success story within the growing ecosystem of blockchain-driven companies.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.