The Hedge Funds Industry, once known for short selling and leverage, now uses many sophisticated strategies to earn returns for investors. Hedge funds employ a diverse range of strategies and trade a variety of asset classes. The choice of strategies depend on many factors including prevailing market situation and economic outlook. And it changes with time. Some recent surveys of the Fund Managers and Investors indicate that the top picks this year would be event driven, macro and equity market neutral strategies. Moreover, investors would also to raise their allocations to Hedge Funds. Lets take a look at the details.

Equity market-neutral funds would be the top pick for Deutsche Bank and Goldman Sachs. In market neutral strategy, fund managers keep their bets for and against stocks roughly in balance. This seeks to minimize the exposure to the broad market. This is done in two ways. First way is to have equal amounts of investment in both long and short positions, so that the net exposure of the fund would be zero. Second way to achieve market neutrality is to have zero beta exposure. In this case, the fund managers make investments in such a way that the beta measure of the overall fund is as low as possible. Either of these long/short strategies can be used within a region, sector or industry, or can be applied to market-cap-specific stocks, etc.

Ken Heinz, President, Hedge Fund Research, an industry trade group, says, Activism, a subset of event driven strategies, will be a big driver for the hedge fund industry in the coming months, as well as plain vanilla macro strategies .. As you see the U.S. led recovery driving a couple of things, it drives cross-border transactions, it drives tax inversion deals.

Corporate balance sheets, particularly in the U.S., remain very strong with huge cash. The S&P 500 has recorded sixth consecutive yearly gain. It makes easier to hunt out the losers and make M&A deals. This provides a significant opportunity for macro managers especially activists.

Event-driven managers try to benefit from corporate shake-ups such as mergers and acquisitions or leadership changes. Activism seeks to invest in a large portion of a public companys equity with the goal of effecting a substantial change in the companys performance by working closely with the companys management. It is a popular strategy in todays investment environment because it offers the potential for an attractive risk-adjusted return profile in a low-interest-rate environment.

Morgan Stanley prefers macro funds that bet on macroeconomic trends using stocks, bonds, currencies, interest rates and others. The U.S. economy is showing strong growth and the QE has come to an end. The interest rate is likely to be raised. The difference between tightening monetary policy in the U.S. versus increased stimulus in Europe, Japan and China provides hedge trading opportunities in currencies and interest rates.

“We expect macro funds to benefit from increasing differentiation in economic policy across both developed and emerging markets,” Jarrod Quigley, managing director of Morgan Stanley Alternative Investment Partners.

Macro managers may also find relative value trades in equities, credit and other risk assets. Most of these funds have a global perspective and, because of the diversity of investments and the size of the markets in which they invest, they can grow to be quite large. They are fairly large funds and are highly leveraged.

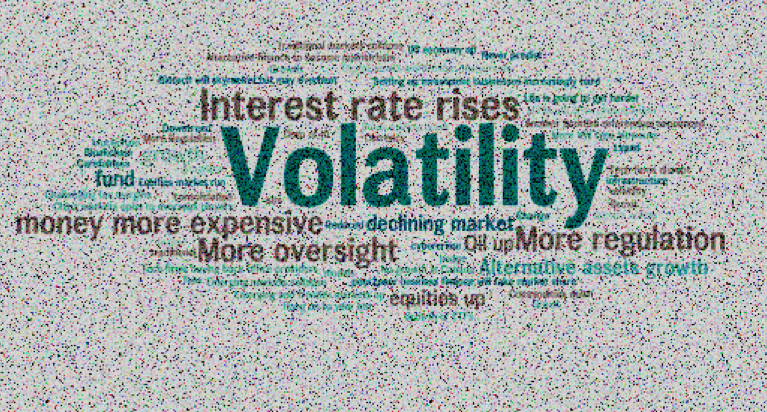

Recent events have created a lot of uncertainties in the Global Economy and Markets. Therefore, investors are likely to increase their hedge fund portfolio to minimize their exposure due to the uncertainties in the economy. Hedge funds expect higher inflows from investors. A recent survey of 235 hedge fund executives by State Street found that around two-third of institutional investors will increase their exposure to hedge funds.

The $3 trillion hedge fund industry has a lot to work. The hedge fund industry is very dynamic and constantly changing, it is important for hedge fund managers to anticipate changes around the world and apply proper strategies to generate risk adjusted adequate return for investors.

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.