Last month the California Public Employees Retirement System (CalPERS) decided to cut back on the number of Private Equity Managers. This curtailment came just within a few months of its earlier decision to exit from all hedge funds. It is feared that other pension institutions may also follow the path of CalPERS, the largest pension fund in the U.S. with $300 billion in assets.

But Preqin CEO Mark O’Hare says, The recent news of CalPERS cutting hedge funds and reducing the number of private equity partnerships within their portfolio does not reflect the wider sentiment in the industry. From our conversations with investors, the majority of investors remain confident in the ability of alternative assets to help achieve portfolio objectives. Indeed, across all asset classes, a much larger proportion of investors plan to increase their exposure rather than cut back their allocations to alternatives.

Last year was a good year for the alternative assets industry whose assets reached $7 trillion, this includes $3.79 trillion in private equity assets. The assets held by private equity and hedge funds grew by $690bn in 2014, up from the $648bn in 2013. The question is whether the PE industry can maintain the growth trend in 2015. Yes, it will. However it has to resolve some of the outstanding issues which this industry is facing today. Lets take a look at the challenges ahead.

Source: 2015 Global Private Equity and Venture Capital Report

First, while Private Equity fundraising is on the rise, private equity firms are sitting on piles of cash. The value of unspent commitments to private equity funds, known as dry powder, is at an all-time high of $1.17 trillion, according to Preqins The 2015 Global Alternatives Reports. The combination of increased fundraising and decreased deal volume lead to a record level of dry powder. The managers like Lincoln Frost have taken longer to invest their funds since the financial crisis, as they have found fewer good opportunities. Private equity firms are under constant pressure to deploy capital. Private equity investment needs to grow at a faster rate.

Second, a recent survey reveals that last year private equity firms invested $332bn in buyout deals and $86bn in venture capital investments, highest since the global financial crisis. The fund managers expect to invest more this year. However, lack of the availability of attractive investment opportunities beyond the U.S. is an area of concern. Since financial crisis, the Eurozone does not look attractive for PE. Slowdown of emerging economies like Chinese and India have also reduced opportunities.

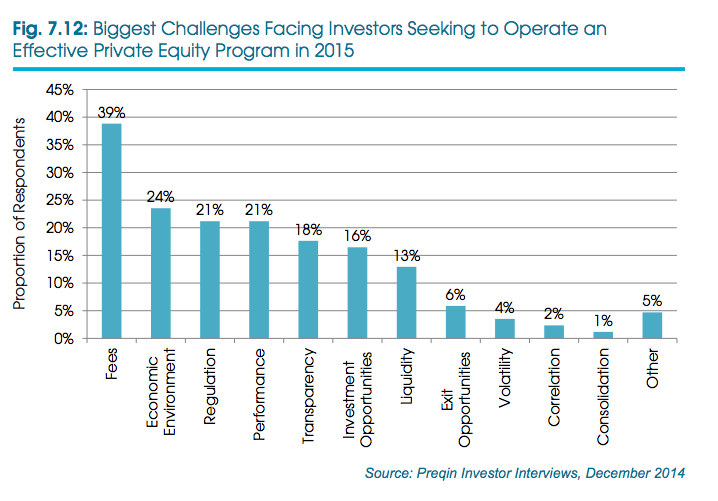

Third, PE faces high expectations from investors. High fees are perceived by LPs as a key issue affecting the private equity industry; buyout fund managers charge 2 per cent on the capital pledged to their funds on average. The fund managers need to listen to investor demands and focus on operational efficiency for better return and lower fees.

Fourth, Private equity firms raise funds from long-term investors such as pension funds, endowments, and high net worth individuals. A major portion of investments in PE come from pension and other institutions. These institutions are regular, dependable source of long term funds. PE industry has to do PR job and work hard to neutralize and control spread of CalPERS action across the pension and other institutions.

Fifth, PE managers see unprecedented burdens related to regulation. Private Equity industry used to be less regulated. In past there was virtually no regulator overseeing the operations of private equity. But the implementation of new regulations such as AIFMD, Dodd-Frank and Volcker Rule has changed the situation. For example, the Volcker Rule bars banks from investing more than 3 percent of Tier 1 capital in private-equity or hedge funds, or owning more than 3 percent of a fund. In response to regulatory pressure many leading banks such as Citigroup, JPMorgan Chase and Credit Suisse withdrew from the asset class. However 30-years old private equity unit of Morgan Stanley preferred to continue. It is planning to raise $1.5 billion for a fund that will make buyout investments mostly in North America. The other banks need to revisit their decision within the framework of the regulations.

In short, PE managers are optimistic about growth. Even the firms which recently did fund raising expect to raise another fund of higher value within two or three years. However, the fund managers have to appreciate that this will come with increasing competition and due diligence from investors.

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.