10 March 2022 – eFront, the leading financial software and solutions provider dedicated to private markets, and a part of BlackRock, has released its latest Quarterly Private Equity Performance Overview, covering the period to the end of Q2 2021.

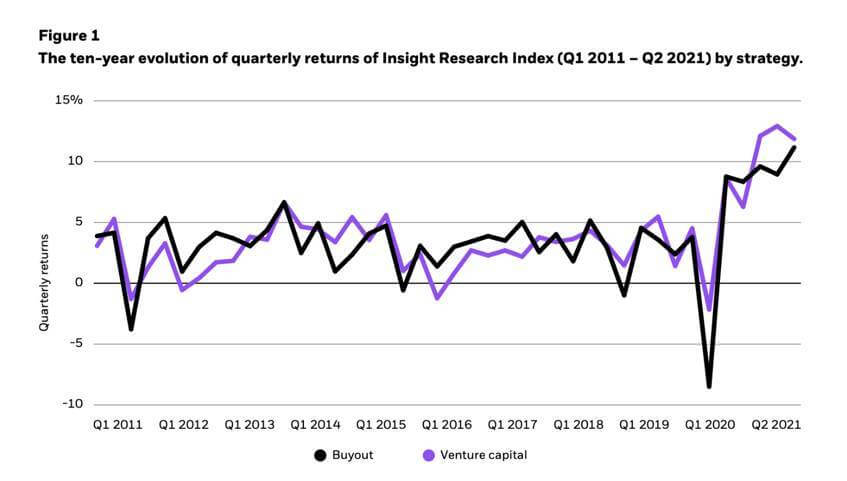

The report shows that the second quarter of 2021 was a particularly good one for the global LBO market, delivering a quarterly return of almost 12% (Figure 1). This growth was mostly driven by the European and North American regions. The strongest progression was recorded for the youngest vintage years of 2017-2019.

Growth in the VC market, meanwhile, slowed modestly, but this sub-strategy is still delivering a double-digit return for investors. On the industry sectors, it was the private equity deals in the Industrials and Financials sectors that accelerated performance most intensively.

After the initial shock brought on by the Covid-19 pandemic, the private equity market has bounced back to multi-year highs. Q2 2021 saw a quarterly return of 11.16% for buyout funds globally, while venture capital stood at 11.87% (Chart 1).

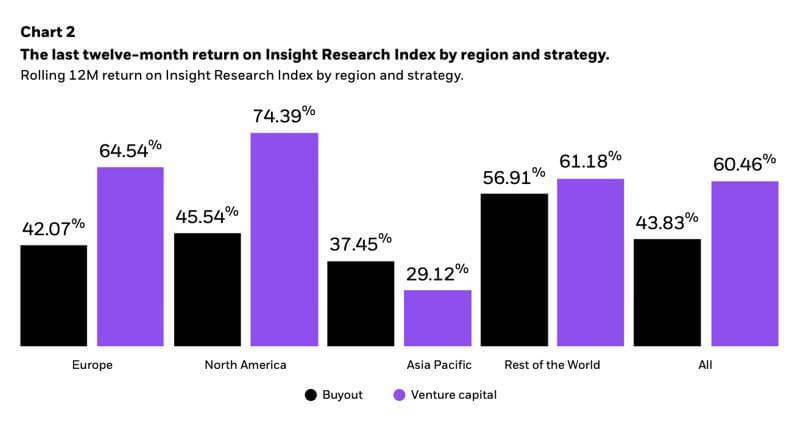

Over the past 12 months, the return figures are 43.83% for buyout and 60.46% for venture capital (Chart 2). This strong performance has been led by the European and North American regions, both of which posted a 12-month return for buyouts of more than 40%. In the venture capital space, North America saw the strongest result, with a return of almost 75%.

In terms of performance since inception, Europe leads the way for buyouts, with a TVPI of 1.71x and an IRR of 14.7%, while North America performs best in venture capital with a TVPI of 2.0x and an IRR of 15.19% (Table 1).

