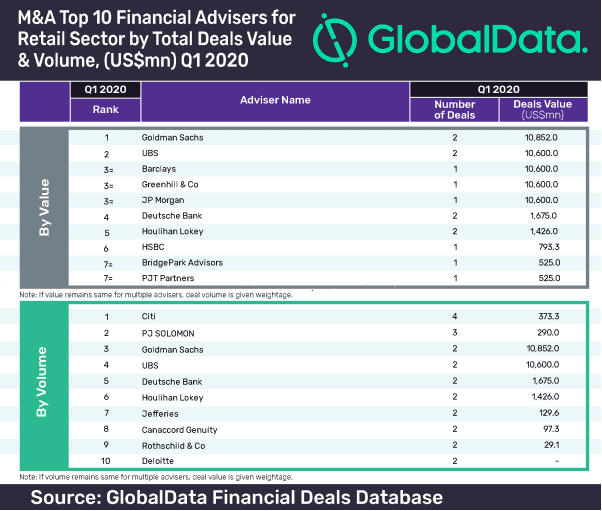

Goldman Sachs has dominated the M&A financial advisers league table based on deal value in the first quarter of the year. Likewise, Citi is the top financial adviser, based on deal volume in Q1, having advised on four deals worth US$373.3m. All these figures are according to GlobalData, a leading data and analytics company.

US-based firm Goldman Sachs has secured the top spot by advising on two deals worth US$10.9bn. GlobalData, which tracks all M&A, private equity/venture capital and asset transaction activity around the world confirmed that UBS occupied the second position with two transactions worth US$10.6bn.

Aurojyoti Bose, Financial Deals Analyst at GlobalData, comments: “Goldman Sachs, UBS, Barclays, Greenhill & Co and JP Morgan managed to surpass the US$10bn mark during the COVID hit Q1. Interestingly, all of these firms achieved their place in the ranking by advising on just one or two high-value deals, including the US$10.6bn Charoen Pokphand Group’s acquisition of Tesco’s Thai and Malaysian operations.”

Goldman Sachs was also first in GlobalData’s recently released global league table of top 20 M&A financial advisers.

Citi tops by volume

Citi is the top financial adviser, based on deal volume in Q1 2020, having advised on four deals worth US$373.3m. PJ SOLOMON occupied second position with three transactions worth US$290m.

Bose comments: “Citi, despite occupying the top spot in volume terms, lagged behind its peers in terms of value by a big margin and did not feature among the top ten advisors by value. PJ SOLOMON also failed to make it to the list.”

Global retail deals market in Q1 2020

During the COVID-19 outbreak, deal activity remained sluggish in Q1 and the retail sector witnessed a decline of 9.71% in deal volume from 577 to 521. However, the deal value increased from US$20.2bn in Q1 2019 to US$30.2bn in Q1 2020.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.