Think leasing a car saves you money? Hidden fees, mileage traps, and zero equity could be costing you thousands. Before you sign that lease, discover the 10 reasons buying is the smarter, wealth-building choice.

When considering a new car, two primary options often arise: leasing or buying. According to recent data, approximately 30% of new car buyers in the UK opt to lease, drawn by the allure of lower monthly payments and the ability to drive a new vehicle every few years. However, while leasing might seem like an attractive choice, the financial realities may not always align with long-term goals. In fact, over the average three-year lease term, you might pay more than the car’s actual value, with nothing to show for it at the end.

On the other hand, buying a car, whether outright or through financing, gives you ownership, which not only provides long-term value but also builds equity. The typical UK driver keeps their car for an average of 7.6 years, according to a 2020 report by the Society of Motor Manufacturers and Traders (SMMT). This extended ownership period contributes to greater cost-effectiveness, as you continue to drive the vehicle without making additional payments once the loan is paid off.

Leasing may be appealing for its flexibility and lower initial costs, but in many cases, it ends up being more expensive in the long run and offers fewer benefits compared to purchasing. We will explore 10 reasons not to lease in the long term.

Why buying may be the smarter choice

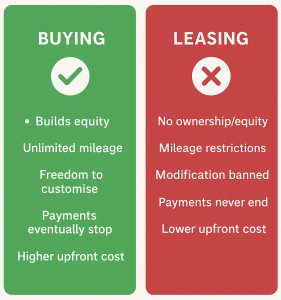

Buying may require a higher upfront deposit and larger monthly payments than leasing, but the long-term benefits far outweigh the short-term strain. Ownership provides:

- Equity and value retention: Even as your car depreciates, it remains an asset you own.

- Freedom and flexibility: Sell, trade, or keep your car whenever you choose.

- Unlimited mileage: Drive as far as you want, without worrying about penalties.

- Customisation: Modify your car to suit your lifestyle.

- Financial control: Once the loan is repaid, your car costs you nothing in instalments, unlike a lease that never ends.

Over a 10-year period, buyers who keep their cars long-term usually spend significantly less than habitual leasers. The initial savings from leasing often evaporate when compared with the endless cycle of payments.

When does leasing make sense?

To be fair, leasing is not without merit. It can suit drivers who:

- Value driving a brand-new car every few years.

- Have predictable mileage needs well within the lease cap.

- Want lower monthly payments in the short term.

- Use the car for business and can deduct lease costs from taxable income.

But for most private drivers, particularly families or commuters, the drawbacks outweigh the advantages.

10 reasons not to lease a car

1. Higher long-term costs

While leasing a car may seem like a budget-friendly option due to lower monthly payments, these payments often add up over time, especially if you continue leasing car after car. In the long run, you could end up paying more than the car’s original value without ever owning it. Once the lease term is over, you return the car, leaving you with nothing tangible for all the money you’ve spent. In contrast, when you buy a car, your payments eventually stop, and you own a valuable asset that can be sold or traded in.

2. Mileage restrictions

Most leases come with mileage limits, typically between 10,000 and 15,000 miles per year. This can be a significant disadvantage for those who drive frequently, such as long-distance commuters or those who love road trips. If you exceed the mileage limit, you’ll be charged an additional fee per mile, which can add up quickly. When you buy a car, there are no mileage restrictions, giving you the freedom to drive as much as you need without incurring extra costs.

3. No ownership equity

One of the biggest downsides of leasing a car is that you don’t build any equity. With each payment, you’re simply covering the depreciation of the vehicle, and at the end of the lease, you have nothing to show for it. In contrast, when you buy a car, whether outright or through a loan, you’re building equity. After paying off the loan, you own the car, which can retain value and be sold or used as a trade-in for a future purchase.

4. Early termination fees

Life can be unpredictable, and your vehicle needs might change over time. If you decide to end your lease early, you’ll likely face significant penalties and early termination fees. Depending on your agreement, you may have to pay the remainder of the lease payments or a hefty termination fee. In contrast, when you buy a car, you have more flexibility to sell or trade it in whenever you wish, without facing high penalties.

5. Wear and tear charges

Leased cars typically need to be returned in near-new condition, minus normal wear and tear. However, what constitutes “normal wear and tear” is subjective and can vary by the leasing company. If the car has any noticeable damage or excessive wear, you could be hit with additional charges when returning the vehicle. This can cause unnecessary stress as you try to maintain the vehicle in pristine condition throughout the lease term.

6. Insurance premiums

Leasing companies often require more comprehensive insurance coverage than what you might need for a car you own. Typically, you’ll need to carry full coverage, including both collision and comprehensive insurance, with lower deductibles. This means higher monthly insurance premiums, adding to your overall cost. While full coverage insurance may also be necessary when you own a car, you have more control over the type of coverage and the deductible, potentially saving money in the long run.

7. Modification restrictions

If you’re someone who likes to modify your car, such as adding custom wheels, a new sound system, or performance upgrades, leasing will not work in your favour. Most lease agreements prohibit any modifications to the vehicle, or if modifications are allowed, they must be reversible. When you buy a car, you have the freedom to make any changes you want, making it truly your own.

8. You’re still responsible for maintenance and repair costs

While leasing typically includes warranty coverage for repairs, you are still responsible for the vehicle’s maintenance and any repairs that go beyond what’s covered by the warranty. Depending on the terms of your lease, this can include regular servicing, tire replacements, and any non-warranty repairs. When you own a car, you’re also responsible for these costs, but unlike leasing, you can decide whether or not to invest in certain repairs, and you own the car outright once your payments are completed.

9. You still need to pay for registration and roadside assistance

Even though you don’t own the car, you’ll still need to cover the registration and any required roadside assistance for a leased vehicle. These costs can be higher for leased vehicles, depending on your location and the car’s make and model. When you buy a car, the costs may vary, but at least you’ll have the option to shop around for the best deals on registration and roadside assistance services.

10. If your car is totalled, your lease terms remain the same

One of the lesser-known downsides of leasing is that if your leased car is totalled in an accident, the lease terms remain in place, and you are still obligated to pay for the remainder of the lease. While gap insurance can help cover this, many drivers do not realise the full extent of the financial responsibility they could face in the event of a total loss. When you own a car, if it’s totalled, the situation is different. You’re typically not tied to any more payments beyond what you owe on the car loan or the car’s insurance payout.

Final thoughts

While leasing a car may appear to be an affordable option upfront, it comes with several long-term financial drawbacks that many drivers overlook. From mileage restrictions and no equity building to the inability to customise the car, leasing can quickly become a costly and restrictive choice. On the other hand, buying a car offers ownership, flexibility, and long-term value.

Ultimately, whether you decide to lease or buy depends on your personal circumstances, driving habits, and financial situation. However, for most people, buying a car provides greater long-term value, control, and flexibility. If you’re unsure, it may be worth consulting with a financial advisor to explore the best option based on your needs.

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.