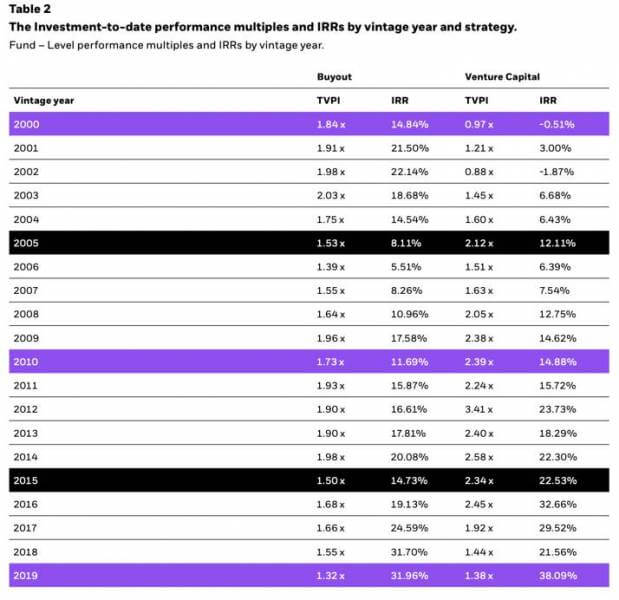

Looking at specific vintage years, for buyouts, the leading performers are the early vintages of 2001-03 and the post-global Finance Crisis years of 2009 and 2011-14 (Table 2). These years have reached a TVPI of more than 1.9x. For venture capital, the leading performance comes from the period 2009-16, during which all years have so far achieved a TVPI of more than 2.3x.

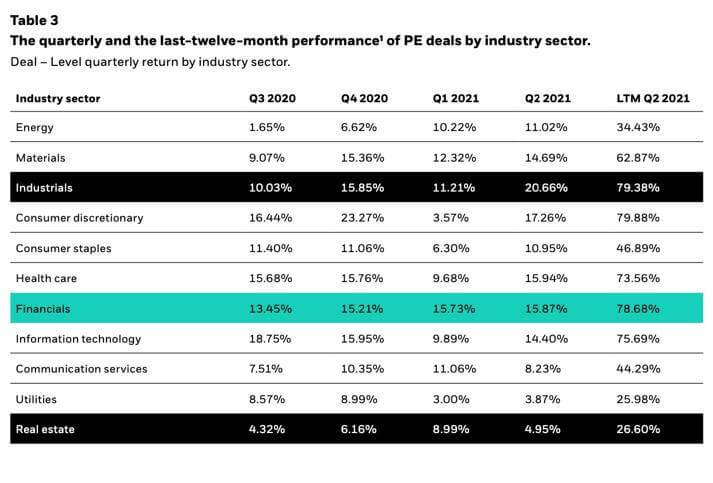

For specific sectors, the strongest quarterly performance came from the Industrials (20.66%), Consumer discretionary (17.26%), Health care (15.94%) and Financials sectors (15.73%). These sectors, plus the Information technology space, have recorded 12-month returns in excess of 75% (Table 3).

The new edition of the eFront Insight Research Quarterly Report presents two sets of performance metrics. The first is based on the fund-level transaction data sourced directly from limited partners who report on the capital calls and distributions paid in and received from the GP managers they are invested with. Transaction data allows the direct calculation of the net-of-fees performance averaged out across the selection of funds.

The new edition of the eFront Insight Research Quarterly Report presents two sets of performance metrics. The first is based on the fund-level transaction data sourced directly from limited partners who report on the capital calls and distributions paid in and received from the GP managers they are invested with. Transaction data allows the direct calculation of the net-of-fees performance averaged out across the selection of funds.

The second set of performance metrics leverages the deal-level data sourced from GP managers who report portfolio deal characteristics and financials every quarter to their investors. This rich and granular dataset enables a thorough breakdown of performance figures across regions and industry sectors. All the reported performance metrics in the second part are presented on a gross-of-fees basis.

For the full report, click here.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals